The Hong Kong Stock Industry-wide Sentiment Index rose at the end of '23, but it is undeniable that changes in external economic expectations still put pressure on the overall trend throughout the year, and the performance expectations of listed companies continued to decline. And with the advent of a new round of annual reporting season for Hong Kong stocks, the time window for inspecting the gold content of companies has once again opened.

Among them, the latest financial report of China Construction Development (0830.HK) was quite surprising. Revenue and profit continued to grow at a high rate, making it one of the few companies that meet the “certainty” label in the current market environment.

Revenue and profit both broke high, and continuous orders strengthened development certainty

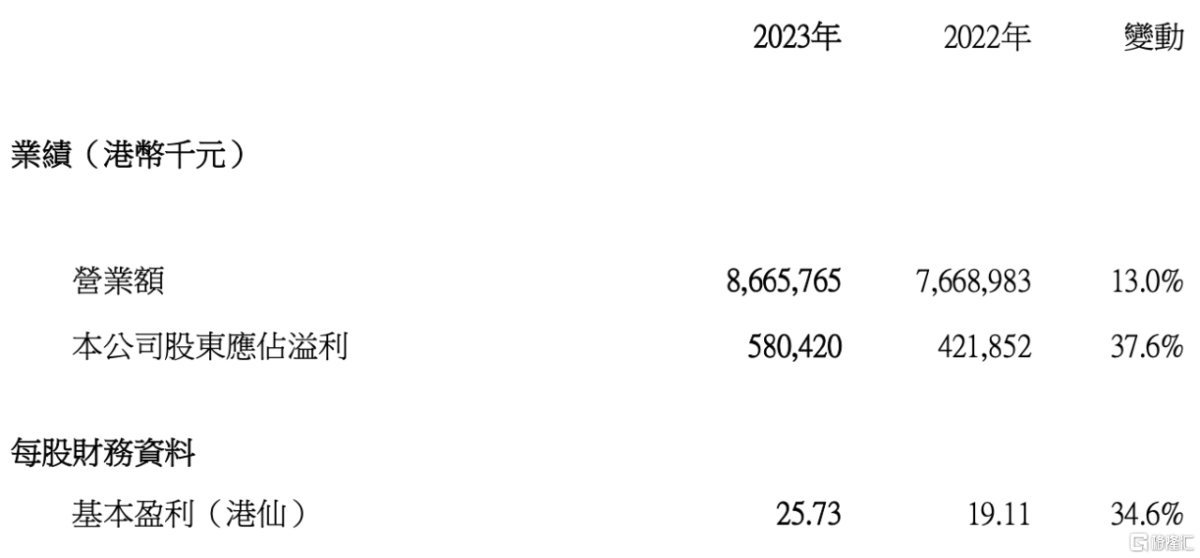

According to the annual results announcement, the company's revenue and profit both reached record highs. Revenue of 2023 was recorded at $8.666 billion (HK$, same unit), up 13.0% from last year. The revenue from the façade engineering business increased 15.2% to $6.665 billion; net profit to mother was $580 million, a significant increase of 37.6% over last year.

(Photo source: Company's 2023 Results Announcement)

On the ROE index, which value investors highly value, it recorded 25.8% in 2023, a further increase of 3.4 pp compared to 22.4% in 2022.

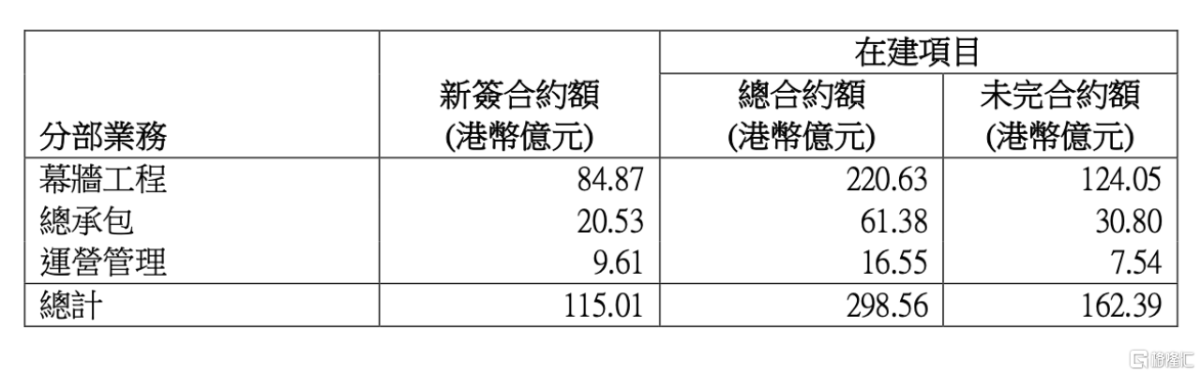

As for the order situation, as of the end of 2023, the total amount of new contracts signed was 11.501 billion yuan, an increase of 13.6% over the previous year. It once again set a new record, and the scale of business continued to expand. Meanwhile, the unfinished portion of the current contract amount was 16.239 billion yuan, an increase of 21.2% over the previous year. It can be inferred from this that the company's sufficient orders will provide strong support for performance growth in 2024 and beyond.

(Image source: Company's 2023 Results Announcement)

In addition to operating efficiency, China Construction Industrial's operating quality last year was also well guaranteed. The balance ratio declined steadily, and net operating cash flow rose to 250 million yuan. Furthermore, as of the end of 2023, the company's cash and cash equivalents were $713 million, maintaining a relatively healthy level.

As can be seen, as the leading curtain wall in Hong Kong and Macau, China Construction Development will implement the “expand Hong Kong and Macao, expand the mainland, and optimize overseas” development strategy, giving full play to the long-term effects of the curtain wall business, so that the company's overall business situation continues to improve and maintain high quality and healthy growth.

Reflected in its market position, China Construction Industry is steadily expanding its leading position in the Hong Kong and Macau curtain wall market by strengthening brand effects, competitive advantages, and contract fulfillment capabilities.

The Northern Metropolitan Area is the new engine for Hong Kong's future development, and the scale of construction is unprecedented, and the company has already won the iconic projects Hong Kong Shenzhen Innovation and Science Park and the Tin Shui Wai Cultural Heritage Restoration Resource Center. For example, in the “Ten-Year Hospital Development Plan,” medical building construction has spawned incremental demand for large-scale facades, and the company received large orders for Kai Tak Emergency Hospital Site A, Prince of Wales Hospital, and Geliang Hung Hospital last year, creating strong impetus for development.

In the long run, China's construction industry will also enjoy more development dividends in the Hong Kong and Macau construction markets as a result. The Hong Kong Special Administrative Region Government previously announced the Northern Metropolitan Area Action Plan, which proposed a new vision for the Northern Metropolitan Area in terms of industrial development, etc. “Industry-driven, infrastructure first”. The company already has a leading edge through projects such as the Hong Kong-Shenzhen Science and Technology Innovation Park in the bid area. It is expected to seize the continuously unleashed business opportunities in long-term regional planning and become the primary beneficiary of the “cake” growth of the market.

It is worth mentioning that from the perspective of sustainable development, the northern metropolitan area is expected to build or explore the prototype of future green ecological cities. Coupled with policies promoting green and low-carbon applications in the construction sector, future curtain wall BIPV, etc. are expected to create huge potential space for the industry.

Furthermore, in overseas markets, China Construction Industry has further optimized its layout and concentrated resources in high-quality markets such as Singapore and the Middle East. Projects such as the Sands Hotel and Marina View in Singapore may increase the company's share in the high-quality high-end blue ocean market, while Saudi Arabia's THE LINE linear city planning program has “natural” business opportunities and is worthy of the market's long-term attention and expectations.

Low-carbon acceleration BIPV opens up room for imagination, and the growth ceiling will continue to rise

In recent years, the country has actively promoted the achievement of the “double carbon” target. In particular, the country issued the “Work Plan to Accelerate Energy Conservation and Carbon Reduction in the Construction Sector” this year, further speeding up the pace of promoting green buildings. Currently, the total construction area of urban and rural areas in China exceeds 60 billion square meters, and the annual completion area is about 4 billion square meters. The value of the intersection of new buildings and the renovation and upgrading of existing buildings is huge.

As a combination product of green buildings and new energy sources, along with the cost benefits brought about by the 80%-90% reduction in photovoltaic power generation costs in the past ten years, BIPV is expected to stimulate market potential and become a trend direction with both certainty and growth in the future. According to Societe Generale Securities estimates, BIPV will form a trillion-dollar market in the future.

China Construction Development has already entered the BIPV field, and has continued to implement products and projects during the period.

In 2023, the company continued to develop new products Light A and Mega Light-A, and completed the first photovoltaic curtain wall production line. This means that the competitiveness of its core technology has been further improved, and it has prepared sufficient production capacity for external application of high-quality products. As a result, the company can seize more high-end market share and win high-quality green building projects.

The company won the bid for the Shenzhen Metrology Institute project in the mainland last year. As the “Shenzhen Zero-Energy Construction Pilot Project”, the project has a total BIPV installation area of 7,756.08 square meters, an installed capacity of 606.92 kWp, and an annual power generation capacity of 752,900 kWh. If the unit price of electricity is calculated at 1.166 yuan/kWh during peak hours in Shenzhen, at the economic level alone, electricity costs can be saved by about 877,900 yuan a year. The potential benefits it has created in reducing carbon and reducing the consumption of public electricity supply resources have not been taken into account. The project will also effectively form a demonstration effect and accelerate the promotion of BIPV projects. Combined with China Construction Industry's position in the global curtain wall market, the company will continue to take the lead in developing the blue ocean of photovoltaic façades, leading the industry to develop green buildings.

(Photo source: Shenzhen Works Department's official account)

According to statistics, the total annual electricity consumption of existing buildings in China is about 1.6 trillion kWh, while the potential for installing photovoltaics in existing buildings is 1,500 GW, and the power generation capacity can reach 150 million kWh. According to estimates from Daxin Research, China has an existing construction area of 60 billion square meters, of which BIPV can be installed accounts for about one-sixth, or 10 billion square meters. The total installed potential of the corresponding BIPV is about 1500 to 2000 GW, and the corresponding market size is about 7.5 to 10 trillion yuan. Under the trillion-dollar market, which is enough to carry many 10 billion or even 100 billion enterprises, industry leaders such as China's construction industry will have plenty of room for imagination.

In addition, the company is also investing in pilot roof photovoltaics at the Hailong Plant in Zhuhai and China Construction Smart Valley in Changsha to explore new commercialization possibilities for BIPV. Through the “self-consumption of electricity+surplus Internet access” model, on the one hand, electricity expenses are effectively reduced for owners, and on the other hand, additional stable cash flow is contributed to the company over a long period of time, and revenue channels are broadened.

In summary, the new technologies and products of China's construction industry are becoming more mature, and project construction in the BIPV field is gradually improving. The business model has formed a good closed loop, and continuous attempts are being made to expand business boundaries. In the future, BIPV will become a high business flashpoint that the company can expect, and a “ceiling” of value that can be reached by sustainable revenue growth with too high revenue.

summed

Behind handing over this high-quality report card, China Construction Industry has always insisted on scientific and technological innovation as the core engine driving business development, actively developing and innovating in fields such as curtain wall technology and BIPV, and has built differentiation barriers in its main business, strengths, and main circuit.

Technology is the primary productive force. Based on the “15th Five-Year Plan” business goals, China's construction industry is using scientific and technological innovation to help the country develop green buildings, promote green and low-carbon transformation, and serve the country to actively and steadily promote carbon neutrality when carbon peaks reach carbon peaks. Achieving carbon neutrality at the peak of carbon is a broad and profound economic and social systemic transformation. The company seeks development based on the country's needs and lays out strategic emerging industries and future industries. It is expected to build an innovative growth pole, seize historic opportunities for rapid growth, and usher in vigorous development.

According to the “14th Five-Year Plan” to “15th Five-Year Plan” business goals, the company will ensure a net profit of HK$1 billion and continue to achieve higher results in 2030. In 2030, new contracts were signed in excess of HK$35 billion; turnover and net profit exceeded HK$25 billion and HK$3 billion respectively, and the compound annual growth rate (CAGR) reached 16.34% and 26.46%.

Over the long term, China's construction industry has followed the trend, showing the technological hard power of high-end curtain wall leaders. Future development will definitely make some gains and bring rewards to shareholders. The capital market is also more willing to pay for companies with high growth, high certainty and strong sustainability. As the performance side continues to fulfill its strategic vision, China's construction industry is expected to receive more recognition at the valuation level.