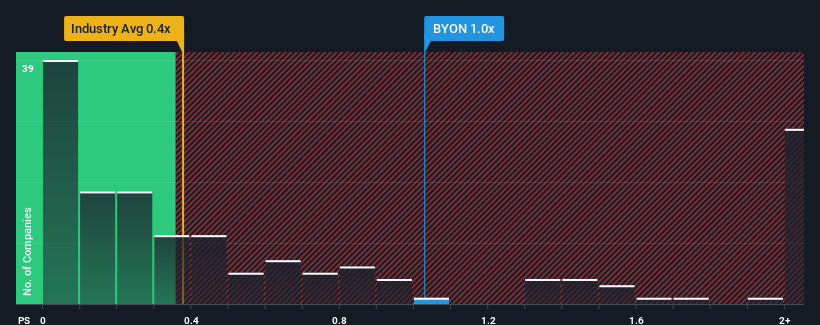

Beyond, Inc.'s (NYSE:BYON) price-to-sales (or "P/S") ratio of 1x may not look like an appealing investment opportunity when you consider close to half the companies in the Specialty Retail industry in the United States have P/S ratios below 0.4x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has Beyond Performed Recently?

Beyond hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beyond.How Is Beyond's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Beyond's is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 19%. As a result, revenue from three years ago have also fallen 37% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the nine analysts covering the company suggest revenue should grow by 24% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 5.6% per annum, which is noticeably less attractive.

With this information, we can see why Beyond is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Beyond's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Beyond shows that its P/S ratio remains high on the merit of its strong future revenues. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Beyond with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Beyond's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.