What does refinancing $1.1 billion mean for existing shareholders?

Amid the cold wave of 18A financing, Kang Fang Biotech (09926) chose to place it again. Judging from the 6% discount, the market feedback is optimistic.

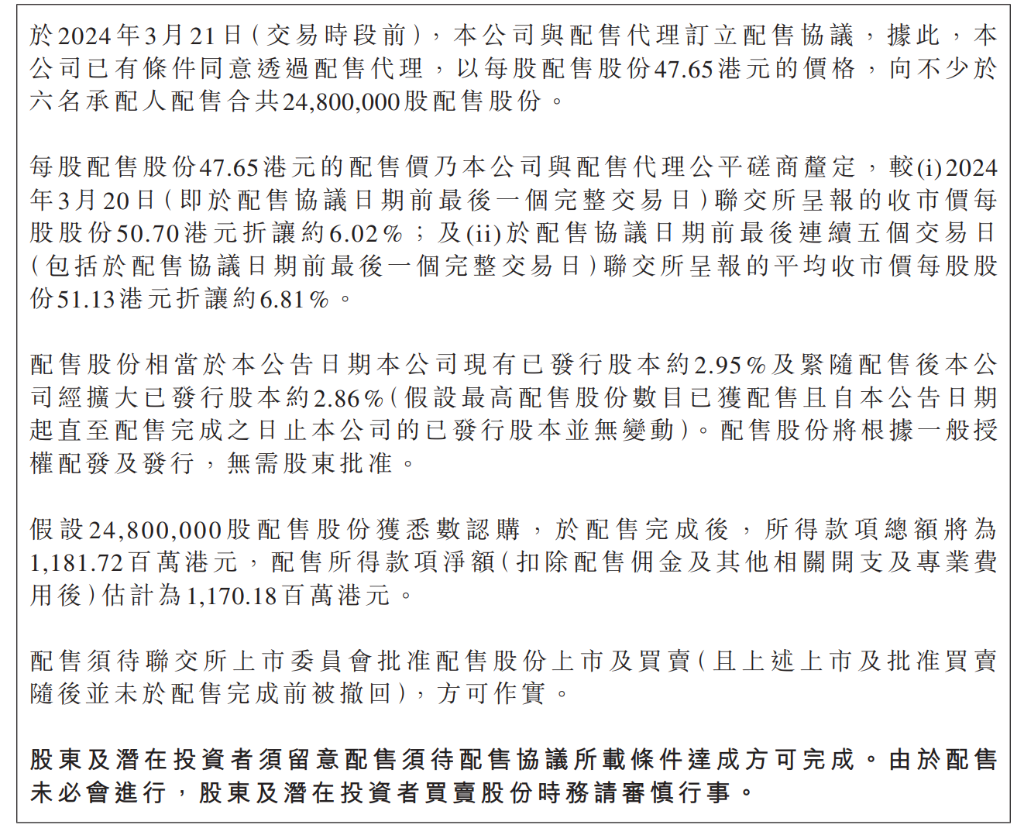

On March 21, one day after the 2023 financial report, Kang Fang Biotech announced that the company will place a total of 24.8 million shares to at least six undertakers at a price of HK$47.65 per share. This price is slightly discounted from the closing price of HK$50.70 on the previous trading day, or approximately 6.02%.

The shares placed this time account for 2.86% of the company's expanded issued share capital. Assuming that all placed shares are subscribed, the net proceeds are expected to reach HK$1.17 billion.

Kang Fang Biotech said that this funding will provide strong support for the company's future development, especially in the field of R&D.

The market is very divided over Kang's refinancing

Since it was listed on the Hong Kong Stock Exchange in April 2020, Kang Fang Biotech has demonstrated its strong ability in raising capital through a series of capital market operations.

At the time of the initial public offering (IPO), the company successfully raised 2,313 billion yuan in capital. Subsequently, in January 2021, Kangfang Biotech once again raised 1,065 billion yuan in capital through the placement of shares.

Entering 2022, Kangfang Biotech continued to maintain its activity in the capital market and raised 522 million yuan in July through the placement of shares. In addition to today's successful fundraising of HK$1.17 billion, Kang Fang Biotech has raised a total of no less than 5.07 billion yuan in the Hong Kong stock market.

Furthermore, Kang Fang Biotech issued an announcement on the Hong Kong Stock Exchange on December 6, 2022, announcing that the company will be listed for the second time on the Science and Technology Innovation Board.

However, due to the tightening of the listing policy of unprofitable biomedical companies on the Science and Technology Innovation Board, Kang Fang Biotech's Science and Technology Innovation Board listing plan is facing uncertainty, and the listing window has yet to be clarified. It is believed that in this context, Kang Fang Biotech chose to carry out this placement in the Hong Kong stock market.

In 2023, Kangfang Biotech had revenue of 4.526 billion yuan and profit of 1.942 billion yuan.

By the end of 2023, Kangfang Biotech's total time deposits for cash and other short-term financial assets were 4.9 billion yuan, compared to 2.29 billion yuan for the same period last year. At the same time, R&D investment was 1,254 billion yuan in 23 years, and marketing expenses were 890 million yuan.

This means that without considering many new clinical trials, Kang Fang's cash can support 2 years of operation with an investment scale of 23 years.

However, there are major differences in the market over Kang's current fund-raising.

First-class investors believe that Kangfang Biotech received a large down payment in 2023, sufficient financial support to meet the product's self-hematopoietic stage, and continued to raise capital, and did not pay enough attention to shareholder returns.

Another type of investor believes that in the current severe market environment facing biomedicine, capital can be raised, and the discount is small, which is proof of the company's excellent quality. At the same time, fund-raising activities are meant to be planned ahead and wait until there is a real shortage of money before trying to raise capital from the market. The company can only passively accept more conditions and lose bargaining chips. Bloody fund-raising will become a probable event. At that time, the damage to shareholders will be even greater.

Similarly, in the US stock market, there are situations where capital is raised after product progress data is updated or after performance meetings. Last year, Legendary Biotech, which had a rapid increase in sales in the US market, also made moves to issue new shares.

From the perspective of the secondary market, investors are optimistic, and Kang Fang Biotech's stock price did not fluctuate much on the 21st.

The use of capital is clear, and ADC will be the focus of R&D in the next stage

Regarding this fund-raising, Kang Fang Biotech clearly stated that 65% of the proceeds from the distribution will be directly invested in R&D, including promoting multiple pre-clinical projects into the IND (Investigational New Drug Application) stage, developing advanced ADC (antibody drug conjugate) platforms, and accelerating global clinical trials of drugs such as cardonil (AK104, PD-1/CTLA-4) and rafferil (AK117, CD47). Additionally, 25% of the capital will be used for the commercialization process of Cardonelli and Iwasi, while the remaining 10% will be used for other general corporate purposes to ensure the flexibility and adaptability of the company's operations.

At the investor conference call yesterday, Kang Fang Biotech said that the company is actively promoting the development of its antibody-drug conjugate (ADC) platform, and it is expected that an ADC product will enter the clinical stage by the end of the year. At the same time, the combined use of dual antibodies and ADCs is also being explored.

In terms of production capacity layout, Kang Fang Biotech said that the company is carefully planning ADC production capacity. Kang Fang has built new production facilities in the existing health technology industrial park to avoid excessive investment in production capacity on the premise of ensuring that production capacity can meet both clinical and commercial needs.

In 2023, Kangfang Biotech achieved outstanding results in commercialization. The cornerstone product cardonilizumab (PD-1/CTLA-4 dual antibody) achieved impressive sales performance in the market, with annual sales reaching 1,358 billion yuan, a sharp increase of 149% over the previous year.

As a major product of Kangfang Biotech, cardonilizumab will make progress in several key areas this year. New drug applications (NDA) for first-line gastric cancer and first-line cervical cancer are ongoing. At the same time, phase III clinical trials for adjuvant treatment after hepatocellular carcinoma surgery and phase III clinical studies for first-line treatment of non-small cell lung cancer with negative PD-L1 expression are also being carried out efficiently. Furthermore, a phase III clinical study of gastric cancer progressing after PD-1/L1 treatment with VEGFR2 monoclonal antibody and proxil has been initiated.

Evosil (PD-1/VEGF), another important product of Kangfang Biotech, is currently actively undergoing 6 phase III clinical studies, 4 of which are phase III clinical studies that compare head-to-head with PD-1 monoclonal antibodies.

The big data includes 2 international multi-center phase III clinical studies led by partner Summit Therapeutics. It is expected that phase 3 data on AK112's indications for treating TKI resistance will be read out in the near future. Head-to-head data is the focus of market attention, and it is also the key to being able to break into the US market.

Looking ahead, overseas HarmonI research is expected to complete enrollment in the second half of 2024. At the same time, domestic head-to-head studies with tirelizumab are also expected to complete enrollment.

Kangfang Biotech's refinancing strategy shows its strategic layout and financial soundness for future development. As key data is about to be released, this action is critical to maintaining the company's R&D momentum and market competitiveness.

However, for minority shareholders, company management should also provide more clear return expectations and guidance to enhance minority shareholders' confidence.