Shenzhen Huakong Seg Co., Ltd. (SZSE:000068) shares have had a really impressive month, gaining 26% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

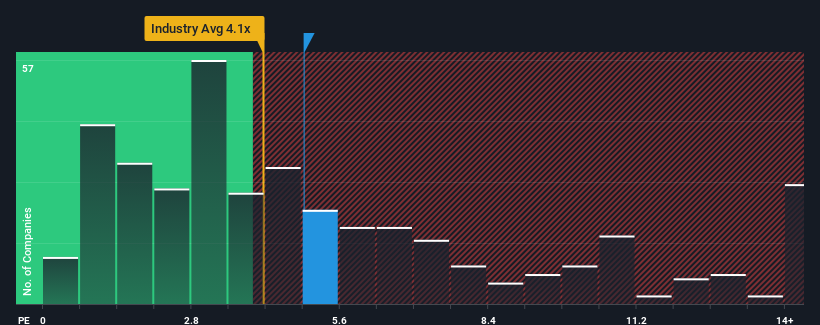

In spite of the firm bounce in price, there still wouldn't be many who think Shenzhen Huakong Seg's price-to-sales (or "P/S") ratio of 4.9x is worth a mention when the median P/S in China's Electronic industry is similar at about 4.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Shenzhen Huakong Seg Performed Recently?

As an illustration, revenue has deteriorated at Shenzhen Huakong Seg over the last year, which is not ideal at all. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Shenzhen Huakong Seg, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shenzhen Huakong Seg's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 29% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 230% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

When compared to the industry's one-year growth forecast of 25%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Shenzhen Huakong Seg is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

What We Can Learn From Shenzhen Huakong Seg's P/S?

Shenzhen Huakong Seg appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We didn't quite envision Shenzhen Huakong Seg's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Shenzhen Huakong Seg (of which 2 don't sit too well with us!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.