Today, the “First Hong Kong Stock Exemption” Quanxin Biotech was officially listed on the main board of the Hong Kong Stock Exchange, with an issue price of HK$19.80 per share.

Judging from the previous stock offering performance,Quanxin Biotech was oversubscribed 163.15 times in the Hong Kong public sale, making it the IPO project with the highest subscription ratio in Hong Kong since 2022. The popular subscription situation already reflects the market's recognition of the company's past performance and expectations for future growth potential. Let's take a closer look at the long-term value growth logic after listing.

Support from professional investment institutions, capital support shows confidence

For most investors, the innovative pharmaceutical industry is often difficult to understand due to its high level of specialization and complexity. In contrast, professional investment institutions have deeper industry knowledge and rich experience, and they generally have an advantage in information acquisition, analysis, and judgment.

In view of this, it is certainly a simple and efficient strategy for ordinary retail investors to choose to follow professional investment institutions when seeking to enter the high-threshold biotechnology enterprise investment field. This not only helps investors avoid risks caused by insufficient expertise, but also uncovers more promising investment opportunities for investors.

In this regard, Quanxin Biotech has continued to be favored by capital and industrial investment since its establishment, which shows its reputation and competitiveness in the field of innovative pharmaceuticals.

According to the prospectus, Quanxin Biotech has completed multiple rounds of pre-initial public offering investments, raising a total of about 1.3 billion yuan. The investor list includes senior investors from Huadong Pharmaceutical, Hongtai Fund, Taizhou State-owned Assets, Jingwei China, Qinzhi Capital, Yifeng Capital, and Shenzhen Mövenpick Source, which have injected strong capital impetus into the company's development.

It is worth mentioning that in order to ensure the stable development of Quanxin Biotech and maximize shareholders' interests, the companyAll existing shareholders (including pre-initial public offering investors) are locked in a one-year ban period from the listing date. This not only demonstrates shareholders' firm confidence in its future development, but also further stabilizes stock prices and provides investors with a more reliable investment environment.

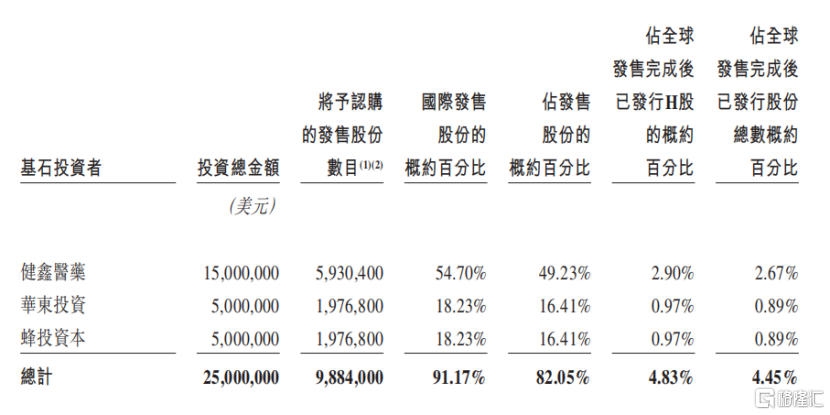

Furthermore, based on the issue price of HK$19.80, Quanxin Biotech's three cornerstone investors (Jianxin Pharmaceutical, Huadong Pharmaceutical, and Bee Investment Capital) together accounted for 82.05% of the shares sold, which is enough to reflect the high level of trust and recognition of the company by professional investors.

According to the author, combined with the extremely high popularity of Quanxin Biotech's public offering and the 100x oversubscription ratio, it may attract the attention of a large number of investors and capital inflows after the company goes public. This trend is also expected to have a positive impact on the company's stock price.

Data source: Prospectus

“Three good” traits lay the logic of growth

Looking at it now, with Quanxin Biotech's official listing on the Hong Kong Stock Exchange, I believe that its “three good” characteristics of a good track, good company, and good price have brought solid support to its good performance after listing.

First, the growth potential of an enterprise depends to a certain extent on the track it is located on. Under the logic of “big water, big fish”, a broad and far-reaching track can provide a company with broader development space and long-term growth prospects.

Most of the self-prevention and allergic diseases that Quanxin Biotech focuses on are chronic diseases, and patients need to bear relatively high long-term medication costs.

According to Frost & Sullivan data, in 2020, the total number of patients with spontaneous immunity and allergic diseases in China exceeded 430 million, compared to 100 million in the US. However, the market size of autoimmune and allergic drugs in China reached only 7.5% of the US market during the same period, which means that there is huge unmet space for China's medical needs in this field.

Reflecting the size of the market, it is estimated that China's autoimmune disease drug market will increase from US$2.9 billion in 2022 to US$19.9 billion in 2030, and the allergic disease drug market will also increase from US$6.1 billion in 2022 to US$21.6 billion in 2030.

A series of data highlights China's rapid growth in the field of drugs for self-prevention and allergic diseases, and also reveals the huge market demand in this field. Quanxin Biotech is expected to obtain continuous commercial growth opportunities on the racetrack.

Second, the high growth of the industry will undoubtedly boost the long-term valuation center of enterprises. In particular, players who have taken the lead in the industry and continue to enhance their core competitiveness are the core beneficiaries of this growth trend.

Simply put, many important factors such as high-value new drugs with a leading layout, continuous high investment in research and development of differentiated pipelines, commercial-scale production capacity, and early “settlement” cooperation on the sales side make Quanxin Biotech's competitive advantage, making it stand out from the fierce market competition.

At present, the company has built a pipeline of 9 drug candidates, covering a wide range of four main areas of self-prevention and allergic diseases, namely skin, rheumatism, respiratory and digestive diseases.

Among them, QX001S is expected to be commercialized by the end of 2024, and is expected to become the first usinumab biosimilar drug approved in China; in the clinical phase of domestic IL-23 targets for treating psoriasis, QX004N is in the top two domestic production; QX005N has been qualified as a breakthrough therapy for treating prurigo nodular; innovative exploration of various potential targets such as c-kit; rapid development of QX013N, etc.

Various achievements show the company's determination to develop innovative drugs. Coupled with its mature and commercial-scale production base, they also provided strong support for subsequent product commercialization and continued growth.

Finally, in the current situation where valuations in the innovative drug sector are relatively sluggish, Quanxin Biotech's offering valuation is relatively attractive.The current sale price is19.80HKD, market capitalization is43.97100 million Hong Kong dollars.

I have noticed that a “Full Chain Implementation Plan to Support the Development of Innovative Drugs (Draft for Comments)” has recently been circulating in the market, all of which comprehensively promote key aspects of R&D, approval, use and payment of innovative drugs, further enhancing the market's positive expectations for the innovative drug industry. Considering the current gradual improvement in the innovative drug sector, the company has maintained reasonable pricing in terms of valuation. This helps attract more investors' attention and participation, while also providing strong support for the company's financing activities.

Summarize

Overall, Quanxin Biotech's listing has opened the next new stage of development for it.

This fundraising gave the company more sufficient capital to accelerate clinical trials and commercialization of core products QX002N, QX005N, and other drug candidates. As the subsequent pipeline continues to achieve commercial verification to bring cash flow, it will also feed back R&D to form a positive cycle, stimulate the company's long-term growth potential, and ultimately be reflected in its capital market performance.