On March 21, China Construction International (3311.HK) handed over the latest financial report for 2023. The results are quite impressive. Last year's performance data continued to grow across the board. The core indicators of profitability all achieved performance that exceeded expectations, and the company continues to fulfill the target vision of high-quality development.

The uncertainty of the current external environment is still disturbing the market, and the overall pattern of pressure on Hong Kong stocks has not been completely reversed, so investors are cautious in choosing value targets. As a scarce “definitive” sample, China Construction International may be able to meet market expectations. Let's start with this financial report and take a look at the company's growth logic in the light of recent positive news.

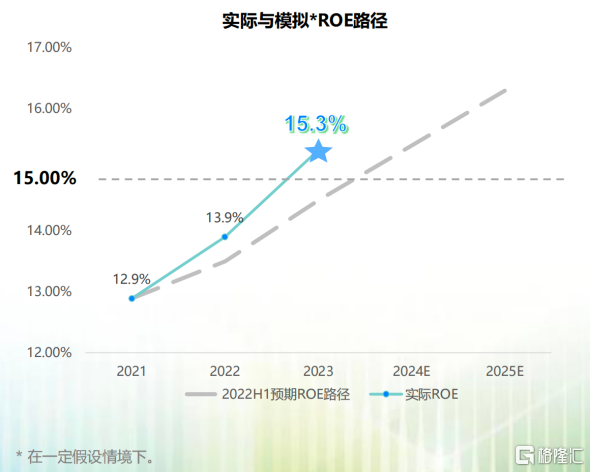

Increased ROE and cash flow levels to achieve high-quality development

ROE and cash flow levels are the best footnotes summarizing China Construction International's overall performance last year.

As an indicator that value investors are concerned about, the company's ROE was 15.3% in 2023, completing the target ROE to 15% in 2025 ahead of schedule, far exceeding the ROE growth path previously anticipated. This means that the transformation and upgrading of the company's business has been verified, and in the end, profitability has gradually increased, showing a greater value space.

(Photo: Company ROE Growth Path)

Further using the DuPont analysis method to disassemble ROE (leverage ratio, net interest rate, asset turnover ratio), it can be found thatOn the basis of maintaining a stable level of leverage, China Construction International's net interest rate has increased, particularly the improvement in asset turnover, which has contributed to a significant increase in ROE.

In terms of net interest rates, thanks to the steady increase in the company's revenue last year, net profit was released at an accelerated pace, and net interest rates were raised as a result. According to financial reports, the company's revenue last year was 113,734 billion yuan (HKD, same unit), up 11.5% year on year; net profit to mother was 9.164 billion yuan, up 15.2% year on year.

In terms of asset turnover, as of the end of 2023, the company's asset turnover recorded 0.48. Looking back at the end of 2022 and the end of '21, they were 0.455 and 0.38, respectively. As can be seen, the company's turnover rate has been on a steady upward trend for the past three years. At the same time, as financial quality continues to improve, it will eventually drive ROE to improve.

In addition to ROE, cash flow is another indicator that investors are concerned about, and the performance is also impressive.China Construction International's operating cash flow in 2023 was 500 million yuan, a significant increase compared to 200 million yuan in 2022. Among them, the mainland market made a landmark leap forward, achieving positive operating cash flow for the first time since the commencement of mainland business.

Specifically, the achievement of the above results is related to structural changes in the company's new orders, that is, investment-driven and technology-driven performance. Technology led to the signing of new contracts of 74.62 billion yuan, achieving a high growth rate of 44.6%; investment-driven businesses also achieved impressive results, with a growth rate of 21.1%.

Among them, investment-driven businesses have capital investment in the early stages, and profit margins are relatively high. After completing the PPP to GTR business model transformation in 2021, there were no long-term projects of more than 5 years in the newly signed contracts. Turnover and cash return became faster, and the dynamic return on capital increased markedly, ultimately driving subsequent improvements in ROE and operating cash flow.

Technology-driven businesses generally do not involve upfront investment and ensure the safety of cash flow to a certain extent. The business increased the company's turnover and achieved better cash flow performance despite sacrificing profit margins compared to investment-driven businesses.

Predictably, as contract projects pay off revenue earlier in the next 2-3 years, the turnover ratio continues to increase, thereby driving further ROE improvement, and cash flow is also expected to continue to grow.

Therefore, China Construction International made great strides in ROE and cash flow in 2023, which is the result of a combined improvement in operating performance and financial quality. In the wave of transformation and upgrading of the construction industry, the company adheres to a scientific and technological strategy, so the fundamentals have been reshaped, and it continues to advance on the path of high-quality development.

Anchor the three determinants and master the logic of long-term growth

Looking at the strategic layout, the core reason why China Construction International is able to achieve high-quality growth is that it has formed the three major deterministic “anchors” of growth.

1. Anchoring development space based on the Hong Kong and Macau markets

In terms of the Hong Kong and Macau markets, China Construction International will enjoy plans such as Hong Kong's northern metropolitan area and the 10-year hospital development plan, which have created development dividends for the construction market.

As a leader, the company has now obtained iconic projects such as the Yuen Long flood control dam in the northern metropolitan area, and has successively obtained large-scale hospital projects such as Prince of Wales Hospital, Ge Lianghong Hospital, and the Macau Outlying Islands Medical Complex Rehabilitation Hospital building. Furthermore, the civil engineering project achieved a breakthrough in Macau and won the bid for the southern section of the Macau Light Rail East Line. It is the project with the largest contract value in the Macau construction market during the year.

It is worth mentioning that China Construction International has once again made a breakthrough in the field of environmental protection based on its advantages in environmental engineering technology. Previously, the company won the bid for the Hong Kong New Territories West Landfill Expansion Project with a contract value of HK$61.1 billion, making it the largest project in the company's history.

(Photo: Rendering of the West New Territories Landfill Expansion Project)

Earlier, the Hong Kong Special Administrative Region Government announced the “Northern Metropolitan Area Action Plan”, which means that plans for the Northern Metropolitan Area have been further clarified, and development is expected to be accelerated. In the long-term development process of the region, China Construction International is able to gather more project resources in the industry and seize continuously unleashed business opportunities based on its leading position.

2. Innovative application of MiC construction anchors growth opportunities

Prefabricated buildings will usher in more space for development, and embracing MiC will reap new opportunities for growth. The 2025 prefabricated development target, that is, prefabricated buildings account for 30% of newly built buildings. Judging from the market size, it is expected to reach 1.5 trillion yuan, which means that MiC is rapidly integrating into the trillion-level market. Recently, Shenzhen Longgang Intelligent Construction Industrial Park plans to expand a large-scale MiC innovation production base, which also reflects strong potential MiC market demand.

At present, China Construction International has formed a strong demonstration effect in the promotion and application of MiC. Take the renovation of Birch Factory Building 8 in Xicheng District of Beijing as an example. The project has now been fully delivered, and it only took 90 days to meet delivery standards. The company provides high-quality solutions for the upgrading and transformation of large and megacities, and will also gain more market recognition after further promotion and application in the future.

The company won the bid for the Kai Tak World Express Road lightweight public housing project at the end of last year. The project provides approximately 10,000 units and is expected to be built over a period of two years, which means that the company will reap high-certainty revenue growth through the MiC sector in the short term. Combining China Construction International's existing expertise and market position in the MiC field, the company will continue to take the lead under the changing development model of the construction industry, thus seizing more growth opportunities in the domestic construction market.

3. Technology empowerment strategy anchors the new value of the Blue Ocean market

In fact, China Construction International is unable to seize every market opportunity without its insistence on technology empowerment strategies. Whether it is winning a bid for a project in the Hong Kong and Macau market or achieving an application breakthrough in the MiC field, it is essentially technological innovation as the underlying support.

(Photo: Technology Empowerment Strategy)

The technology empowerment strategy also determines that China Construction International is an imaginative space for developing a business-level business with technology as the core, and is no longer limited to individual segments. Based on its own strategic advantages, China Construction International can explore new value in the Blue Ocean market for a long time and open up new space for imagination.

summed

The construction industry is transforming in the direction of industrialization, green construction, and intelligent manufacturing, and China Construction International has always insisted on empowering business transformation and upgrading with technological strategies.

Currently, China is developing “new quality productivity” to accelerate the modernization and transformation of the construction industry, thus creating a new engine for economic development. The core of new quality productivity lies in scientific and technological innovation. China Construction International has now formed the core competitiveness of technological leadership, intelligent manufacturing, and green development, which will vigorously promote the high-quality development of China's construction industry. As a result, the company will reap continuously enhanced endogenous growth momentum and usher in vigorous development.

The essence of the international transformation and upgrading of Chinese construction is also a reflection of building “new quality productivity”. It is a microcosm of the traditional construction industry's technological and industrial upgrading. Following the announcement of the results, CICC published a report maintaining China Construction International's “outperforming industry” rating and raising the target price to HK$11. The company's ROE and cash flow levels continue to rise, transformation and upgrading are progressing comprehensively, and it has the ability to gain triple recognition from technology, products and capital markets.