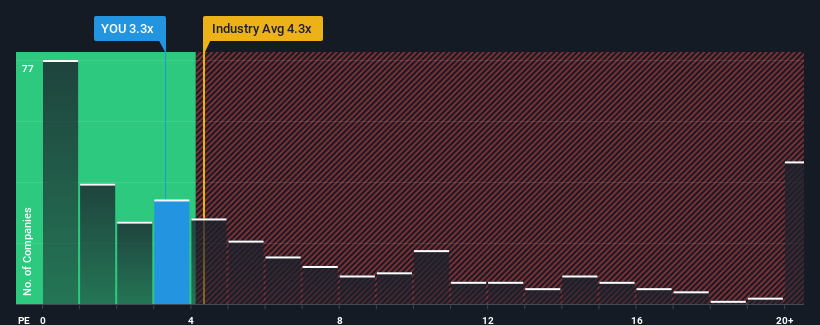

Clear Secure, Inc.'s (NYSE:YOU) price-to-sales (or "P/S") ratio of 3.3x might make it look like a buy right now compared to the Software industry in the United States, where around half of the companies have P/S ratios above 4.3x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Clear Secure's P/S Mean For Shareholders?

Clear Secure certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Clear Secure will help you uncover what's on the horizon.How Is Clear Secure's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Clear Secure's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 40% gain to the company's top line. The latest three year period has also seen an excellent 166% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the nine analysts watching the company. That's shaping up to be similar to the 15% each year growth forecast for the broader industry.

With this information, we find it odd that Clear Secure is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What Does Clear Secure's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Clear Secure's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

Having said that, be aware Clear Secure is showing 1 warning sign in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.