Early Thursday morning, Beijing time, the Federal Reserve remained on hold for the fifth consecutive meeting, and the federal funds rate remained at 5.25%-5.5%, the highest level since 2001. Policymakers have hinted that they are still planning to cut interest rates for the first time since March 2020 this year, but currently they expect to cut interest rates only three times in 2025, which is less than the estimate of December last year.

The Federal Reserve has remained on hold for the fifth time in a row, and the statement issued by decision makers after the interest rate meeting used almost exactly the same wording as the previous one. This rare phenomenon may indicate that the official's assessment of the outlook has not changed much, and they are still waiting for more data to build the mentality for the interest rate cuts expected later this year.

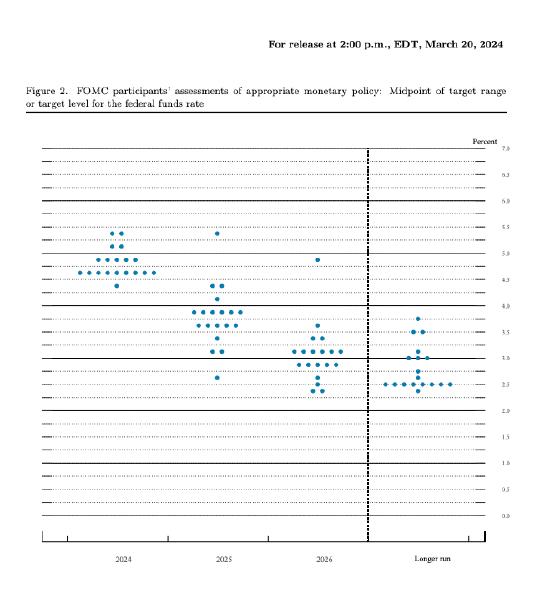

FOMC statement (full text): The bitmap maintains the estimate of three interest rate cuts this year, and lowers the forecast for 2025 interest rate cuts

The Fed's bitmap keeps the forecast of cutting interest rates by 25 basis points three times this year unchanged, but after a recent rise in inflation, policymakers' estimates of the number of interest rate cuts in 2025 were lowered compared to before. Federal Reserve officials remained on hold for the fifth consecutive meeting, and the federal funds rate remained at 5.25%-5.5%, the highest level since 2001. Policymakers have hinted that they are still planning to cut interest rates for the first time since March 2020 this year, but currently they expect to cut interest rates only three times in 2025, which is less than the estimate of December last year.

The median forecast for the Federal Reserve shows that interest rates will be cut by 75 basis points to 4.6% in 2024

The Federal Reserve's bitmap shows that the median federal funds rate is expected to be 4.6% at the end of 2024, compared to 4.6%; the median interest rate forecast for 2025 is 3.9%, previously 3.6%; the median interest rate forecast for 2026 is 3.1%, previously 2.9%; and the long-term interest rate is estimated at 2.6%, previously 2.5%.

The 2024 core PCE inflation forecast was raised to 2.6%

The Federal Reserve expects the median core PCE inflation expectations to be 2.6%, 2.2%, and 2.0% respectively from 2024 to the end of 2026, 2.2%, and 2.0% in December last year; the median PCE inflation expectations are expected to be 2.4%, 2.2%, and 2.0%, respectively, from 2024 to the end of 2026, and 2.4%, respectively, in December last year.

The 2024 GDP growth forecast was raised to 2.1%

The Federal Reserve expects the US GDP growth rate to be 2.1% in 2024 and 1.4% in December last year; the US GDP growth rate is expected to be 2.0% in 2025 and 1.8% in December last year; the US GDP growth rate is expected to be 2.0%, compared to 1.9% in December last year; the long-term US GDP growth rate is 1.8%, compared to 1.8% in December last year.

Remaining committed to returning inflation to 2%

The Federal Reserve's policy statement said that inflation has cooled down in the past year, but it is still at a “high level”; it is still firmly committed to restoring the inflation rate to 2%; employment risks and inflation targets are achieving a better balance; the economic outlook is uncertain, and the Federal Reserve “pays close attention” to inflation risks.

At least 5 Fed officials have cut expectations of interest rate cuts

The Federal Reserve's latest bitmap shows that nine Fed officials expect to cut interest rates 2 or less times in 2024. Compared with the last time, at least 5 Fed officials have cut their expectations of interest rate cuts in 2024.

Powell press conference:

It would be appropriate to start easing policies sometime this year

Powell reiterated that the policy interest rate may have peaked and is prepared to keep interest rates at a higher level for a longer period of time if necessary. It is appropriate to cut interest rates at a certain point this year. Significant weakness in the labor force will be the reason to start cutting interest rates. The intuition is that interest rates will no longer fall to very low levels, but there is huge uncertainty about this.

Recent inflation data suggests the Fed's wait was the right choice

Powell said that raising the inflation forecast does not mean an increase in the Fed's tolerance for inflation. The January CPI and PCE data are quite high, but it may be due to seasonal adjustments. It will not overreact to these two figures, nor ignore them.

“Inflation has dropped drastically” but is still too high

Powell said that the inflation rate has dropped drastically, but it is still too high. The Federal Reserve remains committed to achieving the 2% inflation target. The risks of meeting the Federal Reserve's goals are moving towards a better balance.

Slowing down the pace of downsizing will soon be an appropriate move

Powell said that the decision to slow down the pace of downsizing does not mean that our balance sheet will shrink, but rather allows us to gradually approach the final level. This meeting discussed the issue of slowing down the downsizing. It is appropriate to implement it soon. We will pay close attention to signs that indicate the end of the downsizing. The long-term goal is that the balance sheet is mainly composed of treasury bonds. Research is ongoing on the optimal speed and optimal scale to slow down scaling.

Issuing digital dollars requires authorization from US Capitol Hill

Issuing digital dollars requires authorization from US Capitol Hill, and the statement “the Federal Reserve secretly promotes central bank digital currency (CBDC)” is wrong. ,

Market reaction: The Fed remains on hold, and the three major US stock indices all hit record closing highs and rose above 5,200 points for the first time in S&P history

Traders increased their bets on cutting interest rates for the first time in June after Powell said it was appropriate to begin easing policies “sometime this year.” Investors see this as a sign that the stock market rally may expand.

The Federal Reserve kept the federal funds rate target range unchanged between 5.25% and 5.5%. The Federal Reserve bitmap shows that interest rates will still be cut three times this year. The three major US stock indexes collectively closed higher. The NASDAQ rose 1.25%, the Dow rose 1.03%, and the S&P 500 index rose 0.89%, all of which reached record closing highs. Powell hinted at slowing down the pace of downsizing, easing bets in the market, and US stocks soared at the end of the session, rising above 5,200 points for the first time in S&P history. The two-year US bond yield dived 9 basis points to a daily low, approaching the 4.60% mark. The US stock index rose collectively and soared at the end of the session. Small-cap stocks had the highest gains. The US dollar fell, and the price of gold rose by 30 US dollars to a daily high.