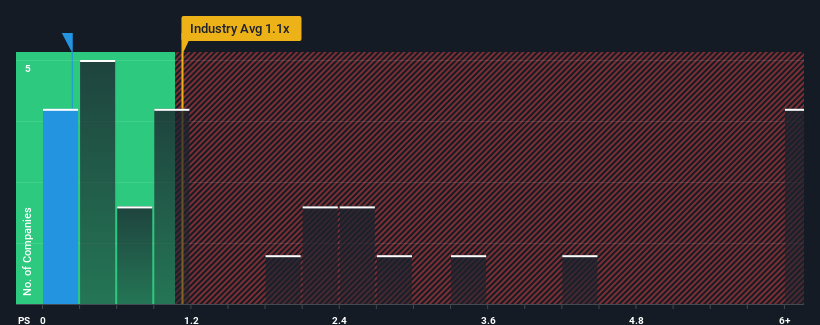

When you see that almost half of the companies in the Specialty Retail industry in China have price-to-sales ratios (or "P/S") above 1.1x, Suning.com Co., Ltd. (SZSE:002024) looks to be giving off some buy signals with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Suning.com Has Been Performing

Suning.com could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Suning.com will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Suning.com would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. As a result, revenue from three years ago have also fallen 74% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 54% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader industry.

With this in consideration, we find it intriguing that Suning.com's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Suning.com's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

To us, it seems Suning.com currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Suning.com with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.