Central China Land Media CO.,LTD (SZSE:000719) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 23% is also fairly reasonable.

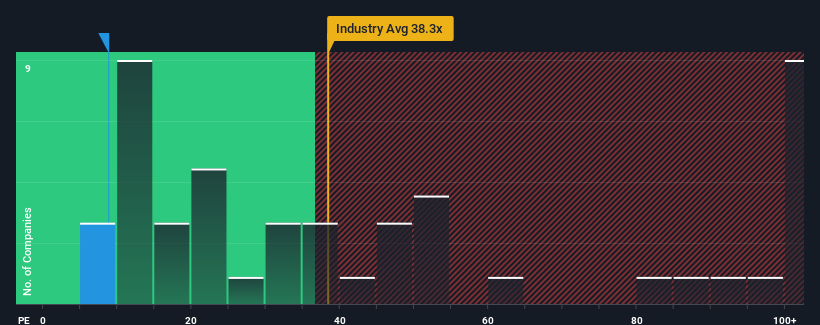

Although its price has surged higher, Central China Land MediaLTD's price-to-earnings (or "P/E") ratio of 8.8x might still make it look like a strong buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 59x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Central China Land MediaLTD as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

Central China Land MediaLTD's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 35%. The strong recent performance means it was also able to grow EPS by 49% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to slump, contracting by 13% during the coming year according to the sole analyst following the company. With the market predicted to deliver 40% growth , that's a disappointing outcome.

With this information, we are not surprised that Central China Land MediaLTD is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Central China Land MediaLTD's P/E?

Shares in Central China Land MediaLTD are going to need a lot more upward momentum to get the company's P/E out of its slump. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Central China Land MediaLTD maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 1 warning sign for Central China Land MediaLTD that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.