China YuHua Education Corporation Limited (HKG:6169) shareholders have had their patience rewarded with a 32% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 43% in the last twelve months.

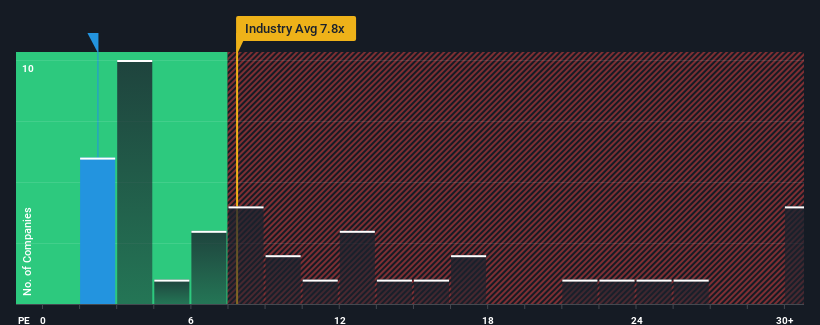

Although its price has surged higher, China YuHua Education's price-to-earnings (or "P/E") ratio of 2.2x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 9x and even P/E's above 18x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

China YuHua Education could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

China YuHua Education's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. Still, the latest three year period has seen an excellent 2,602% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 8.3% per year during the coming three years according to the three analysts following the company. Meanwhile, the broader market is forecast to expand by 15% each year, which paints a poor picture.

In light of this, it's understandable that China YuHua Education's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On China YuHua Education's P/E

China YuHua Education's recent share price jump still sees its P/E sitting firmly flat on the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of China YuHua Education's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for China YuHua Education (2 don't sit too well with us!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on China YuHua Education, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.