[Focus on hot topics]

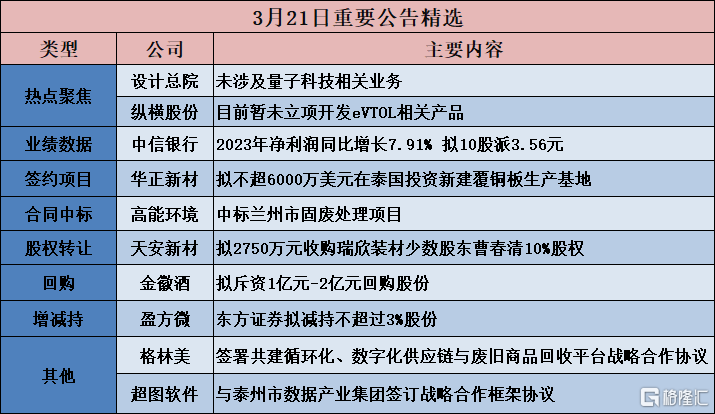

General Design Institute (603357.SH): Not involved in quantum technology-related business

The General Design Institute (603357.SH) announced that recently, the company paid attention to discussions on the company's related business on some media, stock bars and other platforms, involving hot concepts such as quantum technology. According to the company's own investigation, the company did not post relevant information on the Interactive Easy platform, nor was it involved in quantum technology-related business.

Yongyue Technology (603879.SH): There is a significant risk of uncertainty in the execution of the drone contract, and there are no orders in progress

Yongyue Technology (603879.SH) announced that the company's stock has been rising and stopping for 8 consecutive trading days from March 12, 2024 to March 21, 2024, and the company's stock price has increased by 114.75%. There is a significant risk of uncertainty in the execution of the company's drone contract, and there are no orders in progress. The company's operating income mainly comes from the chemical business.

Zongheng Co., Ltd. (688070.SH): Currently, no project has been set up to develop eVTOL related products

Zongheng Co., Ltd. (688070.SH) announced serious abnormal fluctuations in stock trading. Recently, the company is concerned that the low-altitude economy has received strong support from national policies as a strategic emerging industry. It is expected that the future development trend of the industry will be good, but the current industry policy related to the low altitude economy is still unclear, and the direction of industry development is uncertain. The pace of development and phased effects need to be calmly analyzed to avoid blind overheating in the short term. The company is also concerned that eVTOL (electric vertical take-off and landing aircraft) has received great attention from the capital market as an important product direction related to the low-altitude economy, but the specific future market prospects and business models of related products are uncertain, and the company has not yet set up a project to develop eVTOL related products.

Boxin Co., Ltd. (600083.SH): No cooperation with Huawei, only sells some Huawei products as an agent

Boxin Co., Ltd. (600083.SH) announced abnormal fluctuations in stock trading. The company's smart hardware and derivatives business is mainly sales of its own products and agent sales of smart terminals and hardware products from other brands. The products sold by the company are all manufactured on an OEM basis, and the company does not have production capacity. The company did not sell its own brand products in 2023. The company did not cooperate with Huawei in any form. It only sold some Huawei products as agents, and agent sales revenue only accounted for about 0.6% of total revenue, accounting for a very low proportion. As of the disclosure date of this announcement, there have been no significant changes in the company's main business, production and operation conditions and business environment compared to the information disclosed earlier.

[Investment projects]

Hangzhou Colin (688611.SH): The subsidiary plans to invest in the construction of an electrochemical energy storage power plant project

Hangzhou Colin (688611.SH) announced that it plans to invest in the construction of the “Hangzhou Colin New Energy Co., Ltd. 50mW/100MWh grid-side energy storage project” at No. 2728 Jiangdong 2nd Road, Hezhuang Street, Qiantang District. The total investment of the project is estimated to be 148.65 million yuan. The total investment of the final project is based on actual investment. The total investment of the project is based on actual investment.

Huazheng New Materials (603186.SH): Plans to invest no more than 60 million US dollars to build a new copper-clad plate production base in Thailand

Huazheng New Materials (603186.SH) announced that the company plans to invest in a new copper-clad plate production base in Thailand. The total project investment will not exceed 60 million US dollars, including but not limited to matters related to the purchase of land, production plant construction and leasing, and the purchase and construction of fixed assets. The actual investment amount is based on the amount approved by the local authorities in China and Thailand. The company will implement the construction of the Thai production base in stages according to specific conditions such as market demand and business progress.

Yingke Regeneration (688087.SH): Intended to invest in the construction of Vietnam's Yingke Thanh Hoa (Phase II) project

Yingke Regeneration (688087.SH) announced that after carrying out extensive market research and technical research and analysis based on the successful experience and favorable practices of the first phase of the project “Vietnam Yingke's 2.27 million boxes of plastic decorative frames and wire projects”, the company decided to invest in the second phase of the project in Bianshan Industrial Zone, Beishan Fang, Bianshan City, Thanh Hoa Province, Vietnam. The total investment of the project is approximately US$60 million, from own funds or other self-financing.

[Contract won the bid]

High energy environment (603588.SH): won the bid for the Lanzhou Solid Waste Treatment Project

High Energy Environment (603588.SH) announced that it received a “Notice of Winning Bid” from Yongming Project Management Co., Ltd., which was confirmed by the tenderer Lanzhou City Development Investment Co., Ltd. The notice confirmed that the company was the winner of the “Lanzhou Sludge Treatment Plant Upgrading and Renovation Project Phase II Landfill Sludge Surface Solidification and Landfill Odor Control Construction Project EPC General Contractor”. The winning bid amount was $114,174,305.

[[Share acquisition]

Tianan New Materials (603725.SH): Plans to acquire 10% of Cao Chunqing, the minority shareholder of Ruixin Packaging Materials, for 27.5 million yuan

Tianan New Materials (603725.SH) announced that the company plans to acquire 10% of the shares of Cao Chunqing, a minority shareholder of the holding subsidiary Zhejiang Ruixin Decoration Materials Co., Ltd. (“Ruixin Materials” or “Target Company”) (corresponding to 2.81 million yuan of registered capital), with a transaction consideration of 27.5 million yuan.

[Performance data]

CNOOC (600938.SH): 2023 net profit of 123.843 billion yuan fell 13% year on year

CNOOC (600938.SH) released its 2023 annual report. Operating revenue was 416.609 billion yuan, down 1% year on year, net profit of 123.843 billion yuan, down 13% year on year, after deducting non-net profit of 125.188 billion yuan, down 11% year on year, with basic earnings per share of 2.60 yuan. The Board of Directors recommended that a 2023 final dividend of HK$0.66 per share (tax included) be paid to all shareholders, along with an interim dividend of HK$0.59 per share (tax included). The total 2023 final dividend and interim dividend of HK$1.25 per share (tax included).

Donga Ejiao (000423.SZ): Net profit for 2023 increased by 47.55% to 1.151 billion yuan, and plans to distribute 10 to 17.80 yuan

Donga Ejiao (000423.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 4.715 billion yuan, up 16.66% year on year; net profit attributable to shareholders of listed companies was 1.151 billion yuan, up 47.55% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,083 billion yuan, up 54.70% year on year; basic income per share was 1.79 yuan; it plans to distribute a cash dividend of 17.80 yuan (tax included) for every 10 shares to all shareholders.

China Resources Shuanghe (600062.SH): Net profit in 2023 increased 12.96% year-on-year, and plans to distribute 2.57 yuan for 10 shares

China Resources Shuanghe (600062.SH) released its 2023 annual report, with operating income of 10.222 billion yuan, up 6.20% year on year, net profit of 1,333 billion yuan, up 12.96% year on year, after deducting non-net profit of 1,233 billion yuan, up 13.26% year on year, with basic earnings of 1.3002 yuan per share. The company plans to distribute a cash dividend of 2.57 yuan for every 10 shares to all shareholders.

China CITIC Bank (601998.SH): Net profit increased 7.91% year-on-year in 2023, and plans to distribute 3.56 yuan for 10 shares

China CITIC Bank (601998.SH) released its 2023 annual report. Operating revenue was 205.896 billion yuan, down 2.60% year on year, net profit of 67.016 billion yuan, up 7.91% year on year, after deducting non-net profit of 66.524 billion yuan, up 7.56% year on year, with basic earnings per share of 1.27 yuan. A cash dividend of $3.56 is distributed for every 10 shares.

[Repurchase]

Jinhui Liquor (603919.SH): Plans to spend 100 million yuan to 200 million yuan to buy back shares

Jinhui Liquor (603919.SH) announced that the company plans to repurchase some of the issued RMB common stock (A shares) through centralized bidding transactions through the Shanghai Stock Exchange stock trading system to implement employee stock ownership plans or equity incentives. The total capital of the repurchased shares is not less than RMB 100 million (inclusive) and not more than RMB 200 million (inclusive), and the share repurchased price is not more than RMB 28.00 per share (inclusive).

New Clean Energy (605111.SH): Plans to spend 35 million yuan to 45 million yuan to buy back shares

New Clean Energy (605111.SH) announced that the company uses its own funds to repurchase some RMB common stock (A shares) shares already issued by the company and use the repurchased shares for the company's share incentives or employee stock ownership plans. The total capital used for this repurchase shall not be less than RMB 35 million (inclusive) and not more than RMB 45 million (inclusive); the repurchase price shall not exceed RMB 50 per share (inclusive).

Haoubo (688656.SH): Plans to spend 20 million yuan to 30 million yuan to buy back shares

Haoubo (688656.SH) announced that the company plans to use its own funds to repurchase some of the company's issued RMB common shares (A shares) through centralized bidding transactions for employee stock ownership plans or equity incentives. The total capital for repurchasing shares shall not be less than RMB 20 million (inclusive) and not more than RMB 30 million (inclusive); the repurchase price of shares shall not exceed RMB 37.39 per share (inclusive).

[Increase or decrease holdings]

Yingfang Weiwei (000670.SZ): Orient Securities plans to reduce its holdings by no more than 3%

Yingfangwei (000670.SZ) announced that Oriental Securities, a shareholder holding 5% or more of the shares, plans to reduce the company's shares through centralized bidding and bulk transactions within three months after 15 trading days from the date of disclosure of this announcement. The maximum number of shares to be reduced by no more than 3% of the company's total share capital. Among them, those reducing holdings through centralized bidding transactions shall not exceed 1% of the total share capital of the company; those reducing holdings through bulk transactions shall not exceed 2% of the total share capital of the company in total.

Weilong Co., Ltd. (603779.SH): Shiqian Investment plans to reduce its holdings by no more than 1%

Weilong Co., Ltd. (603779.SH) announced that Shenzhen Shiqian Investment and Development Co., Ltd. plans to reduce its holdings of the company's shares by no more than 3,327,400 shares through centralized bidding transactions within 3 months after the disclosure of the current holdings reduction plan announcement (shares cannot be reduced during the window period, etc.), to no more than 1.00% of the company's total share capital.

Xin Fengming (603225.SH): Gongqingcheng Shengbang plans to reduce its holdings by no more than 3%

Xin Fengming (603225.SH) announced that due to its own financial needs, Gongqingcheng Shengbang plans to reduce its holdings of some of the company's shares through centralized bidding transactions within 90 days after the disclosure of the current holdings reduction plan, that is, April 17, 2024 to July 15, 2024, by no more than 15,294,700 shares, that is, no more than 1% of the company's total share capital; reduce its holdings by no more than 30,589,400 shares, that is, no more than 2% of the company's total share capital , the holdings reduction price is determined according to the market price.

[Other]

Grimmie (002340.SZ): Signed a strategic cooperation agreement with JD Group to jointly build a recycling, digital supply chain and waste product recycling platform

Grimmie (002340.SZ) announced that in response to the spirit of “promoting a new round of large-scale equipment updates and consumer goods trade-in to effectively reduce logistics costs for the whole society” proposed by the 4th meeting of the Central Committee on Finance and Economics, in order to better grasp the development opportunities of the country's “Action Plan to Promote Large-scale Equipment Renewal and Consumer Goods Trade-In”, serve the real economy and smooth the domestic cycle, and serve the major trends of digital intelligence, dual carbon, and green manufacturing, Grimmie Co., Ltd. (“Grimmie” or the “Company” for short) and Beijing Jingdong Century Trading Co., Ltd. (“JD Group” for short) On March 21 of this year, the “Strategic Cooperation Agreement on Co-building a Circular, Digital Supply Chain and Waste Product Recycling Platform” was signed. The two sides decided to rely on their respective resource and capacity advantages to establish a long-term and stable cooperative relationship, and promote specific projects through strategic collaboration, business cooperation, and joint promotion of specific projects to promote the two sides to develop e-commerce platforms, digital intelligent supply chains, digital recycling and consumer goods trade-in platforms, integrated optical storage and charging chemical commercial energy storage and smart forklifts, AGV logistics sorting and electrification scenarios, and closed-loop supply and consumption of green low-carbon recycling materials In-depth cooperation.

Chaotu Software (300036.SZ): Signed a strategic cooperation framework agreement with Taizhou Data Industry Group

Chaotu Software (300036.SZ) announced that in order to further promote the company's data element business, the company recently signed a strategic cooperation framework agreement with Taizhou Data Industry Group Co., Ltd. The two sides explore joint operation cooperation models around cooperation content such as data element circulation, application of scenario requirements, and joint technology development, and carry out “(spatial information x data elements) x” related digital intelligence infrastructure construction, data operation services, and industry application scenario construction and promotion.