It is a pleasure to report that the Harbin Bank Co., Ltd. (HKG:6138) is up 34% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Five years have seen the share price descend precipitously, down a full 84%. The recent bounce might mean the long decline is over, but we are not confident. The fundamental business performance will ultimately determine if the turnaround can be sustained. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

While the stock has risen 24% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

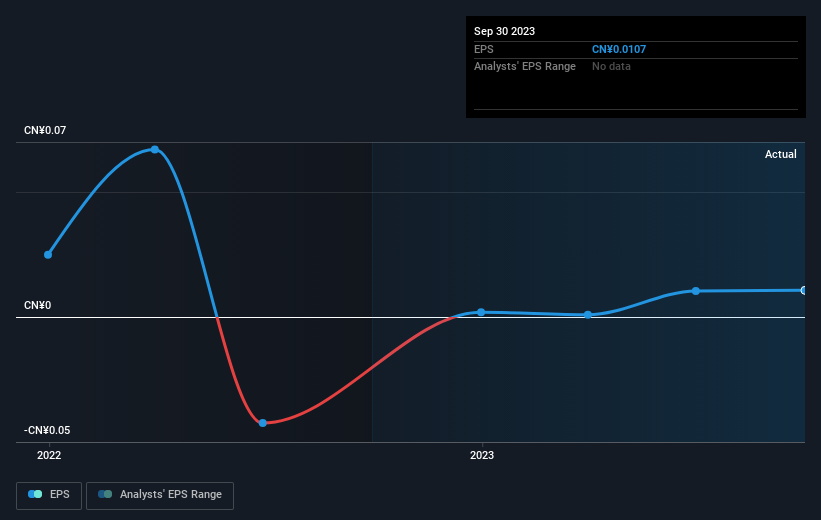

During the five years over which the share price declined, Harbin Bank's earnings per share (EPS) dropped by 53% each year. The share price decline of 30% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Harbin Bank's key metrics by checking this interactive graph of Harbin Bank's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Harbin Bank shareholders have received a total shareholder return of 15% over one year. Notably the five-year annualised TSR loss of 13% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Harbin Bank better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Harbin Bank .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.