Rayonier Advanced Materials Inc. (NYSE:RYAM) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 24% over that time.

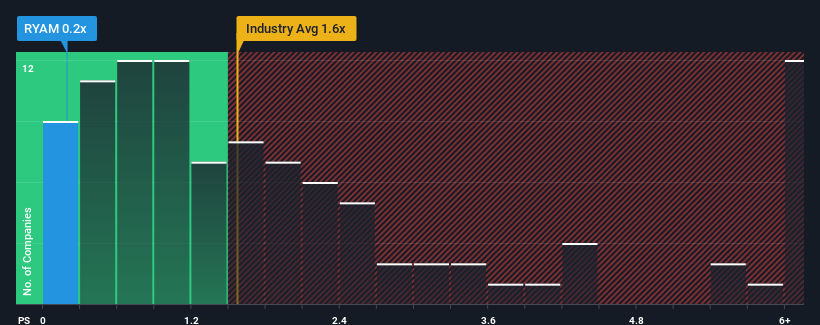

Even after such a large jump in price, given about half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.6x, you may still consider Rayonier Advanced Materials as an attractive investment with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Rayonier Advanced Materials Has Been Performing

There hasn't been much to differentiate Rayonier Advanced Materials' and the industry's retreating revenue lately. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Keen to find out how analysts think Rayonier Advanced Materials' future stacks up against the industry? In that case, our free report is a great place to start.How Is Rayonier Advanced Materials' Revenue Growth Trending?

In order to justify its P/S ratio, Rayonier Advanced Materials would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 4.3% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 22% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 2.2% over the next year. Meanwhile, the rest of the industry is forecast to expand by 5.6%, which is noticeably more attractive.

With this in consideration, its clear as to why Rayonier Advanced Materials' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does Rayonier Advanced Materials' P/S Mean For Investors?

Rayonier Advanced Materials' stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Rayonier Advanced Materials' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Having said that, be aware Rayonier Advanced Materials is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.