Guangdong Create Century Intelligent Equipment Group Corporation Limited (SZSE:300083) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 34% over that time.

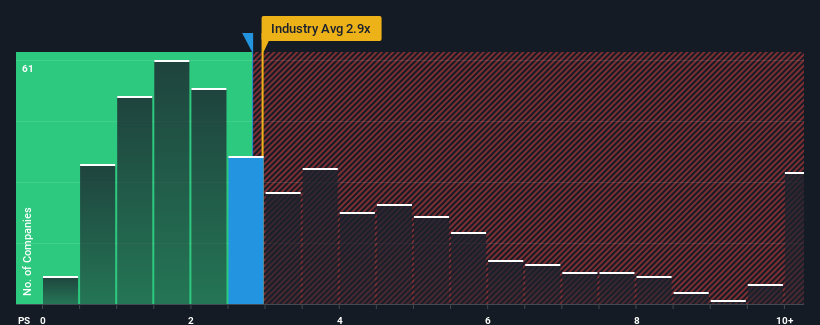

In spite of the firm bounce in price, there still wouldn't be many who think Guangdong Create Century Intelligent Equipment Group's price-to-sales (or "P/S") ratio of 2.8x is worth a mention when the median P/S in China's Machinery industry is similar at about 2.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Guangdong Create Century Intelligent Equipment Group Performed Recently?

Guangdong Create Century Intelligent Equipment Group could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guangdong Create Century Intelligent Equipment Group.Is There Some Revenue Growth Forecasted For Guangdong Create Century Intelligent Equipment Group?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Guangdong Create Century Intelligent Equipment Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 2.9% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 30% as estimated by the three analysts watching the company. With the industry predicted to deliver 27% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Guangdong Create Century Intelligent Equipment Group is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Guangdong Create Century Intelligent Equipment Group's P/S Mean For Investors?

Guangdong Create Century Intelligent Equipment Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Guangdong Create Century Intelligent Equipment Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Guangdong Create Century Intelligent Equipment Group that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.