The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Lamb Weston Holdings (NYSE:LW). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Lamb Weston Holdings' Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Lamb Weston Holdings' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 56%. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

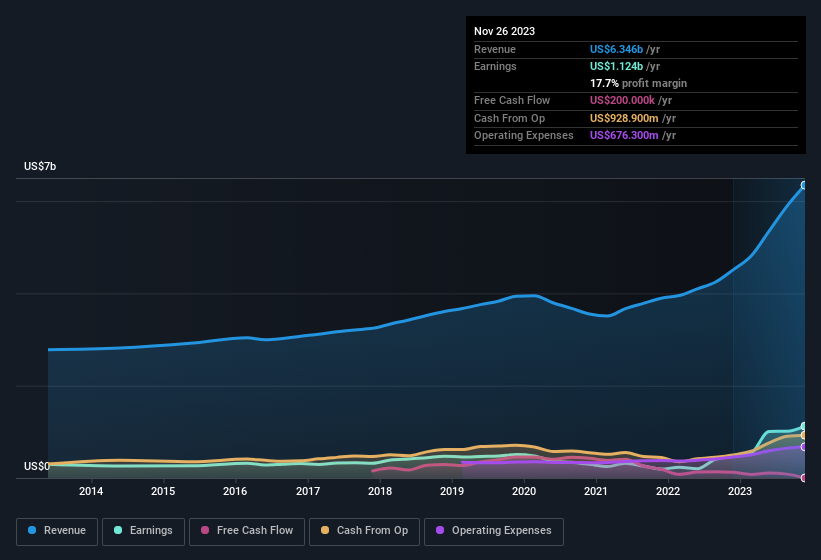

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Lamb Weston Holdings shareholders can take confidence from the fact that EBIT margins are up from 15% to 18%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Lamb Weston Holdings.

Are Lamb Weston Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The first bit of good news is that no Lamb Weston Holdings insiders reported share sales in the last twelve months. Even better, though, is that the Independent Non-Executive Chairman, William Jurgensen, bought a whopping US$253k worth of shares, paying about US$84.35 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

Along with the insider buying, another encouraging sign for Lamb Weston Holdings is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at US$82m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Does Lamb Weston Holdings Deserve A Spot On Your Watchlist?

Lamb Weston Holdings' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Lamb Weston Holdings belongs near the top of your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Lamb Weston Holdings (of which 1 is significant!) you should know about.

Keen growth investors love to see insider buying. Thankfully, Lamb Weston Holdings isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.