Joy Kie Corporation Limited (SZSE:300994) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

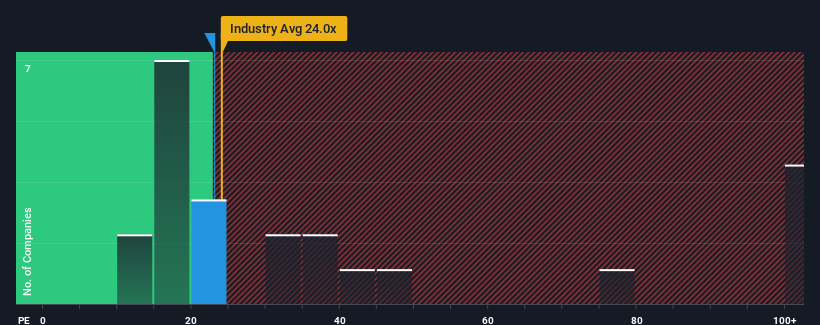

Although its price has surged higher, Joy Kie may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.1x, since almost half of all companies in China have P/E ratios greater than 32x and even P/E's higher than 58x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Joy Kie has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Joy Kie's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 49%. The last three years don't look nice either as the company has shrunk EPS by 39% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 63% over the next year. Meanwhile, the rest of the market is forecast to only expand by 40%, which is noticeably less attractive.

With this information, we find it odd that Joy Kie is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Joy Kie's P/E?

Despite Joy Kie's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Joy Kie currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 3 warning signs for Joy Kie (2 make us uncomfortable!) that we have uncovered.

If these risks are making you reconsider your opinion on Joy Kie, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.