Unfortunately for some shareholders, the Freight Technologies, Inc. (NASDAQ:FRGT) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 91% share price decline.

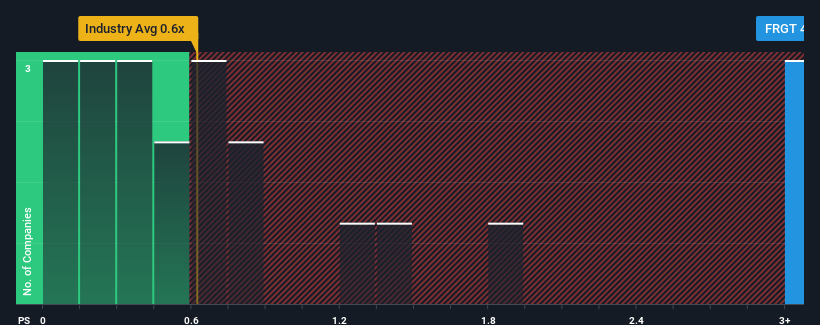

In spite of the heavy fall in price, you could still be forgiven for thinking Freight Technologies is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 4.8x, considering almost half the companies in the United States' Logistics industry have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Freight Technologies' P/S Mean For Shareholders?

Recent times haven't been great for Freight Technologies as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Freight Technologies will help you uncover what's on the horizon.How Is Freight Technologies' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Freight Technologies' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. Even so, admirably revenue has lifted 287% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 71% over the next year. With the industry only predicted to deliver 3.1%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Freight Technologies' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Freight Technologies' P/S

Even after such a strong price drop, Freight Technologies' P/S still exceeds the industry median significantly. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Freight Technologies' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 5 warning signs for Freight Technologies (2 are a bit unpleasant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.