High-rolling investors have positioned themselves bullish on Palantir Technologies (NYSE:PLTR), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PLTR often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 11 options trades for Palantir Technologies. This is not a typical pattern.

The sentiment among these major traders is split, with 72% bullish and 27% bearish. Among all the options we identified, there was one put, amounting to $32,880, and 10 calls, totaling $743,204.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $8.0 to $30.0 for Palantir Technologies over the recent three months.

Volume & Open Interest Trends

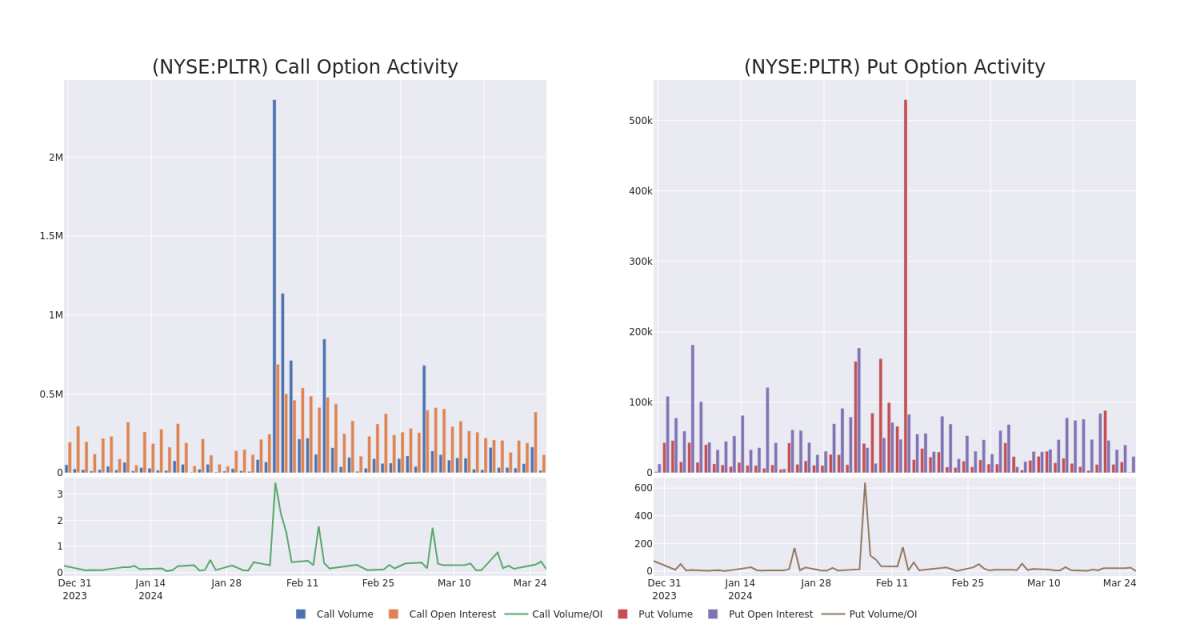

In today's trading context, the average open interest for options of Palantir Technologies stands at 15408.11, with a total volume reaching 15,967.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Palantir Technologies, situated within the strike price corridor from $8.0 to $30.0, throughout the last 30 days.

Palantir Technologies Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| PLTR | CALL | SWEEP | BULLISH | 10/18/24 | $27.00 | $143.1K | 474 | 9 |

| PLTR | CALL | SWEEP | BEARISH | 05/17/24 | $25.00 | $105.7K | 60.2K | 803 |

| PLTR | CALL | TRADE | BULLISH | 05/17/24 | $27.00 | $101.4K | 12.1K | 2.8K |

| PLTR | CALL | SWEEP | BULLISH | 04/19/24 | $24.50 | $89.6K | 5.1K | 9.8K |

| PLTR | CALL | TRADE | BEARISH | 01/16/26 | $8.00 | $88.2K | 994 | 1 |

About Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

After a thorough review of the options trading surrounding Palantir Technologies, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Palantir Technologies's Current Market Status

- Currently trading with a volume of 20,569,461, the PLTR's price is up by 0.44%, now at $25.0.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 40 days.

Expert Opinions on Palantir Technologies

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $28.0.

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Palantir Technologies, targeting a price of $35.

- An analyst from B of A Securities persists with their Buy rating on Palantir Technologies, maintaining a target price of $28.

- Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Palantir Technologies, targeting a price of $21.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palantir Technologies with Benzinga Pro for real-time alerts.