Shaanxi Construction Machinery Co.,Ltd (SHSE:600984) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

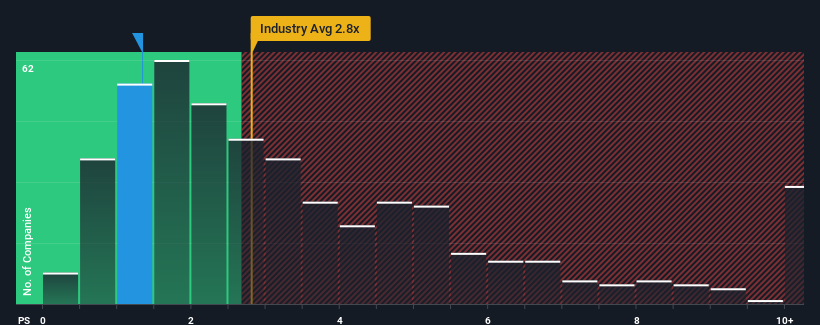

Even after such a large jump in price, Shaanxi Construction MachineryLtd's price-to-sales (or "P/S") ratio of 1.3x might still make it look like a buy right now compared to the Machinery industry in China, where around half of the companies have P/S ratios above 2.8x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Shaanxi Construction MachineryLtd's P/S Mean For Shareholders?

Shaanxi Construction MachineryLtd hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Shaanxi Construction MachineryLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shaanxi Construction MachineryLtd's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shaanxi Construction MachineryLtd's to be considered reasonable.

There's an inherent assumption that a company should underperform the industry for P/S ratios like Shaanxi Construction MachineryLtd's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 20% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 13% as estimated by the one analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 27%, which is noticeably more attractive.

With this information, we can see why Shaanxi Construction MachineryLtd is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Shaanxi Construction MachineryLtd's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Shaanxi Construction MachineryLtd's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Shaanxi Construction MachineryLtd's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Shaanxi Construction MachineryLtd (2 are a bit concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.