[Investment projects]

Changhua Group (605018.SH): Plans to invest the savings raised in the new project “Construction Project for High-Strength Automobile Fasteners Production Line with an Annual Output of 2 Billion Pieces (Phase II)

Changhua Group (605018.SH) announced that the company plans to reduce the total investment of the original fund-raising project “Lightweight Automobile Aluminum Parts Intelligent Production Base Project” from 13,880.57 million yuan to 60717,700 yuan and close the project. The remaining capital raised from the original project was 82.9294 million yuan (including investment income from the purchase of wealth management products and accumulated bank deposit interest received. The actual amount is subject to the balance on the day the funds are transferred out) to invest in the new project “Production Line Construction Project with an annual output of 2 billion pieces of automotive high-strength fasteners” (Phase II). Self-funded solution.

Sea-buckwheat Foods (002956.SZ): Proposed establishment of Jiangsu DaHealth Investment Sea-wheat Health Food Project

Simai Foods (002956.SZ) announced that the company plans to sign the “Suqian Economic and Technological Development Zone Industrial Project Investment Contract” with the Suqian Economic and Technological Development Zone Management Committee to establish a wholly-owned subsidiary, Jiangsu Ximaida Health Food Co., Ltd. (“Jiangsu Health” for short, the name is based on commercial registration) to invest in the “Simai Health Food Project” in the Suqian Economic and Technological Development Zone. The total investment of the project is 330 million yuan, of which the fixed asset investment is not less than 200 million yuan. The project will be invested in two phases. The first phase is to invest 152 million yuan, including 145 million yuan in fixed assets. The company will invest in the “Jiangsu Seema Oat Food Innovation Factory Project” of the wholly-owned subsidiary Jiangsu Seymai Food Co., Ltd. (The project is under construction and will be invested after completion. The specific investment method will be determined by the company according to the situation at that time). If there is a shortage, the company will invest with its own capital. The second phase plans to invest 178 million yuan, of which 55 million yuan will be invested in fixed assets.

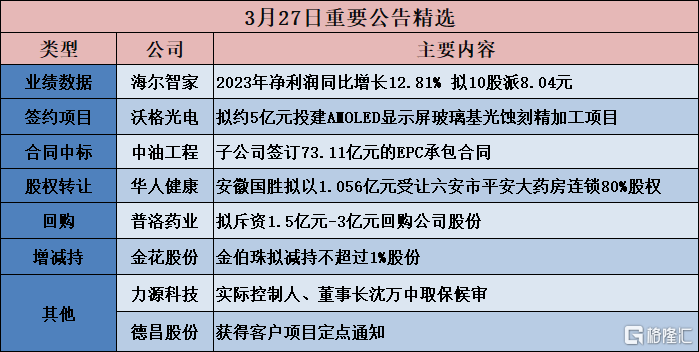

Vogue Optoelectronics (603773.SH): Plans to invest about 500 million yuan to build an AMOLED display glass-based photo-etching finishing project

Vogue Optoelectronics (603773.SH) announced that the board of directors agreed that the company and/or its wholly-owned subsidiary plans to establish a project company in Chengdu to invest in the construction of an AMOLED display glass-based photo-etching and finishing project to provide processing services for processes such as etching, cutting and screen printing of OLED product display panels, with a total investment amount of about 500 million yuan. This project mainly uses ECI (Etching-Cutting-Ink) technology exclusively owned by the company. Through a selective graphic etching process on the glass base of medium and large AMOLED displays, AMOLED displays can be thinned, perforated, and molded once. Compared with traditional LCD thinning technology, this project reduces the process process, improves panel strength and stability, and reduces costs.

[Contract won the bid]

CNPC Engineering (600339.SH): The subsidiary signed an EPC contract worth 7.311 billion yuan

CNPC Engineering (600339.SH) announced that China Global Engineering Co., Ltd. (known as Global Engineering Company), a wholly-owned subsidiary of the company, and Fujian Zhongsha Petrochemical Co., Ltd. (Fujian Zhongsha Petrochemical) have formally signed an EPC general contract for Fujian Gulei's 1.5 million tons/year ethylene and downstream deep processing complex project ethylene and ancillary equipment, with a contract amount of RMB 7.311 billion.

[[Share acquisition]

Chinese Health (301408.SZ): Anhui Guosheng plans to transfer 80% of Lu'an Ping'an Pharmacy Chain's shares for 105.6 million yuan

Chinese Health (301408.SZ) announced that in order to further increase penetration into the core market of Anhui Province, consolidate its competitive position in the existing market, and expand and improve the marketing network, the company's wholly-owned subsidiary Anhui Guosheng Pharmacy Chain Co., Ltd. (“Anhui Guosheng” or “the acquirer”) plans to purchase the combined shares of Shen Haibing, Gan Jihua, and Wang Sihua (hereinafter collectively referred to as the “counterparty”) by paying cash to purchase 80% of the shares of Lu'an Pingda Pharmacy Chain Co., Ltd. (hereinafter referred to as the “target company”) (hereinafter referred to as the “target company”) “Purchase”). The transaction price was based on the evaluation results issued by Walkson (Beijing) International Asset Appraisal Co., Ltd., with an overall valuation of 100% of the target company's shares of RMB 132 million, and the price of 80% of the target company acquired by Anhui Guosheng was RMB 105.6 million. The company plans to use its own funds and self-raised funds to pay for the purchase price.

Shen Haibing, Wang Sihua, and Gan Jihua jointly established the target company on November 13, 2023, with a total registered capital of RMB 11 million. Shen Haibing, Wang Sihua, and Gan Jihua transferred or changed all business and assets of the headquarters, distribution center, and 103 affiliated pharmaceutical retail stores of Lu'an Ping'an Pharmaceutical Chain Co., Ltd. (hereinafter referred to as “Lu'an Ping An”) under their control to the target company. Anhui Guosheng and Huaxi Yinfeng Investment Co., Ltd. (hereinafter referred to as “Huaxi Yinfeng”) acquired a total of 100% of the shares of the target company established after the restructuring of Lu'an Ping An. Among them, Anhui Guosheng acquired 80% of the target company's shares, and Huaxi Yinfeng acquired 20% of the target company's shares. On March 27, 2024, Anhui Guosheng, Huaxi Yinfeng, and their counterparties Shen Haibing, Gan Jihua, Wang Sihua, Lu'an Ping'an, and the target company jointly signed the “Equity Transfer Agreement on Lu'an Pingda Pharmacy Chain Co., Ltd.”. Anhui Guosheng plans to transfer 80% of the target company's shares for RMB 105.6 million.

[Performance data]

Industrial and Commercial Bank (601398.SH): Net profit of 363,993 billion yuan in 2023 increased 0.8% year-on-year

Industrial and Commercial Bank (601398.SH) released its 2023 annual report. Operating revenue was 843.07 billion yuan, down 3.7% year on year, net profit was 363,993 billion yuan, up 0.8% year on year, after deducting non-net profit of 361,411 billion yuan, up 0.8% year on year, with basic earnings per share of 0.98 yuan. The Board of Directors recommended the payment of a 2023 cash dividend of RMB 3.064 for every 10 shares.

Haier Smart Home (600690.SH): Net profit in 2023 increased 12.81% year-on-year, and plans to distribute 8.04 yuan to 10 shares

Haier Smart Home (600690.SH) released its 2023 annual report, with operating income of 261,428 billion yuan, up 7.33% year on year, net profit of 16.597 billion yuan, up 12.81% year on year, after deducting non-net profit of 15.824 billion yuan, up 13.33% year on year, with basic earnings per share of 1.79 yuan. Cash dividends of RMB 8.04 for every 10 shares are distributed to all shareholders.

Kanglong Chemical (300759.SZ): Net profit increased 16.48% to 1,601 billion yuan in 2023, plans to pay 10 to 2 yuan

Kanglong Chemical (300759.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 11,538 billion yuan, up 12.39% year on year; net profit attributable to shareholders of listed companies was 1,601 billion yuan, up 16.48% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,514 billion yuan, up 6.51% year on year; basic income per share was 0.9033 yuan; it plans to distribute a cash dividend of 2 yuan (tax included) for every 10 shares to all shareholders.

China Life Insurance (601628.SH): Net profit in 2023 fell 34.2% year on year to 21.110 billion yuan, and plans to pay dividends of about 12.154 billion yuan

China Life Insurance (601628.SH) released its 2023 annual report. During the reporting period, it achieved operating income of 837.859 billion yuan, an increase of 1.4%; net profit attributable to shareholders of listed companies of 21.110 billion yuan, a year-on-year decrease of 34.2%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 21.285 billion yuan, a year-on-year decrease of 33.8%; and earnings per share of 0.75 yuan.

According to the 2023 profit distribution plan approved by the board of directors on March 27, 2024, it is proposed to distribute cash dividends of RMB 0.43 billion per share (tax included) to all shareholders based on 10% of the net profit for 2023, calculated on the basis of 28,264,705,000 shares already issued, for a total of approximately RMB 12.154 billion.

[Repurchase]

Keanda (002972.SZ): Plans to repurchase 8 million yuan to 10 million yuan of company shares

Keanda (002972.SZ) announced that the proposed repurchase amount will not be less than RMB 8 million, no more than RMB 10 million of the company's shares, and the repurchase price will not exceed RMB 12.5 per share.

Puluo Pharmaceutical (000739.SZ): Plans to spend 150 million yuan to 300 million yuan to buy back the company's shares

Pluo Pharmaceutical (000739.SZ) announced that the company plans to use its own funds to repurchase the company's shares through centralized bidding transactions through the Shenzhen Stock Exchange trading system. The repurchase of shares is intended to be used for employee stock ownership plans. If the company fails to carry out the aforementioned use within 36 months after the share repurchase is completed, the unused portion will be cancelled after following the relevant procedures in accordance with law. The total capital of this repurchase is not less than RMB 150 million (inclusive) and not more than RMB 300 million (inclusive). The share repurchase price is not more than RMB 20 per share (inclusive). The repurchase period is within 6 months from the date the board of directors of the company reviewed and approved the repurchase plan.

[Increase or decrease holdings]

Kaizhong Precision (002823.SZ): Director Wu Qi plans to reduce holdings by no more than 492.09 million shares

Kaizhong Precision (002823.SZ) announced that Ms. Wu Qi, the director and deputy general manager of the company, holds 1,968,359 shares of the company (0.68% of the company's total share capital), and that Ms. Wu Qi plans to reduce her holdings of the company's shares by no more than 492.09 million shares (0.17% of the company's total share capital) through centralized bidding transactions within 3 months after 15 trading days from the date of disclosure of the announcement.

Jinhua Co., Ltd. (600080.SH): Jin Bozhu plans to reduce its holdings by no more than 1%

Jinhua Co., Ltd. (600080.SH) announced that shareholder Jin Bozhu reduced his holdings of the company's unlimited tradable shares within 3 months through centralized bidding, accounting for no more than 1% of the company's total share capital.

[Other]

Liyuan Technology (688565.SH): Actual controller and chairman Shen Wanzhong is on bail awaiting trial

Liyuan Technology (688565.SH) announced that after receiving a notice from the actual controller and chairman, Mr. Shen Wanzhong, the Shanghai Municipal Public Security Bureau issued a “Bail Awaiting Trial Decision” on March 26, 2024. Due to the investigation of suspected illegal disclosure of important information, the Shanghai Municipal Public Security Bureau decided to release Mr. Shen Wanzhong, the actual controller and chairman of the company, on bail awaiting trial. Currently, Mr. Shen Wanzhong is able to perform his duties normally, the company's daily operations are normal, and all tasks are being carried out in an orderly manner.

Dechang Co., Ltd. (605555.SH): Obtained fixed notice for customer projects

Dechang Co., Ltd. (605555.SH) announced that its wholly-owned subsidiary Ningbo Dechang Technology Co., Ltd. received a designated notice on the EPS motor project from the world-renowned Tier1 company for automotive steering systems on March 26, 2024. According to the customer plan, the life cycle of both fixed-point projects is 6 years, with a total sales amount of about 274 million yuan. Mass production is expected to gradually begin in September 2024 and February 2025, respectively.