Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Xylem Inc. (NYSE:XYL) does carry debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does Xylem Carry?

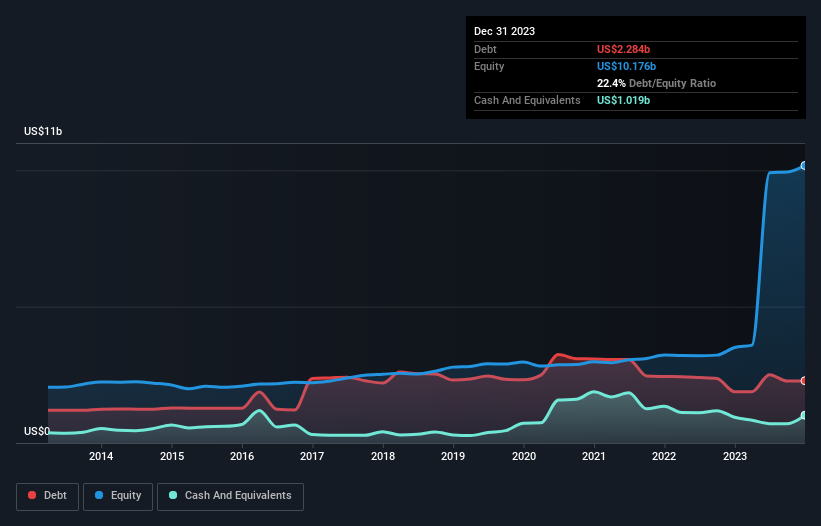

You can click the graphic below for the historical numbers, but it shows that as of December 2023 Xylem had US$2.28b of debt, an increase on US$1.88b, over one year. However, it does have US$1.02b in cash offsetting this, leading to net debt of about US$1.27b.

How Healthy Is Xylem's Balance Sheet?

The latest balance sheet data shows that Xylem had liabilities of US$2.21b due within a year, and liabilities of US$3.73b falling due after that. Offsetting these obligations, it had cash of US$1.02b as well as receivables valued at US$1.62b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.30b.

Since publicly traded Xylem shares are worth a very impressive total of US$31.3b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Xylem's net debt is only 0.98 times its EBITDA. And its EBIT easily covers its interest expense, being 40.6 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. In addition to that, we're happy to report that Xylem has boosted its EBIT by 33%, thus reducing the spectre of future debt repayments. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Xylem's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Xylem produced sturdy free cash flow equating to 62% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Xylem's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its EBIT growth rate also supports that impression! Zooming out, Xylem seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Xylem you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.