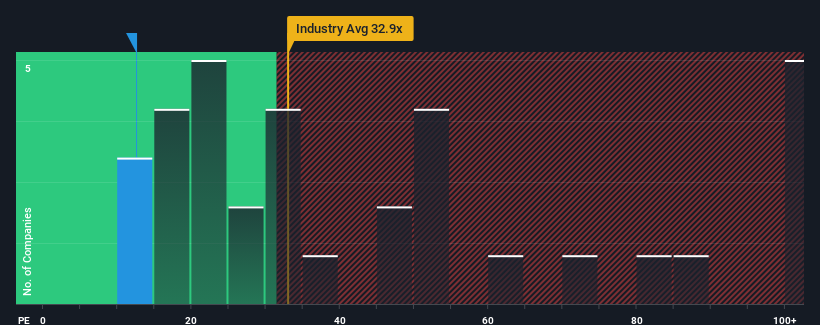

With a price-to-earnings (or "P/E") ratio of 12.5x Shanghai Zijiang Enterprise Group Co., Ltd. (SHSE:600210) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 33x and even P/E's higher than 60x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Shanghai Zijiang Enterprise Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

What Are Growth Metrics Telling Us About The Low P/E?

Shanghai Zijiang Enterprise Group's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 12%. The latest three year period has also seen a 18% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 18% as estimated by the dual analysts watching the company. That's shaping up to be materially lower than the 40% growth forecast for the broader market.

With this information, we can see why Shanghai Zijiang Enterprise Group is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Shanghai Zijiang Enterprise Group's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanghai Zijiang Enterprise Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Shanghai Zijiang Enterprise Group is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Shanghai Zijiang Enterprise Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.