Those holding Rockwell Medical, Inc. (NASDAQ:RMTI) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Taking a wider view, although not as strong as the last month, the full year gain of 22% is also fairly reasonable.

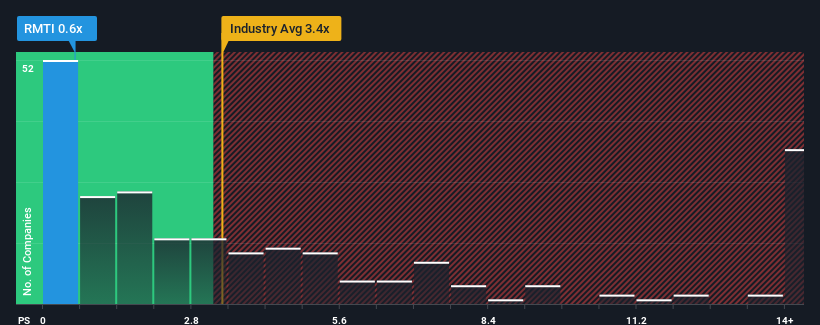

Although its price has surged higher, Rockwell Medical may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.6x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

What Does Rockwell Medical's P/S Mean For Shareholders?

Recent times have been advantageous for Rockwell Medical as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Rockwell Medical.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Rockwell Medical's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. This was backed up an excellent period prior to see revenue up by 34% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 7.5% as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 26% growth forecast for the broader industry.

With this information, we can see why Rockwell Medical is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Even after such a strong price move, Rockwell Medical's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Rockwell Medical maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You need to take note of risks, for example - Rockwell Medical has 3 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of Rockwell Medical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.