Zhejiang Changsheng Sliding Bearings Co., Ltd. (SZSE:300718) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.2% in the last twelve months.

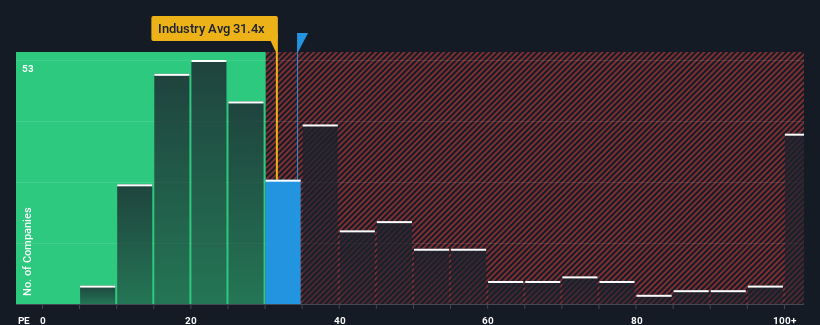

In spite of the firm bounce in price, it's still not a stretch to say that Zhejiang Changsheng Sliding Bearings' price-to-earnings (or "P/E") ratio of 34.2x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 31x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, Zhejiang Changsheng Sliding Bearings has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Is There Some Growth For Zhejiang Changsheng Sliding Bearings?

The only time you'd be comfortable seeing a P/E like Zhejiang Changsheng Sliding Bearings' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered a frustrating 9.3% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Turning to the outlook, the next year should generate growth of 92% as estimated by the three analysts watching the company. With the market only predicted to deliver 40%, the company is positioned for a stronger earnings result.

In light of this, it's curious that Zhejiang Changsheng Sliding Bearings' P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Zhejiang Changsheng Sliding Bearings appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Zhejiang Changsheng Sliding Bearings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Zhejiang Changsheng Sliding Bearings.

If you're unsure about the strength of Zhejiang Changsheng Sliding Bearings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.