Popular products that have been closed for subscription

Which fund was the hardest to buy during the year?

The answer is likely — ICBC Credit Suisse India LOF (hereinafter referred to as India Fund for short).

Subscriptions for this product were suspended in December of last year. Small subscriptions and regular subscriptions were briefly resumed in January of this year, and subscriptions were suspended again in February of this year.

If you want to buy its products, you can only buy it at a premium of 10% or more on the exchange's secondary market in the near future.

Who actually caught up with the Indian Fund's “express train” before the subscription was suspended?Also, which holders will be able to enjoy a profit of 12% or more in 2024 (based on the increase in the secondary market)?

This fund's annual report gave the answer.

The scale quadrupled that year

ICBC Credit Suisse India LOF suddenly became popular in 2023.

The fund's net worth increased by more than 16% last year, and the secondary market rose by 19%, which is quite remarkable.

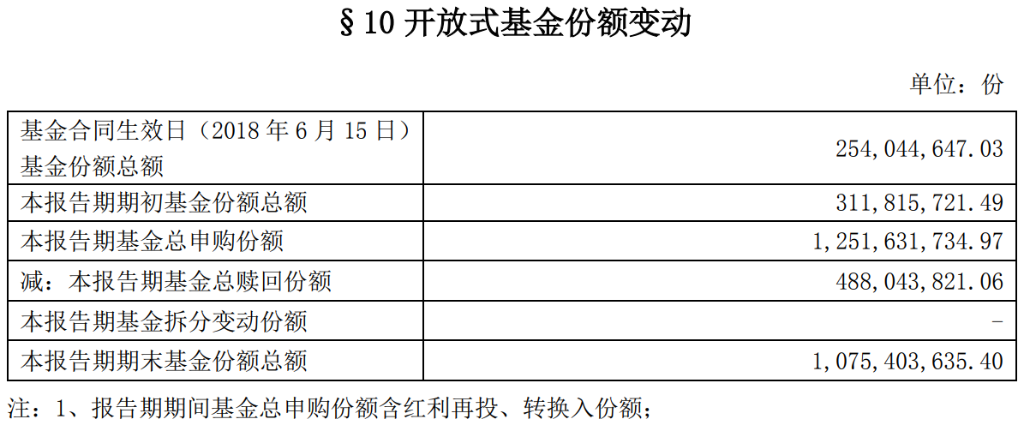

At the same time, the size of India's funds increased dramatically, to 1,075 million shares at the end of the year, which was 3.44 times the share at the beginning of the year.

Combined with the increase in the fund's net worth in 2023, the size of the fund at the end of the year was more than four times that of the beginning of the year.

Who “got on the bus”?

However, even so, the total size of the fund at the end of the year was only 1.5 billion yuan. If you want to enter the market before “shutting down” the subscription, you must do so a little early.

So, which holders bought Indian funds in a timely manner in the second half of last year?

Judging from the annual report of ICBC Credit Suisse India's LOF, the top ten holders showed their talents in a variety of ways.

However, there are two types of mainstream institutions that have almost no substantial holdings. One is insurance capital, and the second is bank financial management and brokerage self-management (figure below).

At first glance, private equity products with a flexible sense of smell account for half of the seats, individuals occupy three seats, brokers' asset management occupy one seat, and ICBC's own FOF asset management plan occupy one seat.

Xitai and Haobuy seize the opportunity

Xitai Investment (private equity institution), which is located in Shanghai, has occupied 2 heavy positions in Indian funds, and is ranked second and third. It has exploded quite a bit on this list.

Specifically, the Xitai Dongsheng No. 1 Private Equity Investment Fund and the Xitai Dongsheng No. 16 Private Equity Investment Fund. Together, these two products hold more than 29.19 million copies in India.

According to reports, the founder of Xitai Investment is Zhu Jigang, born in 1982, and was the current Xueba fund manager of the Guangfa Fund.

He graduated from Tsinghua University majoring in chemistry, then became a seller researcher in the cycle industry of China Merchants Securities, then joined the Guangfa Fund investment and research team, and eventually founded a private equity agency as a star fund manager.

The industry believes that Xitai Investment is characterized by being flexible and active, and that it is particularly good at recruiting investment talents from within the industry. Therefore, its overall investment and research strength has a certain reputation within the industry.

This time, it bought an Indian fund, which is quite in line with the fund's “personality.”

In the Indian fund holder list, there is another well-known private equity institution. The New Equation Chenxi Fund, a subsidiary of Shanghai New Equation, holds nearly 5 million points from the Indian Fund and is among the top seven holders.

It is worth noting that behind Shanghai's new equation is a well-known third party agency in the industry that buys wealth. The agency has huge sales volume in the public and private equity fields all year round, and is quite familiar with related institutions.

The main founder of Haomai Wealth is Yang Wenbin, and his core team all come from well-known public fund institutions in China. It is not surprising that such a private equity institution under a tripartite agency with a relatively “formal” style of play has seized the opportunity of an Indian fund.

Some people get on the bus first and then “jump”

After compiling more report data, we can also find that quite a few investment institutions “dropped out early” from Indian funds last year, or “lost touch” with some markets.

For example, the top three holders in mid-2023, Sun Wenli, Wang Ying, and Xinhu Juyuan Honghu Baishi risk. The share held at the end of the year is estimated to be much lower than the mid-year share, and it is likely that some or all of them “jumped” (sold) in the second half of the year.

Where will the market go later?

Where will the Indian Fund go in the future after getting on the bus? This is a topic that everyone is concerned about.

The fund manager of ICBC Credit Suisse India Fund said in the annual report that looking ahead, India will face an overseas environment similar to other emerging markets in 2024.

Compared to other emerging markets, India's advantage is that strong domestic demand drives economic growth, and inflation, which has cooled significantly recently, has also reduced the constraints on monetary policy.

At the same time, they also believe that steady GDP growth in 2023 and leading indicators that continue to be in the boom range also confirm India's good fundamentals. Currently, the MSCI India Index valuation is still at a moderate level, and there is no significant valuation bubble.