Broadex Technologies Co., Ltd. (SZSE:300548) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

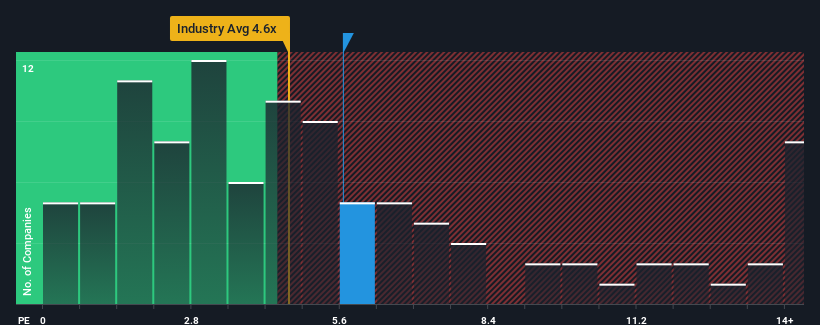

Since its price has surged higher, Broadex Technologies may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 5.7x, when you consider almost half of the companies in the Communications industry in China have P/S ratios under 4.6x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

What Does Broadex Technologies' P/S Mean For Shareholders?

Recent times have been advantageous for Broadex Technologies as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Broadex Technologies.Do Revenue Forecasts Match The High P/S Ratio?

Broadex Technologies' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. This was backed up an excellent period prior to see revenue up by 116% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 20% during the coming year according to the four analysts following the company. That's shaping up to be materially lower than the 50% growth forecast for the broader industry.

In light of this, it's alarming that Broadex Technologies' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Broadex Technologies shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see Broadex Technologies trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Before you settle on your opinion, we've discovered 5 warning signs for Broadex Technologies (2 are a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Broadex Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.