To the annoyance of some shareholders, Seres Therapeutics, Inc. (NASDAQ:MCRB) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 86% loss during that time.

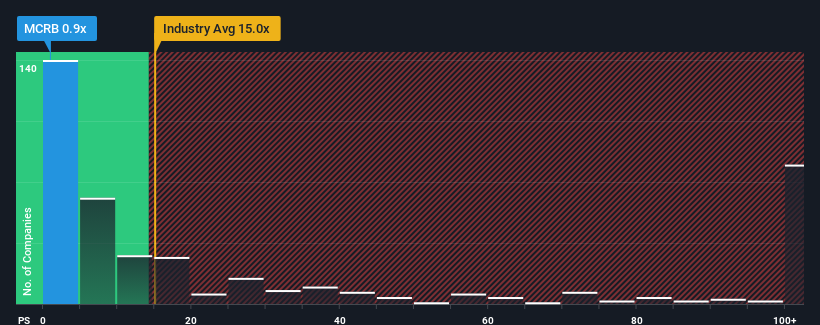

After such a large drop in price, Seres Therapeutics may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 15x and even P/S higher than 75x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Seres Therapeutics' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Seres Therapeutics has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think Seres Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Seres Therapeutics' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. The amazing performance means it was also able to grow revenue by 280% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue growth is heading into negative territory, declining 25% each year over the next three years. Meanwhile, the broader industry is forecast to expand by 167% per annum, which paints a poor picture.

In light of this, it's understandable that Seres Therapeutics' P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shares in Seres Therapeutics have plummeted and its P/S has followed suit. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Seres Therapeutics' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You need to take note of risks, for example - Seres Therapeutics has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.