[Hong Kong, March 27, 2024] NetDragon Network Holdings Limited (“NetDragon” or the “Company”; HKEx stock code: 777), the founder of the world's leading Internet community, announced today its financial results for the full year of 2023. NetDragon management will hold a results conference and webcast on March 28, 2024 at 10 a.m. Hong Kong time to discuss financial results and recent business developments.

Dr. Liu Dejian, Chairman of NetDragon, said, “In 2023, we rationally laid out key strategic areas and made every effort to strengthen execution, thereby promoting sustainable growth and achieving remarkable results. Our gaming business revenue rebounded strongly, achieving revenue of RMB 3.76 billion for the full year, up 9.6% year on year (down 5.8% year on year in 2022). Our game business has achieved revenue growth in nine of the past ten years, and only experienced a decline in 2022 when the domestic economic growth rate slowed due to the pandemic. Our gaming revenue has grown 3.9 times over the past decade, almost entirely due to our endogenous growth, which is driven by our focus on providing players with high-quality games. All of our core gaming IPs achieved strong performance in 2023. We are committed to driving player engagement and consumption, providing quality content, and consolidating our market-leading position through continuous innovation and investment in artificial intelligence (AI) technology. During the year, while continuing to drive the strong growth of existing games, we also vigorously invested in the research and development of new game product lines in various categories. We believe our gaming business will have a unique competitive advantage in 2024, thanks to our excellent track record, R&D capabilities, and large player base.”

“Our education business reached an important milestone in 2023. In December, we successfully completed the spin-off of our overseas education business and listing in the US. This spin-off will not only unlock value for our shareholders, but will also lead our newly listed entity myND.AI to be more competitive in the hardware field and become a leader in the field of classroom software and hardware. Although hardware sales returned to normal levels before the pandemic in 2023, we believe that under the influence of the epidemic, the penetration rate and application rate of interactive displays have increased significantly, laying a more solid foundation for the widespread application of software in the future. We believe that Mynd.AI, as a market leader, can fully seize the opportunity and redefine the education industry landscape.”

“In 2023, we continued to make positive progress in environmental, social and governance (ESG). In December, we received an ESG rating from MSCI (Ming Sheng), an authoritative international index agency, to upgrade our ESG rating to BBB, which is a significant increase from the previous rating, showing that the company's achievements in the ESG field are well recognized by the market.”

“We are pleased to announce that the Board has decided that the final dividend for 2023 is HK$0.4 per common share. Together with the dividend announced during our interim results, the total dividend for the year reached HK$1.8 per common share.”

2023 Full Year Results Financial Summary

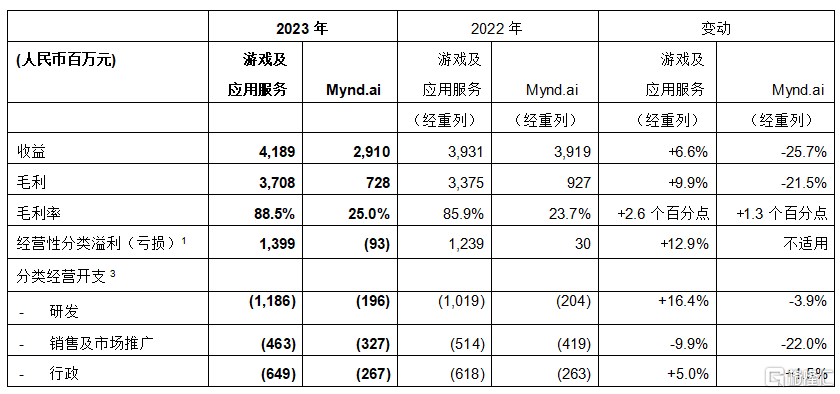

• Revenue was RMB 7.10 billion, down 9.7% year over year.

• Revenue from games and application services was RMB 4.19 billion, accounting for 59.0% of the Group's total revenue, an increase of 6.6% over the previous year.

• Revenue from Mynd.ai was RMB 2.91 billion, accounting for 41.0% of the Group's total revenue, a year-on-year decrease of 25.7%.

• Gross profit was RMB 4.4 billion, up 1.9% year over year.

• Operating classification profit from games and application services was RMB 1.4 billion, an increase of 12.9% over the previous year.

• In 2023, the operating classification loss 1 from Mynd.ai was RMB 93 million, while in 2022, an operating classification profit of RMB 30 million was recorded.

• Profit before depreciation and amortization before interest tax was RMB 1.33 billion, a year-on-year decrease of 8.7%.

• Operating profit was RMB 820 million, a year-on-year decrease of 28.6%.

• Non-GAAP operating profit was RMB1.15 billion, a decrease of 12.7% year over year.

• Profit attributable to the Company's owners was RMB 550 million, a year-on-year decrease of 34.1%.

• Non-GAAP profit2 attributable to the owners of the Company was RMB 960 million, a decrease of 24.9% over the previous year.

• Cash flow from operating activities was RMB 1.12 billion, up 4.2% year over year.

• The Company announced a final dividend of HK$0.4 per common share (2022: HK$0.4 per common share), subject to approval by the upcoming Annual General Meeting of Shareholders.

Categories Financial Summaries

Previously, the two main categories we reported were “gaming business” and “education business.” Since our overseas education business was spun off and listed in the US in December 2023 and renamed to Mynd.ai, starting with the full year results of 2023, our two categories will be changed to “Game and Application Services” and “Mynd.ai”, while also providing comparable financial data for the same period in 2022.

Gaming business

In 2023, with macroeconomic recovery after the pandemic and our focus on implementing sustainable growth strategies, our game revenue reached a record high, rising 9.6% year over year to RMB 3.76 billion, accounting for 89.7% of game and application service revenue. Over the past decade, our gaming revenue has grown more than 3.9 times, which fully proves the success of this strategy. During the year, we focused on expanding game content in a planned manner to achieve both “content” and “development” attributes. We have noticed that more players are willing to pay for innovative and high-quality content that is continuously updated in the game. This content is seamlessly integrated with the gameplay to provide players with a better gaming experience. We are also continuing to strengthen our operational capabilities in marketing, user acquisition, user retention, and game distribution to optimize our active player base. On the one hand, we promote game fairness and fun for all players; on the other hand, we enhance players' loyalty and encourage them to spend in order to enjoy a higher quality gaming experience.

In 2023, our domestic and overseas game revenue increased by 10.5% and 4.5%, respectively. The decline in player activity in the overseas game market after the pandemic, compounded by the overall impact of changes in user privacy policies, the overall overseas revenue of Chinese game developers fell 5.7% year on year in 2023, yet our overseas revenue still showed strong resilience, accounting for 15.0% of total game revenue. Furthermore, we achieved revenue growth in both the mobile game and mobile game sectors. Mobile game revenue increased 11.1% year over year to RMB 3.17 billion, accounting for 84.3% of total game revenue. Mobile game revenue increased 2.0% year over year to RMB 590 million, accounting for 15.7% of total game revenue.

“Magic Domain” IP achieved excellent results in 2023, with revenue growth of 12.4% year-on-year to RMB 3.43 billion, highlighting the enduring appeal of this flagship IP and continuing to consolidate our competitive advantage in the MMORPG game field. Among them, our flagship mobile game “Magic Domain” achieved revenue growth of 14.0% year-on-year to RMB 2.89 billion, thanks to our growth strategy, namely i) launching new content and gameplay mechanisms at a high frequency, ii) improving the overall experience of players by truly meeting the needs of all players, thereby achieving a balance in the ecosystem, and (iii) improving our level of service to paying users. Our strategy not only boosted revenue growth, but also increased player engagement. The average gaming time of “Magic Domain” IP users increased by 50.4% year-on-year during the year.

Our content strategy has also achieved remarkable results in the mobile game field. The number of monthly active users of “Magic Domain” (mobile game) increased by 50.4% year-on-year, accounting for 36.2% of the number of monthly active users of mobile games. At the same time, the average paid users of “Magic Domain Interactive” account for about 20% of mobile game paid users. The high level of participation of our players in mobile and mobile games, as well as the continuous increase in the dual platform (i.e. mobile game and mobile game) attributes of “Magic Domain”, have brought us higher player engagement and monetization opportunities. In 2023, revenue from mobile game products under the “Magic Domain” IP increased 4.6% year over year. Among them, our flagship mobile game “Magic Domain Pocket Edition” achieved a 6.0% year-on-year increase in sales, thanks to the continuous enhancement of our gaming experience and further optimization of distribution strategies to acquire users more efficiently.

Our “Soul Blade” IP regained growth in 2023, and game revenue under this IP increased 5.8% year over year. During the year, the “Soul Blade” IP became more and more popular, and the number of live viewers of the “Soul Blade” e-sports tournament held in the second half of the year reached a record high. With the restart of e-sports events after the pandemic in 2023, we have achieved great success in the e-sports field, and with a player base of over 300 million since launch, we will further promote the “Soul Blade” IP and acquire more players.

Our “Conquer” IP also made significant progress in 2023. Due to the success of the “MMO+ casual” gameplay in the “Conquer” game, we have begun the development of a new game (“Codename - Alpha”), which is expected to be launched in 2024. At the same time, we have begun to build an online and offline tournament system with the aim of raising players' participation to a new level.

During the year, we made significant progress in applying generative artificial intelligence (AIGC) to create value for different segments of our game business. Our use of AI in art production increased from 14% in the first quarter of 2023 to 58% in the fourth quarter. At the same time, as we increasingly benefit from AI language model training, the labor cost saved by AI in the fourth quarter of 2023 increased by 300% compared to the first quarter of 2023, thus achieving efficient production of high-quality content. With AIGC, we can update content more frequently, thereby increasing player retention and driving monetization. Furthermore, we strategically invest in areas where the company's business is deeply integrated with AIGC to enhance our competitive advantage. During the year, we made significant progress in the “AI Companionship” technology developed in MOBA games, which significantly increased the retention rate of players through AI companionship. We have also made breakthroughs in the development of non-player characters (NPCs), and these NPCs are expected to be integrated into our new open world MMORPG games in the future.

Looking ahead, we will continue to drive revenue and profit growth in our game business through a two-pronged strategy. On the one hand, we will drive revenue growth for existing games, and on the other hand, we will invest in the research and development of a range of new game projects, including social casual games, card placement games, aerial shooter multiplayer games, MOBA games, MMORPG games, and two-dimensional games. Furthermore, we will continue to expand our market in 2024, with plans to enter or expand our share in markets such as Japan, the Middle East, and Indonesia.

Mynd.ai

In December 2023, we successfully completed the spin-off listing of our overseas education business through a merger with Gravitas Education Holdings Inc. (“GEHI”), a company listed on the New York Stock Exchange. The combined entity was valued at US$800 million and renamed Mynd.ai, Inc. (“Mynd”). Prior to the completion of the transaction, GEHI had completed the sale of all of its businesses except the education business in Singapore (accounting for about 8% of Mynd exam preparation revenue in 2023). As of December 31, 2023, NetDragon held 74.4% of Mynd's issued shares and continued to consolidate Mynd's financial results into the company's 2023 financial statements.

In 2023, Mynd's revenue was RMB2.91 billion, compared to RMB3.92 billion in 2022. The decline in revenue reflects the return to normalization of the business environment after the COVID-19 pandemic ended. Specifically, in the education technology market, governments around the world have launched epidemic relief plans in 2021 and 2022. With the support of subsidy funds, customer demand has increased significantly, and these plans have basically come to an end in 2023. Compared with 2020 and previous years (before the pandemic), Mynd's revenue in 2023 continued to grow.

Other financial highlights for Mynd in 2023 include:

-Gross margin reached 25.0%, up 1.3 percentage points from 2022, due to lower raw material and freight costs, and the impact of exchange rates

-Cash flow from operating activities increased by RMB 23 million compared to 2022

- The year-end cash balance was RMB 650 million compared to RMB 200 million at the end of 2022

-Core category loss 1 was RMB 93 million, while profit in 2022 was RMB 30 million, mainly due to the decline in sales volume due to the return to normalization of the above mentioned market

Mynd subsidiary Prometheus continues to maintain its market leadership position. In 2023, Prometheus's share of the global K-12 interactive flat panel display market (excluding China) reached 17.4%. In the fourth quarter of 2023, Prometheus achieved 21.1% market share in the global K-12 interactive flat panel display market (excluding China), and continued to maintain the leading position in the US, the UK, Ireland, and Germany in terms of market share. 6

Prometheus' leadership in the global K-12 market helps the company continue to grow its hardware and software business. In addition to driving the growth of the hardware business, Prometheus also recently launched Explain Everything Advanced, a comprehensive SaaS solution to develop software revenue opportunities based on a subscription model using our global market channels. In 2024, Mynd will continue to promote the development of the software business, enhance the competitiveness of core products, and vigorously promote sales activities. At the same time, Mynd will continue to invest in research and development to maintain its leading position in the high-end market while increasing its penetration rate in the middle- and low-end markets with greater prospects.

We believe that Mynd has the following unique advantages in gaining market share:

- As a market leader, Prometheus has a large installed base, which is conducive to the sale of replacement hardware and SaaS software

- Extremely focused on the field of education and in-depth understanding of school needs

- Has an in-house education consultant team, can conduct professional training for users, and has the unique ability to understand and meet the different needs scenarios of schools/teachers

- Comprehensive after-sales support structure to ensure seamless integration with teachers' workflows

- A complete global network of over 4,000 distributors/dealers has been established for more than 20 years, and distributors/dealers have a deep understanding of the value of Prometheus displays

- Prometheus' market reputation and long history as a market-leading brand give us confidence to become a long-term technology partner for a wide range of users

The spin-off has laid the foundation for Mynd to surpass the original hardware business and integrate software applications into the product, thereby taking the teaching experience to a new level. Looking ahead, continued growth in hardware revenue, investment in software application development to achieve large-scale SaaS revenue, and strengthening the leading position in the hardware and software market will drive Mynd's further success.