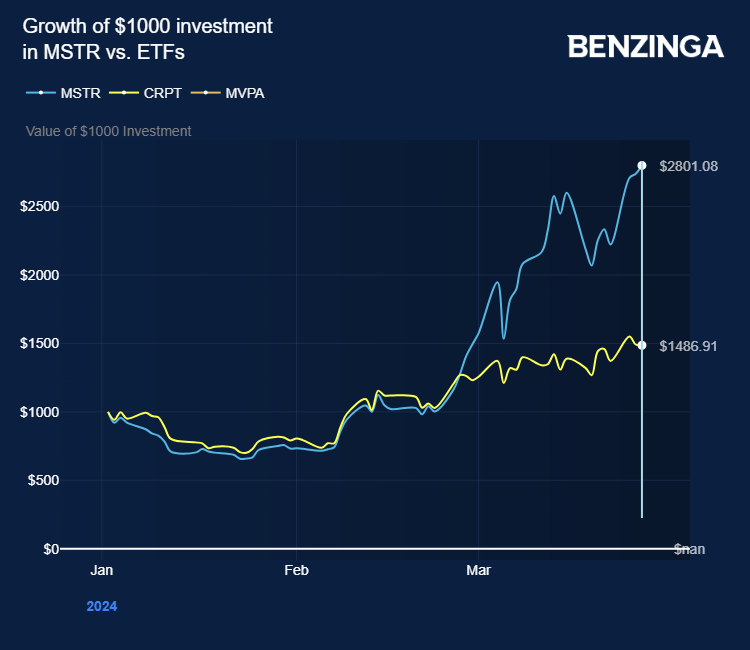

$MicroStrategy (MSTR.US)$, known for its substantial $Bitcoin (BTC.CC)$ holdings, has seen its stock surge by a staggering 204% this year, reaching $1,919 by Wednesday's close.

This surge has propelled its market capitalization to over $32 billion, surpassing 237 companies in the S&P 100, including well-established names like $eBay (EBAY.US)$ and $Delta Air Lines (DAL.US)$.

Despite being classified under the Russell 2000 Index, typically comprising smaller-cap stocks, its market value rivals that of much larger entities, Bloomberg reports.

However, MicroStrategy's inclusion in the $S&P 500 Index (.SPX.US)$ is not straightforward, as its revenue model primarily hinges on its Bitcoin holdings rather than conventional business operations.

Some analysts, like Steve Sosnick from Interactive Brokers, view MicroStrategy as a leveraged holding company for Bitcoin, raising questions about its suitability for S&P 500 inclusion.

Despite its profitability in the fourth quarter of 2023, driven by a tax benefit from its Bitcoin stash, MicroStrategy has faced setbacks due to Bitcoin's volatile valuation.

It has incurred losses in quarters when Bitcoin's value declined, complicating its eligibility for S&P 500 inclusion.

Also this week, MicroStrategy introduced an innovative AI-powered bot, MicroStrategy AutoTM, streamlining the delivery of business intelligence (BI) across organizations.

The Auto AI Bot, which is lightweight and embeddable, can operate independently within the MicroStrategy ONE library or seamlessly integrate into third-party applications, offering extensive customization options like appearance, language, and detail level adjustments.

The stock surged over 141% year-to-date.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.