The top three net purchases on the Dragon Tiger list today are Hi-Tech Development, Wanji Technology, and Haofeng Technology

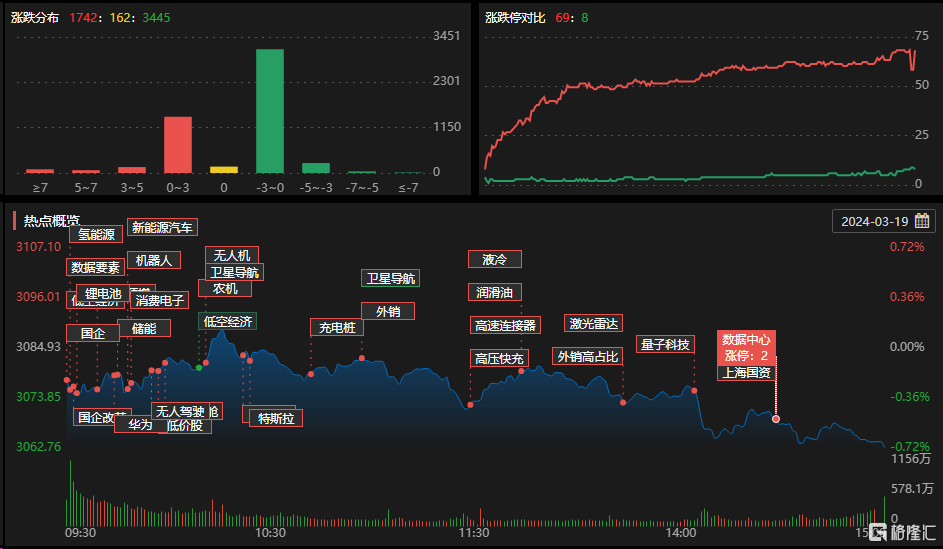

On March 19, the main index of A-shares fluctuated and declined. More than 3,400 shares fell, and traded 1.08 trillion yuan throughout the day, breaking through trillion yuan for the 2nd day in a row, with net sales of 7.011 billion yuan of capital from North China.

On the market, the EDR concept increased, the pork and chicken concepts strengthened, the high-speed connector concept, starting with copper cables, soared, and sectors such as ERP concepts, lidar, and communication equipment registered the highest gains. The PLC concept declined, the securities sector generally declined, the robot actuator sector weakened, and sectors such as Montmorillonite, diversified finance and medical services registered the highest declines.

Today, a total of 65 shares rose or closed. The total number of shares on the board was 15. 26 shares failed to be closed. The sealing rate was 71% (excluding ST shares, delisted stocks, and unopened IPOs).

In terms of individual stocks, Ai Seiko's 11 board in the machinery and equipment sector, Furong Technology's 14-day 8 board, Yingtong Communications 2 board, low-altitude economy concept stock Yongyue Technology 6 board, Oriental Fashion 2 board, pharmaceutical stock Dali Pharmaceutical 6 board, Seli Medical 2 board, hydrogen energy+large aircraft's Xinda A4 board, silicone sector, Honda New Materials 4 board, AI concept stock TV media board 3 board, and Boxin shares 3 board.

Let's take a look at today's Dragon Tiger rankings:

The top three net purchases on the Dragon Tiger list today were Hi-Tech Development, Wanji Technology, and Haofeng Technology, which were 375 million yuan, 594.274 million yuan, and 58.2456 million yuan respectively.

The top three net sales on the Dragon Tiger list were CNOOC Engineering, Taihua New Materials, and Mingpu Optoelectronics, which were 326 million yuan, 121 million yuan, and 597.1889 million yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three were Taier Shares, Huahong Technology, and Chaotech, which were 375.21,000 yuan, 35.413 million yuan, and 26.6476 million yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three were CNOOC Engineering, Taihua New Materials, and Huafeng Technology, which were 270 million yuan, 131 million yuan, and 92,2398 million yuan respectively.

The subject of some of the individual stocks on the list:

High-tech development (artificial intelligence+computing power)

1. On February 29, Chengdu Dingqiao was established with a registered capital of 1 billion yuan. Its business scope includes 5G communication technology services, mobile communication equipment sales, and IoT technology research and development. The company is jointly owned by Chengdu Gaoxinagai Communications Equity Investment, Shenzhen Hubble Technology Investment, a subsidiary of Huawei, and Chengdu Gaotou Electronic Information Industry Group.

2. On February 18, 2024, it was announced that 25% of Huakun Zhenyu's shares held by Gaotou Electronics in total have completed payment of all transaction prices on January 30, 2024, and the industrial and commercial changes related to the aforementioned share transfer will be registered in accordance with the procedures.

3. On October 19, 2023, it was announced that the company plans to purchase 70% of Huakun Zhenyu's shares. The target is a Huawei Kunpeng ecosystem enterprise, which ranks first in terms of sales scale and capacity assessment of Kunpeng + Shengteng Ecosystem.

4. Huakun Zhenyu has launched more than 30 types of computing power products based on Kunpeng and Shengteng, and is fully responsible for the development, production and marketing of “Tiangong” own-brand servers based on Huawei's “Kunpeng + Shengteng” processors.

5. The company's main business is the construction industry, smart city construction and operation, and futures business. The final actual controller is the Chengdu High-tech Development Zone Management Committee.

Wanji Technology (lidar+robot+starflash+ETC)

1. The company has a variety of automotive lidar products that can be mass-produced, such as automotive-grade 16-wire semi-solid state lidar and hybrid solid-state 128-wire automotive-grade lidar. The Huawei M5 has only 96 lines. The company and Yutong Bus reached a cooperation on lidar, and the product is used in L4 class autonomous vehicles.

2. The company's lidar business has established cooperative relationships with more than 100 robotics companies.

3. The company joined the Starflash Alliance to rely on the StarFlash Alliance platform and take advantage of the company's rich technical accumulation and product experience in short range communication and lidar.

4. The company specializes in intelligent transportation systems and other services, providing road traffic and urban transportation customers with the development and production of special short-range communication, laser products and other products.

5. The company's main EIC products include highway no-stop toll systems, multi-lane free-flow electronic toll systems, truck ETC, intelligent OBU, etc.

Offshore oil project (central state-owned enterprise reform+oil service concept)

The company's net profit to mother in 2023 was 1,621 million yuan, up 11.08% year on year; of these, net profit to mother for the fourth quarter was 248 million yuan, down 60.26% year on year. The company's annual revenue and profit all rose, but the fourth quarter results declined significantly.

Institutions focus on trading individual stocks:

Taier shares:Today's increase was 2.54%, the daily turnover rate was 41.28%, and the turnover was 1,293 billion yuan, or 7.63%. According to data from the Dragon Tiger List, the net purchase of the organization was 375.21,000 yuan, and the total net sales of sales department seats was 74.6979 million yuan.

Huahong Technology:Today's increase was 3.38%, the daily turnover rate was 11.79%, and the turnover was 669 million yuan, or 19.39%. According to data from Dragon Tiger List, the net purchase of institutions was 35.45413 million yuan, the net purchase of Shenzhen Stock Connect was 163.354 million yuan, and the total net sales of sales department seats was 4.8367 million yuan.

Beyond technology:Today's increase was 5.52%, with a turnover of 533 million yuan and a turnover rate of 69.67%. According to post-market data from the Dragon Tiger list, the four institutions made a net purchase of 26.647,600 yuan.

Offshore oil engineering:It fell to a halt today, with a turnover of 899 million yuan and a turnover rate of 3.17%. According to post-market data from the Dragon Tiger List, the Shanghai Stock Connect exclusive seat bought 394.102 million yuan and sold 95,143 million yuan, 4 institutions bought 885.52 million yuan, and 4 institutions sold 359 million yuan, for a total net sale of 270 million yuan.

Taihua New Materials:Today's decline was 8.49%, with a turnover of 462 million yuan and a turnover rate of 5.54%. According to post-market data from the Dragon Tiger List, the Shanghai Stock Connect exclusive seat bought 8.475,600 yuan and sold 17.1536 million yuan. 2 institutions bought 20.6461 million yuan, and 4 institutions sold 152 million yuan, for a total net sale of 131 million yuan.

Huafeng Technology: It rose and stopped today. The turnover rate was 19.56%, the amplitude was 16.00%, and the turnover was 365 million yuan. According to post-market data from the Dragon Tiger List, the total net sales of the five organizations were 92.2399 million yuan.

In the Dragon Tiger list, there are 6 individual stocks involving Shanghai Stock Connect exclusive seats. CNOOC Engineering's Shanghai Stock Connect exclusive seats had the largest net sales, with a net sale of 557.328 million yuan.

In the Dragon Tiger list, there are 7 individual stocks involving exclusive seats on Shenzhen Stock Connect. Hi-Tech Development's Shenzhen Stock Connect exclusive seat had the largest net purchase amount, with a net purchase of 43.655 million yuan.

Trends in volatile capital operations:

Low-level excavation:Net purchases of Sichuan Jiuzhou, Wanji Technology, and TV Media were 108.6 million yuan, 1963 million yuan, and 16.49 million yuan respectively

Hujialou:Net purchase of RMB 27.14 million in Jiuzhou, Sichuan

Pink kudzu:Net purchase of 99.34 million yuan from Hi-Tech Development

Department of Chengdu:Net purchases of Haofeng Technology and Zhaolong Internet were 21.67 million yuan and 15.17 million yuan respectively

Tohoku Takeo:Net purchase information of $12.034 million

Brother Sun:Net sales of HTC New Materials for 14.1673 million yuan

Shandong gang:Net purchases of HTC New Materials and Tianyuan Smart were 1.09 million yuan and 13.53 million yuan respectively

Stock trading to support the family:Net purchase of Yashi Optoelectronics was 10.565,400 yuan