SSAW Hotels & Resorts Group Co.,Ltd. (SZSE:301073) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 47% over that time.

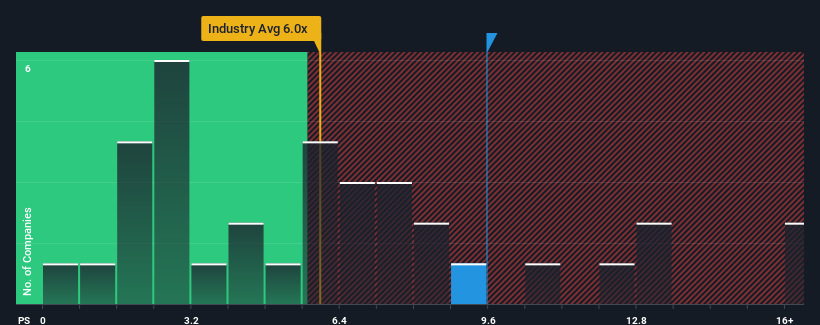

Following the firm bounce in price, SSAW Hotels & Resorts GroupLtd's price-to-sales (or "P/S") ratio of 9.6x might make it look like a strong sell right now compared to other companies in the Hospitality industry in China, where around half of the companies have P/S ratios below 6x and even P/S below 2x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has SSAW Hotels & Resorts GroupLtd Performed Recently?

SSAW Hotels & Resorts GroupLtd could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on SSAW Hotels & Resorts GroupLtd.Is There Enough Revenue Growth Forecasted For SSAW Hotels & Resorts GroupLtd?

The only time you'd be truly comfortable seeing a P/S as steep as SSAW Hotels & Resorts GroupLtd's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 52%. Pleasingly, revenue has also lifted 79% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 65% during the coming year according to the five analysts following the company. With the industry only predicted to deliver 35%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why SSAW Hotels & Resorts GroupLtd's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has lead to SSAW Hotels & Resorts GroupLtd's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that SSAW Hotels & Resorts GroupLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Hospitality industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 2 warning signs for SSAW Hotels & Resorts GroupLtd you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.