Despite an already strong run, Taysha Gene Therapies, Inc. (NASDAQ:TSHA) shares have been powering on, with a gain of 55% in the last thirty days. The last 30 days were the cherry on top of the stock's 306% gain in the last year, which is nothing short of spectacular.

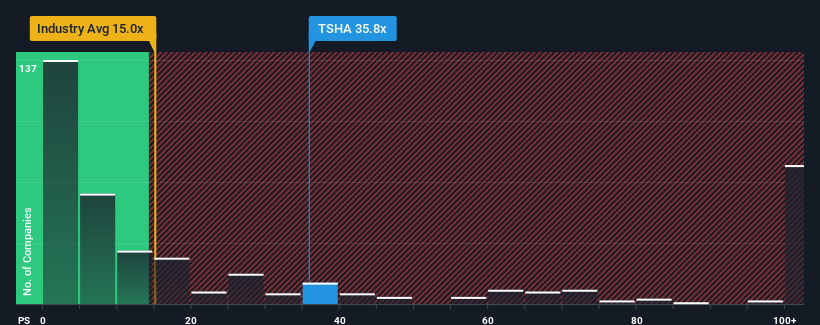

After such a large jump in price, Taysha Gene Therapies may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 35.8x, since almost half of all companies in the Biotechs industry in the United States have P/S ratios under 15x and even P/S lower than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

What Does Taysha Gene Therapies' P/S Mean For Shareholders?

Recent times have been advantageous for Taysha Gene Therapies as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Taysha Gene Therapies' future stacks up against the industry? In that case, our free report is a great place to start.How Is Taysha Gene Therapies' Revenue Growth Trending?

Taysha Gene Therapies' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Although, its longer-term performance hasn't been anywhere near as strong with three-year revenue growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 60% per year as estimated by the ten analysts watching the company. Meanwhile, the broader industry is forecast to expand by 145% each year, which paints a poor picture.

With this information, we find it concerning that Taysha Gene Therapies is trading at a P/S higher than the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Taysha Gene Therapies' P/S Mean For Investors?

The strong share price surge has lead to Taysha Gene Therapies' P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

For a company with revenues that are set to decline in the context of a growing industry, Taysha Gene Therapies' P/S is much higher than we would've anticipated. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Taysha Gene Therapies (2 are significant!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.