In 2023, due to the combined effects of macroeconomic factors such as global economic fluctuations, capital market performance was not ideal. In particular, the innovative drug sector of Hong Kong stocks continued to fluctuate and adjust. The market further released pessimistic values, and sector valuations also fell to a historically low range for a while.

At the same time, the domestic healthcare industry's financing environment has also been significantly affected. According to the Sino-Thai International Research Report, the total financing of the domestic healthcare industry fell 30.1% year on year to 10.9 billion US dollars in 2023, equivalent to about 1/3 of 2021 and falling back to around 2017.

Pan Tianqi of the League of Nations Fund believes that now is a time when expectations are low, fundamental trends, and subsequent market performance are very much worth looking forward to. For investors, in addition to maintaining confidence after a sharp decline, it is more important to rationally evaluate risk-return opportunities. The pharmaceutical industry includes many high-quality growth tracks. If there are no fundamental changes in long-term fundamentals, intrinsic factors such as growth space, competitive pattern, and governance structure will drive the company's profit scale to expand, and expected earnings are expected to follow.

Here, you might as well use Lepu Bio-B (2157.HK), which has just handed over its annual financial report, as a reference to talk about the author's current investment in the innovative drug industry.

Steady performance, accelerated release of growth momentum

Judging from Lepu Biotech's annual performance, it can be summed up in eight words “steady growth, full of motivation”.

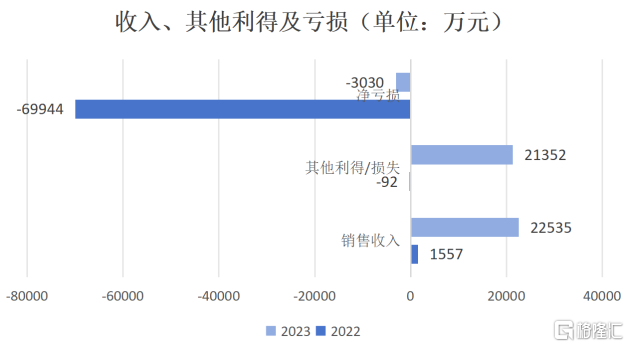

According to the data, for the full year of 2023, Lepu Biotech achieved revenue of about 225 million yuan (RMB, same below), a year-on-year increase of 1347.2%; net loss was about 30 million yuan, a sharp decrease of 96% compared with the same period last year; net loss during the adjusted year was reduced from 700 million yuan in 2022 to 250 million yuan.

Data source: Company financial report

By disassembling financial reports, the author found that on the basis of a sharp jump in the company's revenue, there are also the following reasons behind the sharp narrowing of net loss:

By reducing its shareholding in Haoyang Biotech, the company achieved an investment income of about 104 million yuan, and its long-term equity investment in Wuhan Binhui recorded an income of about 116 million yuan due to passive dilution of shares. The above two combined other benefits totaled approximately $220 million.

At the same time, Lepu Biotech has made great efforts to reduce costs and increase efficiency. Through the construction of operation management capabilities, the company's internal operating efficiency is controlled, and operating costs are significantly reduced. Financial reports show that in 2023, the company's R&D expenses reached 458 million yuan; administrative expenses were about 87 million yuan, a year-on-year decrease of 37.6%; and sales and marketing expenses were about 43 million yuan.

By digging deeper into Lepu Biotech's financial reports and understanding the company's business progress over the past year, you will find that under the impetus of Lepu Biotech's commercialization strategy and business operations, its commercialization results are quite impressive, and it is continuously raising the company's imagination space. This is also what we need to review next.

First, actively promote Pu YouhengCommercial sale of (Pritrizumab injection, HX008).Pu YouhengAfter successively being approved for the two major indications of MSI-H/dMMR solid tumors and unresectable or metastatic melanoma in the second half of 2022, Lepu Biotech acted quickly, built its own competent commercial team and started sales, and achieved sales revenue of 101 million yuan in 2023. This achievement indicates that the company's ability to commercialize independently has been initially verified.

More importantly, the company passed PuyouhengThe sales opened up a full chain of industry experience from R&D to sales, and laid a solid foundation for subsequent commercialization of ADC and oncolytic virus drugs. The company adopted a strategy of concentrating resources and focusing on key provinces and cities. Through self-management and channel cooperation, the company effectively promoted PuyouhengSales and market expansion in uncovered regions through CSO platforms and other partner organizations.

As Lepu Biotech successfully promotes the commercialization process of this product in multiple indications in the future, the gradual implementation of superimposed sales channels and further market expansion will provide strong support for the long-term development and performance growth of Lepu Biotech.

Second, CMG901 has achieved a BD breakthrough and will promote the implementation of more BD projects in the future.

In February of last year, Lepu Biotech and AstraZeneca reached an exclusive licensing agreement on CMG901 (CLOUDIN18.2 targeted ADC), granting AstraZeneca an exclusive global license for research, development, registration, production and commercialization of CMG901. In 2023, Lepu Biotech's revenue from CMG901 BD and technical services reached 124 million yuan.

Through this cooperation model, it is possible not only to help the two companies achieve complementary advantages and synergy, thereby contributing to rapid growth in performance. More importantly, the success of this cooperation can bring an excellent demonstration effect to the company, and at the same time strongly endorse the company's R&D, production and commercialization capabilities in the ADC field, thereby stimulating the accelerated transformation of potential cooperation orders.

It can be seen from this that CMG901 is only the beginning. As the company actively promotes BD cooperation and project implementation for other ADC pipelines in the future, it is expected that the company's performance will be rapidly released.

While promoting domestic sales through self-operation+channel cooperation, we are expanding overseas markets through BD to continuously provide the company with increased performance.

Furthermore, surplus production capacity is used to provide CDMO services.In November of last year, Lepu Biotech and Lepu Medical signed a CDMO service framework agreement, which will provide CDMO technical services to Lepu Medical and its subsidiary companies, and establish a CDMO service framework agreement accordingly. Lepu Biotech can effectively utilize surplus production capacity, bring stable profits to the company as a whole, and supplement working capital.

In the future, the company will continue to dispose of and reduce its fixed assets and long-term equity investments in a timely manner, making good use of the credit lines already obtained from many commercial banks, and at the same time, along with the gradual implementation of the company's core pipeline and taking the opportunity to refinance, thereby supplementing the company's cash flow and providing a solid financial guarantee for the company's steady operation and future development. This comprehensive development strategy ensures that the company maintains a steady growth momentum in an ever-changing market environment.

The commercialization of ADC is being implemented at an accelerated pace, and joint drug use continues to make new progress

After initial success in commercialization, there is also a key issue to focus on: How certain and sustainable is future growth capacity? This depends on the company's ability to innovate, which is mainly reflected in the company's product pipeline.

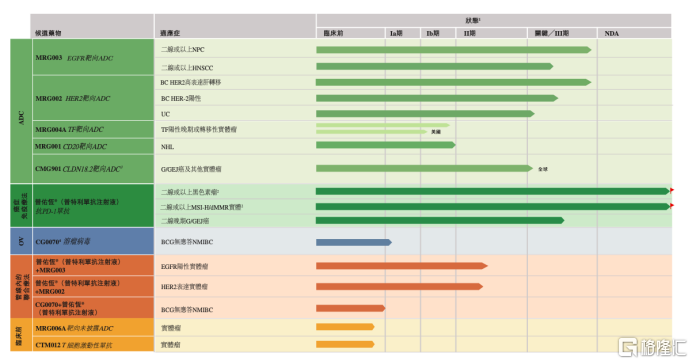

Overall, Lepu Biotech's R&D strategy is clear, focusing first on the field of immuno-oncology (IO), with PuyouhengEstablish the company's basic market, then continue to work in the field of antibody-conjugated drugs (ADC) to build a world-leading ADC drug pipeline. In addition, the company has also arranged research and development of oncolytic viruses.

Currently, Lepu Biotech has formed a combination drug containing 1 commercially marketed drug, 7 clinical-stage drug candidates, and 3 clinical-stage proprietary drug candidates.

Photo Source: Company Financial Report

In addition to Pu Youheng, which has already been commercializedFurthermore, among the remaining pipelines, ADC research and development is progressing the most, or is entering the harvest period one after another.

Take MRG003, which is currently progressing rapidly, as an exampleMRG003 is an ADC formed by coupling an EGFR-targeted monoclonal antibody with a potent microtubule inhibitory payload MMAE molecule through a VC linker. It specifically binds EGFR on the surface of tumor cells with high affinity and releases a potent payload after entering the tumor cell through endocytosis, leading to tumor cell death.

Currently, the product has been granted Fast Track Qualification (FTD) by the FDA for the treatment of advanced nasopharyngeal cancer (NPC), and the key registration phase IIb clinical trial has also completed the enrollment of all subjects, and will become Pu YouhengAnother new pharmaceutical product that has been approved for marketing and is close to being marketed. In the future, as MRG003's potential for treatment of other types of cancer is exploited, and the advantages of commercialization channels that the company has already opened up are expected to bring greater commercial value to the company.

In addition to MRG003, Lepu Biotech is also making every effort to promote the development process of another innovative ADC drug, MRG004A.

Not long ago, MRG004A was granted Fast Track status by the FDA for the treatment of pancreatic cancer (PC). Previously, MRG004A had obtained IND approval in China and the US, respectively, and was granted Orphan Drug Qualification (ODD) by the FDA. Phase I/II clinical studies are currently being conducted in the US and China, and anti-tumor activity signals have been observed in indications such as pancreatic cancer, triple-negative breast cancer, and colorectal cancer.

It should be noted, however, that due to the emergence of resistance mechanisms, the duration of the objective response or clinical benefit of ADC as a monotherapy is limited. Therefore, in recent years, pre-clinical and clinical trials of ADC in combination with other anti-cancer drugs, including chemotherapy, molecular targeted drugs, and immunotherapy, have been actively studied, and there is great room for imagination.

In response to this, Lepu Biotech has always aimed at unmet clinical needs and the competitive situation for the next 3-10 years, formulating strategies and making timely adjustments, and actively promoting the progress of joint drug use projects.

Among them, Lepu Biotech's own ADC and PuyouhengClinical research on combined drug use is moving in this direction. The company has completed MRG003 and PuyouhengPhase I trials for combined treatment of solid tumors have observed good preliminary data, and phase II clinical trials are currently being conducted. MRG002 and Pu YouhengPhase I/II clinical trials for combined treatment of HER2-expressing solid tumors are ongoing.

For Lepu Biotech, actively promoting joint drug use programs can, on the one hand, achieve further improvement in curative efficacy, and on the other hand, bring greater clinical benefits and commercial value to the company. According to Huachuang Securities Pharmaceutical's forecast, nearly half of the current IO therapies may be upgraded from IO+ chemotherapy to IO+ADC, and the market for related indications is expected to expand by 100-200%.

Creating globally competitive products through continuous technological innovation and grasping trends is what Lepu Biotech is currently doing. Predictably, as Lepu Biotech's core drug candidates gradually enter the harvest period, they will contribute more to its performance.

The policy market is driven by both factors, and long-term growth potential can be expected

Looking at it from a longer perspective, the market is also continuously sending positive signals, injecting strong impetus into the development of the innovative pharmaceutical industry. Innovative pharmaceutical companies such as Lepu Biotech are facing rare opportunities.

From a policy perspectiveThis year's government work report focuses on new quality productivity. For the first time, innovative drugs were included in the work report as a core technology-driven industry for the high-quality development of pharmaceuticals and biology.

The report shows that the government will accelerate the development of innovative drugs, biomantry, and life sciences, and promote the collaborative development and management of health insurance, medical care, and pharmaceuticals, giving the industry great confidence. The March 12 meeting of the State Drug Administration also stated that it will continue to actively promote the development and marketing of innovative drugs and high-end medical devices on the premise of fully controlling drug quality and safety.

Furthermore, the “Implementation Plan for Supporting the Development of Innovative Drugs in the Whole Chain (Draft for Comments)”, which has recently been circulating in the market, aims to comprehensively promote key aspects of R&D, approval, use and payment of innovative drugs, and is of great significance to the entire innovative drug industry.

From the market sideSince 2022, there has been a rapid increase in the number of ADC drug licensing transactions worldwide.

According to Lilac Garden data, the number of global ADC drug licensing transactions in 2022 was 56, an increase of 229% year on year; in 2023, the number of projects increased to 73, an increase of about 30% year on year. In addition, the total transaction amount also increased significantly, from about $20 billion in 2022 to over $100 billion in 2023, an increase of 440% over the previous year.

Picture source: Shen Wan Hongyuan

According to forecasts, from 2022 to 2030, the global ADC drug market will continue to grow rapidly at a compound growth rate of 52.3%, and the market is expected to expand further as new indications and new products are approved.

Since this year, the domestic healthcare industry's financing environment has also shown signs of a moderate recovery. According to the Sino-Thai International Research Report, the total amount of financing for the domestic healthcare industry in January-February of this year was close to the total amount for the first quarter of 2023, which may indicate that the market's confidence in the innovative drug sector is gradually recovering.

With the repeated development of the “trading myth” of the ADC circuit and the further recovery of the financing environment, the company, as a leading domestic ADC pharmaceutical company, is expected to further increase its market share in the future.

Generally speaking, whether it's Pu YouhengThe commercialization progress, whether it is the implementation of the BD project, or clinical development and combination therapy of the ADC pipeline, has demonstrated Lepu's biobalance and efficient operation capabilities. By accurately concentrating resources on indications and drug candidates with the greatest potential for development, it has ensured optimal use of resources, and further highlighted the company's expertise in this field.

Combining innovative strength and operational efficiency, Lepu Biotech has shown unique differentiated advantages in the ADC and IO fields, while maintaining a comprehensive and balanced development trend. As a leading company in the ADC field, Lepu Biotech already has all the necessary conditions to become a leader in the industry. Over time, more milestones will gradually be realized, validating its potential for development.