Summary: The light boat has already passed Wanjou Mountain. It is small but beautiful and more resilient.

Due to the combined impact of various factors, the performance of the Hong Kong stock market has not been as good as expected. However, expectations of interest rate cuts in 2024 are certain. Regulatory reform measures continue to advance, and expectations of market recovery have been further strengthened. “undervaluation”, which has always been criticized by investors, will instead further highlight investment value. In particular, some small but beautiful companies, small market capitalization, and continuous improvement in performance may bring us a surprise.

Zhiyun Health (09955.HK), which was listed on the Hong Kong Stock Exchange in July 2022, specializes in “AI+ Healthcare”. As the largest one-stop chronic disease management and smart medical solution service provider in China, the company's market value was only HK$1.8 billion as of March 21, 2014.

The company disclosed its 2023 annual report on March 21, 2024,Among them, profit was achieved for the first time in the fourth quarter of 2023, breaking operating records, and in 2023, it also achieved the best annual performance since the launch of Zhiyun Health.

Zhiyun Health currently has a small market capitalization, but it is a pioneer in the digitalization of chronic disease management in China and the largest provider of digital chronic disease management solutions in China, especially when it achieved profit in a single quarter for the first time. Is this a small but beautiful underrated listed company worthy of our attention? Here's a detailed analysis based on the latest 2023 annual report.

1. A single quarter turned a loss into a profit, and the inflection point in performance under steady management has arrived

Judging from the freshly released 2023 annual report, Zhiyun Health's annual report card is remarkable.

The biggest highlight is that in the fourth quarter of 2023, the company achieved a single-quarter profit that broke its business history, indicating that the company has reached an inflection point in profit performance in a continuous positive business trend.

On the profit side, the company achieved net profit of more than 10 million yuan in the fourth quarter of 2023, turning a year-on-year loss into a profit in the fourth quarter, which also drastically narrowed the company's losses throughout the year. According to international accounting standards, the company's net loss in 2023 narrowed sharply by 80.70% year on year, while the adjusted net loss (not measured by IFRS) was reduced to 75.1 million yuan. The adjusted net loss decreased significantly by 77.40% year on year.

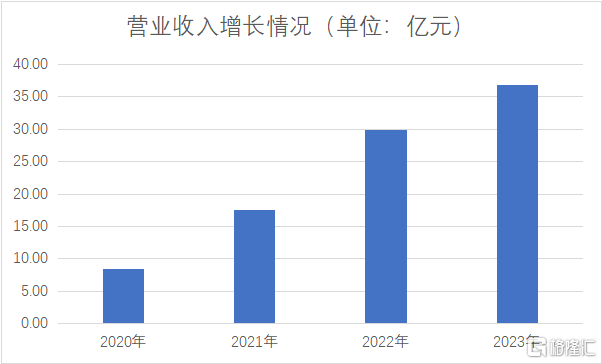

The continuous improvement in the company's performance is mainly due to the fact that the company's operating income continued to grow in 2023. Operating revenue increased 23.50% year on year to 3,691 billion yuan, and gross profit reached 909 million yuan, up about 14.80% year on year during the same period. Operating income continued to grow, the scale effect continued to ferment, and the company's comprehensive profitability of providing products and services remained stable, so that the company achieved a transformation in business performance in 2023 after years of intensive cultivation in “AI+ Healthcare”.

Figure 1: Revenue Growth

(Data source: company annual report, compiled by Gelonghui)

Looking at the balance and liability situation, as of December 31, 2023, the total amount of cash and cash equivalents on the company's account plus short-term wealth management products was 595 million yuan, accounting for about 20% of the total assets. It can also be said that about one-fifth of the company's assets are equivalent to cash. In terms of interest-bearing liabilities and solvency, the company has almost no interest-bearing liabilities, and the current ratio has more than doubled.

It is easy to find that the company has plenty of cash reserves on its accounts, excellent short-term solvency indicators, and a fairly stable balance sheet.

2. Continued growth, integrated coverage inside and outside the hospital

Zhiyun Health is the largest provider of digital chronic disease management solutions in China. It mainly provides services and digitalization for key players in the value chain, including hospitals, pharmacies, pharmaceutical companies, patients, and doctors, based on the number of SaaS (software and services) deployed in hospitals and pharmacies and the number of online prescriptions issued through this service. Its main services include two major components: in-hospital solutions and out-of-hospital solutions (including pharmacy solutions and personal chronic disease management solutions), that is, its revenue comes from sales of these two major services.

In terms of in-hospital solutions, the AIM model, that is, access, installation, and monetization, has effectively promoted the growth of the hospital business. The company launched Zhiyun Hospital SaaS in 2016. By the end of 2023, 2,719 hospitals had installed Zhiyun Hospital SaaS, of which more than 70% were tertiary and level-II public hospitals, including 40 of China's top 100 hospitals. Such results fully demonstrate the wide recognition and strength of the company's in-house solutions.

In terms of pharmacy solutions, the company's SaaS system deployment has achieved remarkable results. As of December 31, 2023, 219,716 pharmacies had deployed the company's SaaS system, an increase of more than 26,000 pharmacies over the end of 2022, covering about 35% of pharmacies in China.

Figure 2: The company's business model

(Photo source: company announcement)

From 2019 and 2023, the company's revenue increased from 524 million yuan to 3,691 billion yuan, an increase of about 6 times, with a compound annual growth rate of 62.87%. This kind of growth, which has maintained steady and rapid growth for four years, is rare among listed companies, and is also excellent among fellow digital healthcare listed companies.

Under the hospital-first development strategy, in-hospital solutions are the company's most important source of revenue, accounting for nearly 80% of the company's revenue in 2023. From 2019 to 2023, in-hospital solution revenue grew from 177 million yuan to 287 million yuan, with year-on-year growth rates of 138.42%, 201.66%, 71.56% and 31.52% respectively in the last four years (Note: In 2023, according to the upgraded P2M strategy, the company already used P2M solutions as a new sub-division, mainly selling proprietary products. In 2023, P2M solutions achieved revenue of about 101 million yuan, gross profit margin of 81.4%).

Among them, when the revenue of in-hospital solutions increased by 31.52% year-on-year in 2023, gross sales margin fell slightly to 27.60% from 31.3% in 2022, indicating that while maintaining strong growth, the profitability of in-hospital solutions did not decrease significantly. This may be due to the company's unique business model, established industry reputation and network, and high customer stickiness.

In terms of the pharmacy solution business, its revenue increased from 327 million yuan in 2019 to 659 million yuan in 2023 (pharmacy value-added revenue of 59 million yuan, subscription solution revenue of 600 million yuan). The company launched Pharmacy SaaS Zhiyun Consultation in the first half of 2019, so that pharmacies can provide real-time in-store consultation and prescription issuance services for customers without an appointment. From 2019 to 2023, pharmacy solution revenue continued to grow steadily, doubling in five years.

Among them, pharmacy solutions increased by about 6.9% year-on-year in 2023, and gross sales margin fell slightly from 11.40% in 2022 to 10.80% in 2023. This part of the gross sales margin was not high, mainly because Zhiyun Health's role as an “intermediary” for value-added pharmacy solutions did limit the gross profit margin of this business to a certain extent. However, as the largest pharmacy SaaS product provider in China, the company's additional expenses in this business are relatively limited, and the oversupply of prescription drugs for chronic diseases in the pharmacy sales process allows the company to use Zhiyun consultation to empower pharmacies, provide real-time in-store consultation and prescription services to customers without an appointment, and maintain steady business growth.

In terms of revenue structure, personal chronic disease management solutions do not account for a high share of the company's revenue. In 2013, personal chronic disease management solution revenue accounted for about 4% of revenue, but the gross margin of this business targets individual users, which is conducive to adjusting and optimizing the company's business revenue structure. Its operating income increased from 203 million yuan in 2019 to 159 million yuan in 2023. Growth was average, but gross sales margin increased 7.4 percent year-on-year in 2023, reaching 28.10%, mainly because the company focused on users Providing high-quality and accurate healthcare services, the company is in no hurry to commercialize personal chronic disease management solutions. Judging from operating data, the number of registered users on its platform rose from 28.5 million in 2022 to 31.2 million in 2023, and the number of registered doctors on the platform also rose from 98,700 in 2022 to 102,600 in 2023. By the end of 2023, the number of online consultations and prescriptions for the whole year reached about 185 million, a strong year-on-year increase of 8.76% based on a high base. It is undoubtedly the largest online consultation and prescription platform in China.

3. Leaders and pioneers in the AI medical industry in the era of digital intelligence

Currently, artificial intelligence has become one of the important engines of economic development. As a representative of the country's new productivity and one of the important directions, the healthcare industry is accelerating its transformation and upgrading in the direction of digitalization and intelligence under the impetus of 5G, big data, artificial intelligence and other technologies.

According to Frost & Sullivan data, it is estimated that by 2030, the digital marketing service market is expected to exceed 163.3 billion yuan and maintain continuous high growth, which provides broad market opportunities for the company in the future.

Furthermore, according to Frost & Sullivan data, in terms of consultation volume, Zhiyun Health is already the largest online medical service provider in China, providing more than 185 million consultation services to end users in 2023 alone.

As a company deeply involved in the field of digital chronic disease management, Zhiyun Health mainly enters the sub-market of providing digital marketing services to pharmaceutical and medical device companies. Judging from the disclosed annual report data, the pharmaceutical SKUs covered by the company's digital marketing business developed rapidly, from 6 increases in 2019 to 59 in 2023, a year-on-year increase of 73.50% over 2023. In 2023, the company's digital marketing service (subscription service for in-hospital solutions) had revenue of 467.21,000 yuan and a gross margin of 91.50%. In terms of revenue, its market share ranked first in the industry.

On July 24, 2023, six departments including the National Health Commission and the National Development and Reform Commission jointly issued the “Key Tasks for Deepening the Reform of the Medical and Health System for the Second Half of 2023", which clearly proposed the important task of “promoting medical artificial intelligence pilots”. This move marks the formal transition of AI medical technology from the R&D stage to the stage of substantial implementation and application.

According to iResearch, it is estimated that by 2025, the market size of China's medical industry will reach 38.5 billion yuan. Among them, AI healthcare will account for an important share. With the continuous advancement of technology and continuous policy support, AI healthcare is expected to achieve explosive growth in the next few years, providing strong support for the transformation and upgrading of the medical industry.

Zhiyun Health has more significant advantages at the data level, and can provide solid data support for the training of artificial intelligence models. Its self-developed and launched hospital SaaS systems, pharmacy SaaS systems, and Internet hospital platforms have become close partners in the digital upgrading of many industry partners. Up to now, the SaaS system has served nearly 2,700 hospitals, more than 200,000 pharmacies, and more than 10,000 hospitals cooperating with related businesses across the country. The number of online services reached 190 million in 2023.

By providing products and services covering in-hospital, online and offline, Zhiyun Health has accumulated rich and diverse dimensions, huge data scale, and extremely high data quality. They are all real diagnosis and treatment data. Abundant medical data resources helped the company release Zhiyun Medical Brain, seize AI medical opportunities, achieve implementation from the data layer to the application layer, and also announced that the company's AI healthcare has entered the commercialization and commercialization stage.

On the basis of the self-developed AI platform Zhiyun Medical Brain, the company has built two major medical industry models — Cloud GPT and Cloud DTx — to continuously upgrade products and services intelligently and iteratively.

The Cloud GPT model is mainly used in AI-assisted diagnosis and treatment in hospitals, internet hospitals, etc. With its excellent performance, the model can help doctors in underdeveloped regions to quickly diagnose conditions and provide doctors with accurate diagnosis and treatment plans.

In addition, the Cloud GPT model also played an important role in the online follow-up procedure for patients. Through quality control, the model effectively guarantees the safety of patients' medication use and reduces medical risks caused by improper medication use. Powered by the Cloud GPT model, the Zhiyun platform has achieved efficient patient service response. About 99% of patients can receive service responses within 180 seconds, greatly shortening patients' waiting time and improving the efficiency of medical services.

The Cloud DTx model is mainly used in AI-assisted R&D scenarios such as pharmaceutical device development and digital therapy. Relying on the Cloud DTX model, the company successfully developed an innovative digital therapy, CloudTX-CVD for cardiovascular disease, and its research results were included in the top international journal JMIR. As the first publicly published clinical study using digital therapy to intervene in blood lipids in the field of cardiovascular disease treatment, the success of CloudTX-CVD not only provided new treatment options for patients with cardiovascular disease, but also an effective complement to existing clinical treatment plans for patients with cardiovascular disease.

Let's go back to the artificial intelligence boom that is currently sweeping the world.

Nvidia's helmsman Hwang In-hoon, the “Godfather of AI”, has called “AI+ medical systems/biology” “the next amazing revolution” in the field of technology more than once in various public forums.Nvidia's continued innovation and breakthroughs in the field of AI, along with its blowout performance and Hwang In-hoon's prediction of the strong future of artificial intelligence, made Nvidia's stock price continue to break through record highs. The capital market's enthusiasm for the AI concept also danced along with Nvidia's stock price, and related stocks were constantly being hyped up, setting off a wave of artificial intelligence and AI medical treatment in the capital market.

Admittedly, short-term speculation on stock prices is not necessarily a reflection of a company's intrinsic value. However, for Zhiyun Health, as a leader and pioneer in the AI medical industry in the digital intelligence era, it has provided new growth imagination for the company's performance as AI medical application scenarios continue to be implemented.

IV. Conclusion

Looking at the company's financial level, Zhiyun Health turned a loss into a profit for the first time in a single quarter in the fourth quarter of 2023, and an inflection point in the company's profit performance appeared.

Judging from the company's operation and management situation, the company's balance sheet is steady, and revenue has continued to grow in the past five years. Against the backdrop of the rising prosperity of the chronic disease medical industry, the company has shown excellent growth, and by actively embracing AI healthcare, it has also injected more levels of growth into its performance growth.

In terms of market capitalization, since it went public in July 2022, the company's market value has dropped by more than 80%, and the market capitalization is at an all-time low. Currently, its net market ratio is only about 1.1 times, and the market sales ratio is less than 1 times.

So, is the company a small but beautiful listed company? Is the market capitalization undervalued or overvalued? You can interpret it based on our analysis above and future expectations.