Those holding Dongrui Food Group Co., Ltd. (SZSE:001201) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 26% over that time.

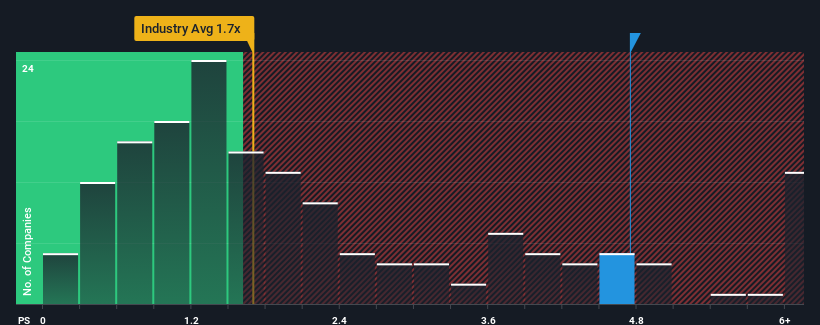

Following the firm bounce in price, you could be forgiven for thinking Dongrui Food Group is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.7x, considering almost half the companies in China's Food industry have P/S ratios below 1.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Dongrui Food Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Dongrui Food Group has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Dongrui Food Group will help you uncover what's on the horizon.How Is Dongrui Food Group's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Dongrui Food Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 11% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 138% over the next year. With the industry only predicted to deliver 15%, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Dongrui Food Group's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Dongrui Food Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Dongrui Food Group shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Dongrui Food Group (including 1 which is a bit unpleasant).

If you're unsure about the strength of Dongrui Food Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.