In recent years, changes in the external environment have changed the consumption habits and lifestyle of ordinary consumers, but few people have noticed that they are also reshaping people's production methods, accelerating the digital upgrading of the global industrial manufacturing industry and reducing costs and increasing efficiency.

Industrial products with TOB business as the core. Under the wave of digitalization, MRO (Industrial Product Procurement Service) forms a potential circuit for continuous value growth.

Among them, “China's first MRO stock to go to the US” Zhen KH.US (ZKH.US) announced its first financial report after listing. Revenue grew steadily in 2023, turning losses into profits in the quarter, showing stronger and stronger business management capabilities.

Judging from the stock price, it has shown an overall upward trend since it landed on the NYSE. At press time, the stock price reached $19.51, up nearly 26% from the issue price of $15.5, and the company was recognized by the capital market.

Currently, MRO is developing relatively mature overseas, and many “giants” with a market capitalization of 10 billion dollars have sprung up in the US stock market. For example, US MRO giant Guanjie's stock price was refreshed again this year, and the market capitalization reached 50 billion US dollars. Looking back at the performance of the past 10 years, the stock price has more than doubled tenfold as profits have increased.

Looking at the development path of overseas markets, how did Zhenkun break the profit dilemma? What future growth logic is in place?

MRO Track “Nagasaka Heavy Snow”

Financial reports show that in 2023, Zhenkun Bank's GMV was 11.083 billion yuan, up 18.2% year on year; annual revenue was 8.721 billion yuan, up 4.9% year on year; gross margin was 16.7%, and gross margin continued to rise for three years.

At the data level, profitability continues to increase thanks to increased gross margin, reduced management fee rates, and performance fee rates. The company turned a loss into profit for the first time in the fourth quarter of last year, achieving adjusted net profit of 27.54 million yuan. It has been improving and increasing simultaneously for seven consecutive quarters.

As can be seen, while the external economic environment is still uncertain. For example, against the backdrop of declining prosperity in the industrial sector of construction and related industries, Zhenkun has maintained business resilience and continued growth in performance.

Combined with changes in the size of overseas markets, and when viewed horizontally, overseas giants will find that Zhenkun is on MRO, a long-slope, heavy snowy track. The overall scale growth shows a healthy upward curve, and the industry has high certainty and strong sustainability.

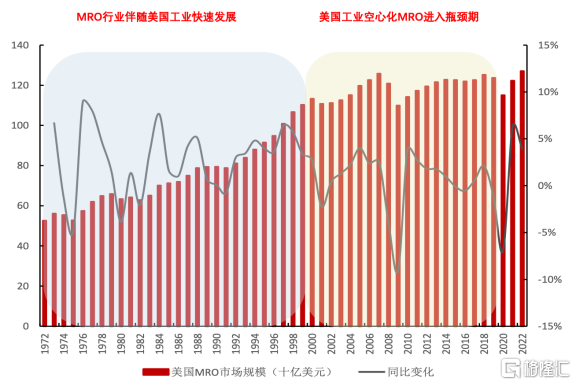

Take the US MRO market as an example. From 1972 to 2000, its market size gradually exceeded 100 billion US dollars, and the year-on-year growth rate remained in the single-digit range. The overall trend was a gradual upward trend. Since 2000, due to the impact of industrial migration, market growth has stabilized. Even after experiencing a scale contraction caused by two changes in the external economic environment, it can quickly recover and maintain an upward trend.

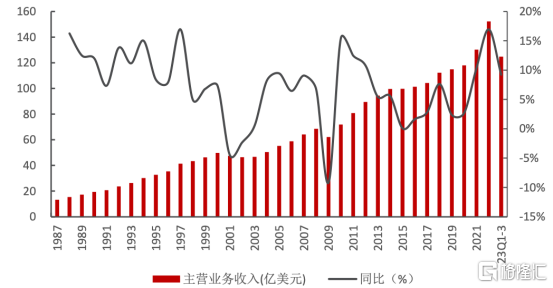

Looking further at the American giant Guanjie, whose stock price is “growing stronger”, its year-on-year revenue growth rate over the past 10 years is also generally in single digits. Profit growth has remained above 10%, and PE has stabilized between 20-30X.

The above is sufficient to show that MRO is a business model that has withstood time and market verification and has been recognized by investors. It has spanned changes in the industrial age, the Internet era, or other times, and is still worth operating for a long time. Therefore, investors chose Guanjie as their target, and it is easy to guess that the core reason lies in the value potential unleashed by this giant's long-term steady growth.

This is exactly where the “appeal” of MRO lies, and it is probably possible to fully enjoy its value potential while Zhenkun is maintaining steady growth. China is a major manufacturing country, and MRO development is still in its early stages. Chinese MRO companies do not lack the “soil” for growth. From a long-term perspective, it is likely that many “invisible champions” giants will rise from it.

The next “Guanjie” giant in mainland China

The rise of any giant must have a recipe for success. Taking the consumer goods market as an example, Pinduoduo's rapid rise is due in large part to a low-cost and efficient business model. The rise of JD is inseparable from the “self-operated e-commerce” business model and logistics system support. They have successfully met consumer demand, and growth has exploded.

In the industrial B2B sector, manufacturing companies choose MRO for industrial goods procurement. From a demand perspective, the core is to hope to quickly and accurately procure a complete range of cost-effective industrial supplies, while reducing procurement and management costs, and improving procurement compliance and efficiency. Well, among Chinese MRO companies, who can achieve this to the extreme and establish differentiated advantages and competitive barriers, will achieve high-value growth.

Sorting through the strategic development path of Zhenkun, the author found that it is developing such potential and is gradually entering the stage of determining market position.

1. Product path: focus on the standard product and position all categories to support the high revenue ceiling

Zhenkun takes a product path similar to Guanjie, focuses on products in specific segments, and extends the product horizontally to “broaden” the product, covering all major MRO product lines. At the same time, in terms of “depth”, Zhenkun is selectively and deeply involved in the process of product definition, selection, R&D, and even intelligent manufacturing according to different product characteristics and development stages, to create popular products in each production line, and continue to cultivate its own brands.

Currently, Zhen Kun has involved five major categories, including industrial spare parts, general consumables, administrative materials, processing and manufacturing tools, and chemicals. It has 32 product lines, including more than 17 million SKUs, and has leading field coverage capabilities.

Standardized SKUs can enhance the customer ordering experience, while rich SKUs provide customers with diverse choices, and the audience industry and customers will be broader. By the end of 2023, the number of customers covered by Zhenkun Bank reached 6,6562, an increase of 14.8% over the previous year, and is still increasing. By following this product path, the development of all categories will support a huge business scale in the future, which means that the revenue “ceiling” of Zhen Kun Hong will be further raised, and its ability to generate revenue will continue to improve.

2. Business model: self-operation+platform, driving the growth flywheel of two market segments

In the early stages of Zhen Kun Xing and Guanjie, both adopted a self-operated model, that is, purchasing products from suppliers and selling them to customers. The platform model was then extended, that is, suppliers sell directly to customers through the platform, and the platform is like a “bridge” to collect commissions on a proportional basis. As can be seen, Zhen Kun Xing has adopted a “self-employed+platform” business model, which is quite similar to “JD+Ali” in the industrial product industry.

The company has built up procurement, warehousing, logistics distribution, delivery and production capabilities. For example, in terms of warehousing, it currently has 30 general warehouses and 96 transit warehouses across the country, and its ability to fulfill contracts has been greatly enhanced. This means that the company enters the entire chain of MRO products, can better control product quality and supply chain, and also provide better after-sales service.

On this basis, Zhenkun has formed its own brand, which can flexibly grasp prices and increase profit levels. American giant Guanjie has 7 major private brands and accounts for more than 20% of sales, which is an important reason why it can obtain high gross margins. At the same time, through logistics distribution capabilities and sales under its own brand, it will undoubtedly enhance the brand value of Zhen Kun Hong and form a differentiated advantage.

As a result, the platform model will also usher in better development. The platform expands product categories to attract suppliers. As the frequency of purchases on the platform increases, it will further attract new suppliers, thereby increasing profit margins and forming a positive cycle of growth. Last year, GMV under the platform model reached 2,746 billion yuan, a significant increase of 90.2% over the previous year.

It is worth mentioning that Zhen Kun Xing places great emphasis on using digital intelligent methods to solve supply chain management problems. Compared with traditional models, the essential difference of industrial e-commerce is that, from “traditional empirical decisions” to “big data decisions”, technology empowers the entire business process to improve quality and efficiency. In key supply and demand matching links, historical transaction data, industry knowledge, and expert experience are deposited into IT systems through machine learning algorithms. Through the power of AI models, supply and demand can be matched to achieve intelligent operation of the entire chain. Examples include self-developed RPA (process robots), AI expert assistants, etc. Currently, the volume of transactions completed independently online by Zhenkun Bank accounts for about 70% of the total GMV. At the same time, human efficiency has increased by about 39%. The company ultimately drives profit optimization through continuous efficiency improvement.

It can be seen that Zhen Kun Xing has already embarked on a clear development path, and its commercialization capabilities are gradually being verified. Guanjie is indeed a learning target for Chinese MRO companies. In comparison, Zhen Kun Xing is still young after being deeply involved for more than 20 years. In terms of strategic layout alone, it's not much easier.

Judging from Guanjie's growth trajectory, in the past, it used its long-term accumulated advantages to expand all categories horizontally and build a global product network. At the same time, Guanjie continues to improve its online platform and supply chain system, and can now provide high-quality and high-value-added solutions, forming a differentiated brand advantage. With this kind of market position, it seems that Zhenkun is also quietly taking shape.

Enjoy value growth under China's trillion-dollar blue ocean

Compared with overseas markets, the Chinese MRO market has a wider potential. According to the CIC report from Insight Consulting, the market size of MRO procurement services in China increased from 2074.7 billion yuan to 3004.1 billion yuan from 2016 to 2022. In 2027, it will reach 3976.6 billion yuan, with a compound annual growth rate of 5.8%. This is a trillion-dollar blue ocean market.

China is the only country in the world with all industrial categories in the United Nations Industrial Classification. As the world's largest industrial supply chain market, China has more than 300,000 private enterprises, foreign-funded enterprises, state-owned enterprises, etc. There is a wide range of products, involving many types of enterprises, and the procurement demand for MRO products is no less than that of overseas.

Today, as a major manufacturing country, China is transforming into a manufacturing power, and enterprises need more intelligent and refined management. On the one hand, enterprises themselves have a need to reduce costs and increase efficiency. On the other hand, in terms of policy, the country is also vigorously promoting innovation and transformation in the supply chain to achieve high-quality industrial development. These will all drive companies' demand for digital procurement of MRO.

In particular, with the development of the industrial Internet, under the catalyst of the AI era, AI technology, AI models, and AIGC can all participate in procurement, warehousing, logistics distribution, and production processes to improve the service quality and efficiency of the entire online MRO process. This means that more and more customers will be willing to accept digital MRO, accelerate the penetration of digital MRO, and promote the continuous expansion of the market size.

By calculating the average customer unit price (GMV/number of customers) at Zhen Kun, it is found that this figure increased from 161,600 yuan in 2022 to 166,500 yuan in 2023. The value of individual customer contributions is gradually rising, and the company's customer stickiness is also getting higher and higher.

In order to further expand its business scope and increase customer stickiness, Zhenkun Bank has built its own factory in the Taicang area. The factory produces about 1.5 billion pieces of high-end fasteners per year. It is expected to be completed by the end of 2024, and the estimated annual output value will reach 600 million yuan after completion.

The increase in the penetration rate of digital MRO will welcome a period of major development in the industry in the future. In 2022, more than 15% of the leading digital MRO procurement listed companies in the US had an average gross margin of more than 30% and an average net margin of more than 10%. As the penetration rate of digital MRO in China increases, leading digital MRO companies in China will usher in room to further improve their profitability.

Furthermore, Zhenkun is closely following the needs of overseas customers, serving industrial companies going overseas, and replicating successful domestic experiences and business models to overseas markets. It can be expected that the overseas business will become another growth curve for the company.

summed

Steady growth in performance and turning quarterly losses into profits means that through continuous practice, Zhenkun has initially explored a profit model suitable for the local Chinese market. This is also the key to distinguishing it from the American giant Guanjie. The success of overseas giants is worthy of being recognized by China's MRO company, and Zhen Kun Xing has gone his own way.

Currently, China's MRO is still in its early stages, but the market space is huge. Companies represented by Zhen Kun already have a relatively complete product and business layout, and have a foundation for rapid scale expansion in the future. Zhen Kun Xing is expected to catch the olive branch thrown out by this trillion-dollar blue ocean market and gain more expectations from the capital market.