Despite 3 consecutive years of high performance growth, market concerns about Aimeike's future growth momentum have not been resolved.

Since 23, the beauty and skin care sector has experienced an industry downturn. The market value of the leader Aimeike has returned to the initial level of listing, and the market is divided on its future growth.

Aimeike, which chants “Your neck condition reveals your true age,” once relied on the first injectable material used for neck repair, and carried the company's performance growth banner in one fell swoop. The registration cycle for the three types of medical devices of at least 2 years plus a 2-4 year clinical cycle was enough for Aimeike to eat up the dividends of the neck wrinkle removal market.

However, in the eyes of investors, the monopoly scarcity circuit itself also contains expectations for continued high growth in performance. Once high growth is unsustainable, the original logic will completely change.

On the evening of March 19, Ameke released its 2023 annual report. During the reporting period, the company achieved annual revenue of 2869.3472 million yuan, a year-on-year increase of 47.99%; achieved total profit of 21.555532 million yuan, a year-on-year increase of 44.83%; and realized net profit of 185,4917,400 yuan, an increase of 46.33% over the previous year.

Judging from financial indicators, Aimeike has exceeded its 2023 equity incentive target, and strong growth has boosted market confidence. Looking back at the past three years, Ameke's net profit growth rates were 32% in 2022, 117% in 2021, and 44% in 2020, respectively, and continued to achieve high growth since its launch.

However, the market still has doubts about the continuation of the high growth rate.

The power of an ace item

The company's explanation for the increase in performance is that the medical and aesthetic industry, especially the light medical and aesthetic industry, is still in a relatively rapid growth process. Despite weak overall macroeconomic growth in 2023, the overall growth rate of the light medical and aesthetic industry remained above 15%. Due to its low penetration rate, its growth rate is far higher than the global market.

In the financial report, special emphasis was placed on the significant contributions of the two leading products, Hi Ti and White Angel, to performance.

Hi body

During the reporting period, the company's solution and gel injection products all achieved year-on-year growth. Among them, solution injection products with Hi-Body as the core achieved operating revenue of 167,05266 million yuan, an increase of 29.22% over the same period last year;

Moreover, according to the industry, with Aimeike increasing the direct sales coverage of the Hi-Tei series in '24, and the approval of several Hi-Ti series products in '25, there is still room for Hi Ti. According to Cinda Securities's forecast, the Hi-Sports series is expected to reach 2.42 billion yuan in 2025, with a 3-year CAGR of 23%. Panda acupuncture and water light are core growth products.

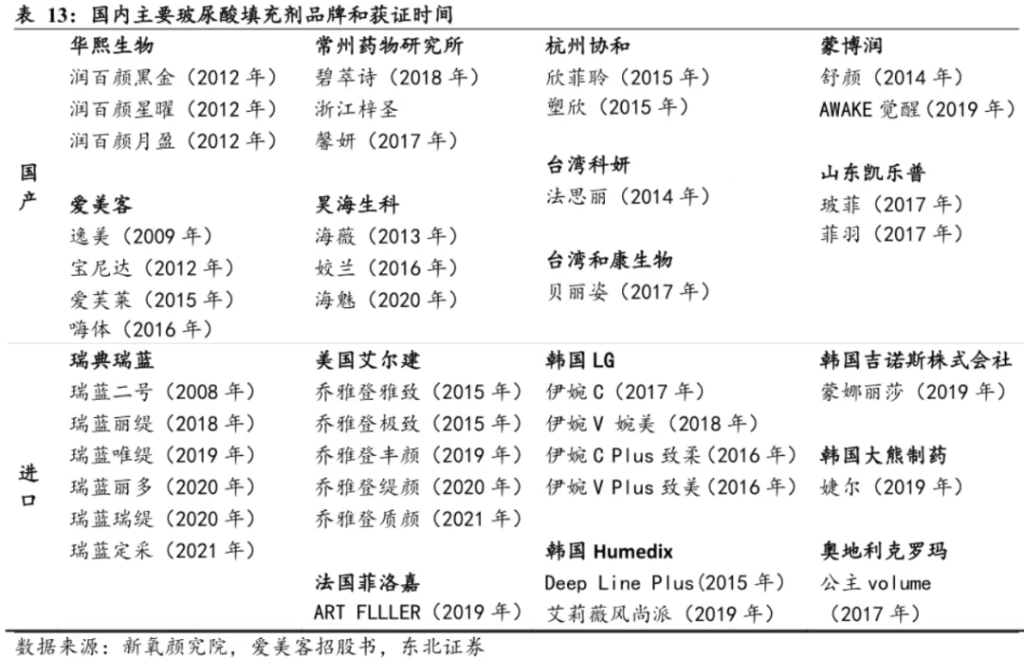

However, it is undeniable that in terms of the number of products and business models, the hyaluronic acid market is quite mature. The main barrier to competition is whether to obtain approval for sale. Currently, there are more than 30 brands of injectable hyaluronic acid that have obtained certification for three types of medical devices in China, and the market competition is extremely fierce. Compared to the market pattern of botulinum toxin, collagen, etc., where only single digits of approval are obtained, the difference is obvious.

Wet white angel

Compared to hyaluronic acid, which has entered the Red Sea, the company's other flagship product, is in the regenerative market. Currently, there are only 5 products approved for sale in this market, including “Avellan” by Changchun Shengbomer, “Yi Yanshi” by Huadong Pharmaceutical, “Wet White Angel” and “Like a Living Angel” by Meike, and Aesthe Fill in Wuzhong, Jiangsu. The competitive pattern is relatively stable.

According to feedback from medical and aesthetic channels, due to the high unit price and repair and regeneration function, regenerative products and collagen are currently the key promotion categories of institutions.

During the reporting period, gel injection products with Wet White Angel as the core achieved operating revenue of 115,77651 million yuan, a year-on-year increase of 81.43%. It is expected to relay the Hi-Body series and become the company's second growth pole.

Furthermore, according to company disclosures and industry expert opinions, there is currently only a few hundred active institutions, and there is plenty of room for improvement in terms of the breadth and depth of institutional coverage; however, in terms of the breadth and depth of institutional coverage, it is mainly injected into shallow fat. It is mainly injected into superficial fat. It is more difficult to use than Wet White Angel in a single use, and is expected to cover more doctors and institutions.

Cinda Securities predicts that by 2025, the volume of Wet White Angel and Like a Living Angel will reach 1.31 billion yuan and 750 million yuan respectively. The Angel Series is expected to have a CAGR of 80% + in 22-25, and the coverage population of Like a Living Angel will be higher than that of Wet White Angel, and the sales scale potential is greater.

Moving from explosive growth dependent on a single product to the next stage

The scarcity of Monopoly Hi-Tech was once a catalyst for Aimeike's performance growth, but market concerns about its sustainability followed. As market supply matured and participants increased, could the high growth of Ameke's ace products continue?

Not only is competition in the hyaluronic acid market entering the Red Sea, but recombinant collagen also poses a threat to the health and regeneration market due to its advantages of strong plasticity, high activity, and proximity to natural proteins. Pioneer Kinba Creatures and Giants Creatures have already reaped the benefits of pioneers.

According to Jinbo Biotech's 2023 performance report, the main driving force behind its performance growth is the rapid release of Weiyimei, a major single product of collagen. Annual sales are expected to exceed 500 million yuan; the sales growth rate of Juzi Biotech's brand Kefumei, which uses recombinant collagen as the main ingredient, continues to exceed the industry average.

Affected by changes in the supply market, it is hard to ignore that Hi-Tech's high growth rate is already slowing down. According to financial reports, the growth rate of solution injection products was 29.22% in 2023, while this figure was 26.8% in 2022, 119% in 2021, and 80% in 2020.

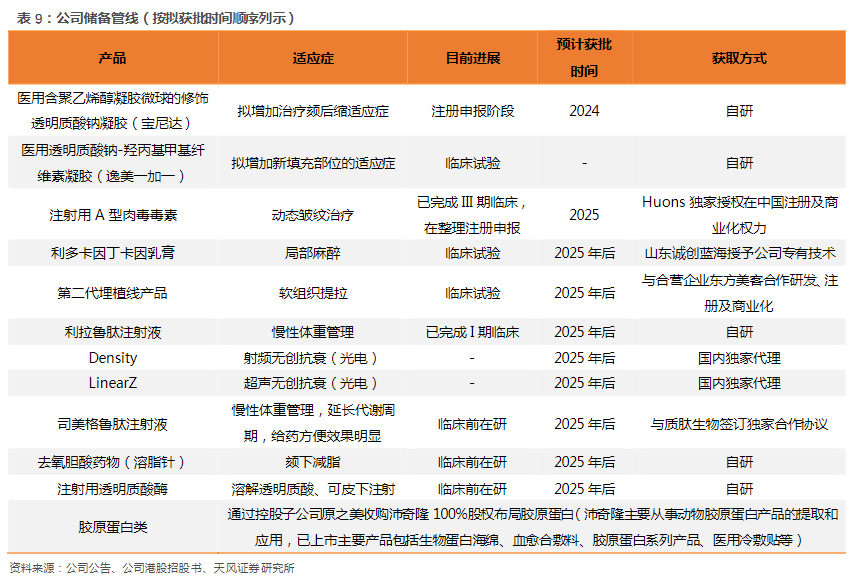

Aimeike, which is losing its scarcity, needs to prove to the market as soon as possible that it is not a single-product dependent company. Through self-development/BD/cooperation, the company is also positioning itself in multiple potential fields such as botulism, optoelectronics, fat reduction and molding, collagen, and thread implants, moving from explosive growth based on a single product to a growth stage of category expansion:

According to Wall Street News ● Insight Research, the company's subsequent pipeline layout mainly focuses on a circuit with large market space and a better competitive pattern. Once a new product is launched, it is expected to seize market share and bring growth to the company.

However, it should be noted that they have all emerged as representative companies in the above fields. For example, in the field of recombinant collagen, Juzi Biotech and L'Oréal entered the market for the second time; in addition to the already marketed Botox, Hengli, Jixi, and Lotibao, there are also companies such as Jingding Pharmaceuticals, Fosun Pharmaceuticals, Huadong Pharmaceuticals, and Haohai Biotech;

In the field of optoelectronic beauty, the company exclusively represents two products of the Korean company Jeisys Medical Inc. in this field, not only self-developed companies such as Peninsula Healthcare and Pumen Technology, but also Fosun Pharmaceutical and Huadong Pharmaceutical have entered the market through mergers and acquisitions;

In terms of chronic weight management, by the end of June 2023, the Liraglutide injection, an Aimeike product under development, had completed phase 1 clinical trials, and its indications intersected with the already marketed simeglutide. Furthermore, there are plenty of marketing pipelines. Until July '23, Lilupin, a subsidiary of Huadong Pharmaceutical, and benaglutide, a subsidiary of Renhui Biotech, were successively approved as GLP-1 drugs for obesity and overweight, and they will compete with them for share in the future.

summed

Overall, with a gross profit of close to 95% and a net profit of more than 60%, Ameke once made the market think that it has a deep moat in the medical and aesthetic field. However, with the emergence of new competitors and the deterioration of the competitive landscape, even though the company is still in a period of rapid growth, the market is divided over the future growth of its performance.

The company is striving to transform from a product company to a platform company. However, with regard to the reserve pipeline, it is still difficult to see how much it can contribute to performance growth; in the future, we need to focus on the approval situation.