The express delivery industry is an industry with remarkable economies of scale. Faced with multiple global macroeconomic challenges and increasingly fierce industry market competition, express delivery companies are firmly grasping the market opportunities for the rapid development of e-commerce in various countries under the wave of the times.

In this macro context, the global logistics service operator Jitu (1519.HK) recently handed over its first financial report after listing is outstanding. The advantages of Goku's global layout are being highlighted, and operational efficiency and profitability are also improving, showing the steady pace of high-quality and rapid development in the industry.

1. Key words of Jitu's financial report: gross profit and adjusted EBITDA were corrected for the first time, and the Chinese market made a profit for the first time

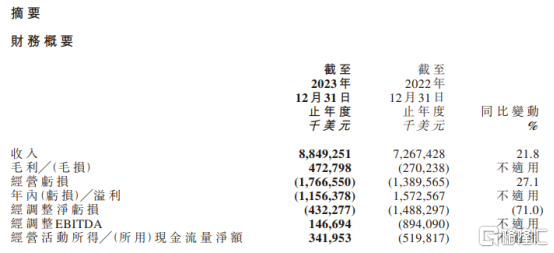

Judging from the financial data released by Jitu this time, its revenue has maintained rapid growth in the past 2023, while also breaking through milestones in terms of profit.

Among them, gross profit and adjusted profit before tax, interest, depreciation and amortization (EBITDA) were corrected for the first time, reaching US$473 million and US$147 million, respectively. In addition, gross profit and adjusted EBITDA in the Chinese market were also corrected for the first time.

(Source: Polar Rabbit Earnings Report)

These indicators can be said to have sent quite positive signals to the outside world.

On the one hand, the first correction in gross profit shows that Jitu has been effectively controlled in terms of overall costs, and that scale effects and synergy effects continue to unleash the potential for performance growth.This transformation not only means that Polar Rabbit already has the ability to continue hematopoietic, but also has more living space and development opportunities in the fierce battle of the industry.

On the other hand, the first adjusted EBITDA regularization more comprehensively reflects Jitu's profitability in operating activities, because it takes into account factors other than general profit items, such as interest, taxes, depreciation, amortization, etc.This also fully shows that Goku has made positive progress in managing daily operations and capital expenses, and has achieved certain achievements in controlling costs and improving efficiency.

It can be said that the first correction in gross profit and adjusted EBITDA shows the positive trend of Jitu on the path of sustainable profit growth, which indicates its strong market competitiveness and long-term development potential.

However, in the Chinese market, the achievement of this profit record is even more of a landmark.

Last year, Jitu's revenue in the Chinese market grew rapidly by 27.7% year on year, reaching US$5.229 billion. Considering the fierce competition in the overall domestic market and the sharp drop in industry prices last year, Jitu not only remained stable in terms of single ticket revenue, but at the same time, the structure of business volume was optimized, operating efficiency continued to improve, and operating costs continued to decrease, all of which supported it to achieve profit breakthroughs in the Chinese market. Financial reports show that in 2023, Jitu's gross profit and adjusted EBITDA in the Chinese market were corrected for the first time, reaching US$58.822 million and US$307.30 million respectively.

Based on the above performance breakthroughs, it can be said that Jitu already has a strong ambition to consolidate the “big cake” of the Chinese market. It is worth mentioning that in 2023, Jitu's revenue in the Chinese market increased to 59.1% of the group's revenue. Over the past four years, Jitu has continued to be heavily invested in the Chinese market, and now it has finally ushered in a substantial breakthrough. This also means that in the future, it will have more energy to continue to replicate its business model and business system into other emerging markets, conquer global markets, and achieve greater business growth.

2. Polar Rabbit's global ambitions and international layout have achieved remarkable results

Polar Rabbit's global performance is steadily improving. According to financial data, in 2023, Polar Rabbit handled a total of 18.8 billion packages worldwide, an increase of 29% over the previous year. Among them, the number of packages in Southeast Asia, China, and new markets increased by 28.9%, 27.6%, and 369.0%, respectively. Southeast Asia ranked first for four consecutive years, and the market share of China and new markets also increased rapidly.

(Source: Polar Rabbit Earnings Report)

In the Southeast Asian market, Jitu's core competitiveness is reflected in good cooperation with e-commerce platforms, efficient use of infrastructure and resources, and excellent service quality. Specifically, Jitu provides e-commerce partners with huge network carrying capacity to solve peak season delivery problems. During the 2023 Double 12 period, Jitu handled a peak of more than 16 million packages in a single day in Southeast Asian countries. Furthermore, Jitu has further improved the efficiency of the utilization of key infrastructure and resources such as transit centers, outlets, and vehicles, and promoted scale effects. Financial data shows that in 2023, the average cost of a single ticket for Jitu in Southeast Asia declined steadily, and the average delivery time was 6.5% shorter than in 2022. At the same time, the customer complaint rate continued to decline.

As far as the Chinese market is concerned, against the backdrop of intense competition in the industry and a large year-on-year decline in industry prices, Jitu's single ticket revenue was stable compared to the previous year, mainly because Getu optimized the package volume structure of different e-commerce platforms and obtained more high-quality customers. At the same time, the proportion of reverse parts and loose parts gradually increased, further stabilizing the overall single ticket revenue. At the same time, thanks to the scale effect brought about by the growth in business volume and refined operation management, the cost of a single ticket for Jitu continued to decline, from $0.40 in 2022 to $0.34 in 2023.

It is worth mentioning that Jitu's service quality in the Chinese market has been steadily improving. In various official logistics service opinion surveys, Jitu maintained a high level of satisfaction. According to public data disclosed by the State Post Office, Jitu's average complaint rate in 2023 was 0.54, the lowest among major express delivery operators in China, far below the industry average of 4.45; in 2023, Jitu's comprehensive complaint handling index was 99.43, which also ranked first among major express delivery operators in China, higher than the industry average of 97.09.

Furthermore, since 2022, Jitu has accelerated business globalization and opened up new markets, and has successively expanded its business to Saudi Arabia, the United Arab Emirates, Mexico, Egypt, and Brazil. Financial reports show that in 2023, Jitu's market share in the new market increased from 1.6% in 2022 to 6.0% in 2023. The number of packages was 230 million, up 369.1% year on year, and annual revenue increased 299.7% year on year to US$327 million in 2023.

Judging from the overall global layout, Jitu's express delivery service network currently spans 13 countries. As of December 31, 2023, Jitu has approximately 8,500 network partners and approximately 19,600 outlets worldwide, and operates 237 transit centers, more than 3,900 trunk routes and 9,600 trunk vehicles, including more than 5,100 of its own trunk line vehicles.

Regarding future global development, Jitu stated in this financial report that it will pay close attention to other global market trends, choose the right method, and carefully enter other markets to achieve sustainable growth on a global scale, and will better serve global customers and achieve long-term growth goals through unremitting efforts and continuous innovation.

3. Conclusion

In the capital market, Jitu has also been favored by major international banks. Among them, Deutsche Bank covered Gerabbit Express for the first time in a recently released research report and gave it a “buy” rating. The target price was HK$16.

Deutsche Bank said it is optimistic about the unique advantages and growth potential of GeRabbit Express in the logistics industry. It is estimated that in 2024, Jitu's performance is expected to surpass the industry average, and its market share will further increase. At the same time, the industry's downward trend in single ticket revenue is slowing down, which will have a positive impact on the company's profit margins. Deutsche Bank is also optimistic about the future of Goku Express's expansion in overseas markets.

Looking forward to the future, it can be expected that as Jitu continues to consolidate its core competitiveness, strengthen its domestic market share and quality of operations, and actively enter emerging markets to seize opportunities under the wave of Chinese e-commerce going overseas, both domestic and overseas businesses will usher in more opportunities for growth. Based on this, the value growth path of Polar Rabbit is clear enough.