China Dredging Environment Protection Holdings Limited (HKG:871) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 43% in the last year.

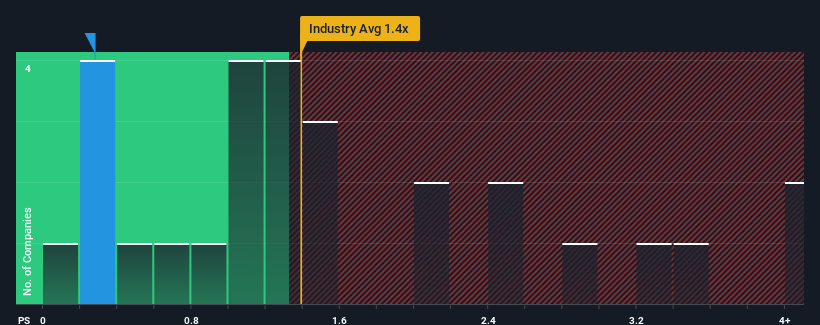

Even after such a large jump in price, when close to half the companies operating in Hong Kong's Infrastructure industry have price-to-sales ratios (or "P/S") above 1.4x, you may still consider China Dredging Environment Protection Holdings as an enticing stock to check out with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does China Dredging Environment Protection Holdings' Recent Performance Look Like?

Revenue has risen at a steady rate over the last year for China Dredging Environment Protection Holdings, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Dredging Environment Protection Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

China Dredging Environment Protection Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 4.9% gain to the company's revenues. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

In light of this, it's peculiar that China Dredging Environment Protection Holdings' P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Key Takeaway

Despite China Dredging Environment Protection Holdings' share price climbing recently, its P/S still lags most other companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that China Dredging Environment Protection Holdings currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching the company's performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions should normally provide more support to the share price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for China Dredging Environment Protection Holdings (1 is concerning!) that you should be aware of before investing here.

If you're unsure about the strength of China Dredging Environment Protection Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.