Jiangsu Hanvo Safety Product Co., Ltd. (SZSE:300952) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.6% in the last twelve months.

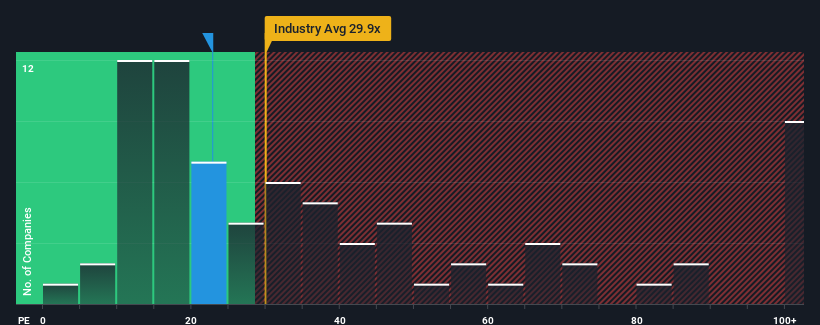

Although its price has surged higher, Jiangsu Hanvo Safety Product's price-to-earnings (or "P/E") ratio of 22.8x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 32x and even P/E's above 58x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Jiangsu Hanvo Safety Product has been struggling lately as its earnings have declined faster than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

Jiangsu Hanvo Safety Product's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 7.3%. As a result, earnings from three years ago have also fallen 22% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 59% as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 40% growth forecast for the broader market.

In light of this, it's peculiar that Jiangsu Hanvo Safety Product's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Jiangsu Hanvo Safety Product's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Jiangsu Hanvo Safety Product's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Jiangsu Hanvo Safety Product you should know about.

You might be able to find a better investment than Jiangsu Hanvo Safety Product. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.