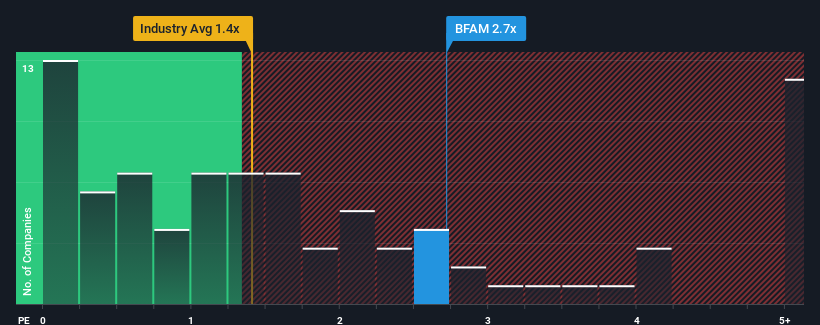

When you see that almost half of the companies in the Consumer Services industry in the United States have price-to-sales ratios (or "P/S") below 1.4x, Bright Horizons Family Solutions Inc. (NYSE:BFAM) looks to be giving off some sell signals with its 2.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Bright Horizons Family Solutions Has Been Performing

Recent revenue growth for Bright Horizons Family Solutions has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bright Horizons Family Solutions will help you uncover what's on the horizon.How Is Bright Horizons Family Solutions' Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Bright Horizons Family Solutions' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The strong recent performance means it was also able to grow revenue by 60% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 8.7% per annum during the coming three years according to the nine analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 15% each year, which is noticeably more attractive.

In light of this, it's alarming that Bright Horizons Family Solutions' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Bright Horizons Family Solutions' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It comes as a surprise to see Bright Horizons Family Solutions trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Bright Horizons Family Solutions that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.