ClouDr Group Limited (HKG:9955) shareholders that were waiting for something to happen have been dealt a blow with a 47% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 63% loss during that time.

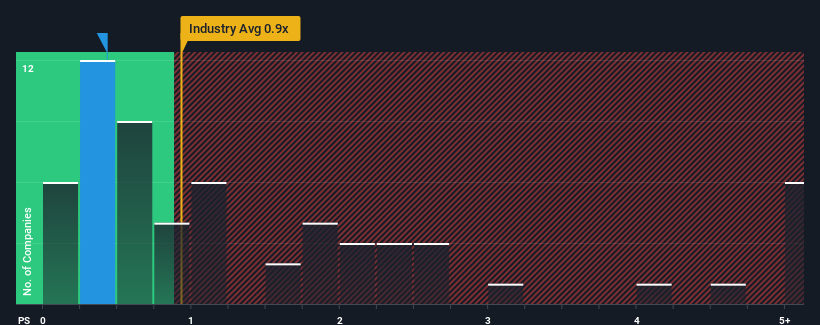

Even after such a large drop in price, there still wouldn't be many who think ClouDr Group's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Hong Kong's Healthcare industry is similar at about 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

How Has ClouDr Group Performed Recently?

ClouDr Group's revenue growth of late has been pretty similar to most other companies. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on ClouDr Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For ClouDr Group?

The only time you'd be comfortable seeing a P/S like ClouDr Group's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 13% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that ClouDr Group's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

ClouDr Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at ClouDr Group's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for ClouDr Group with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.