Deep-pocketed investors have adopted a bearish approach towards Intuitive Surgical (NASDAQ:ISRG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in ISRG usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Intuitive Surgical. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 21% leaning bullish and 78% bearish. Among these notable options, 3 are puts, totaling $116,354, and 11 are calls, amounting to $613,841.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $330.0 to $490.0 for Intuitive Surgical during the past quarter.

Analyzing Volume & Open Interest

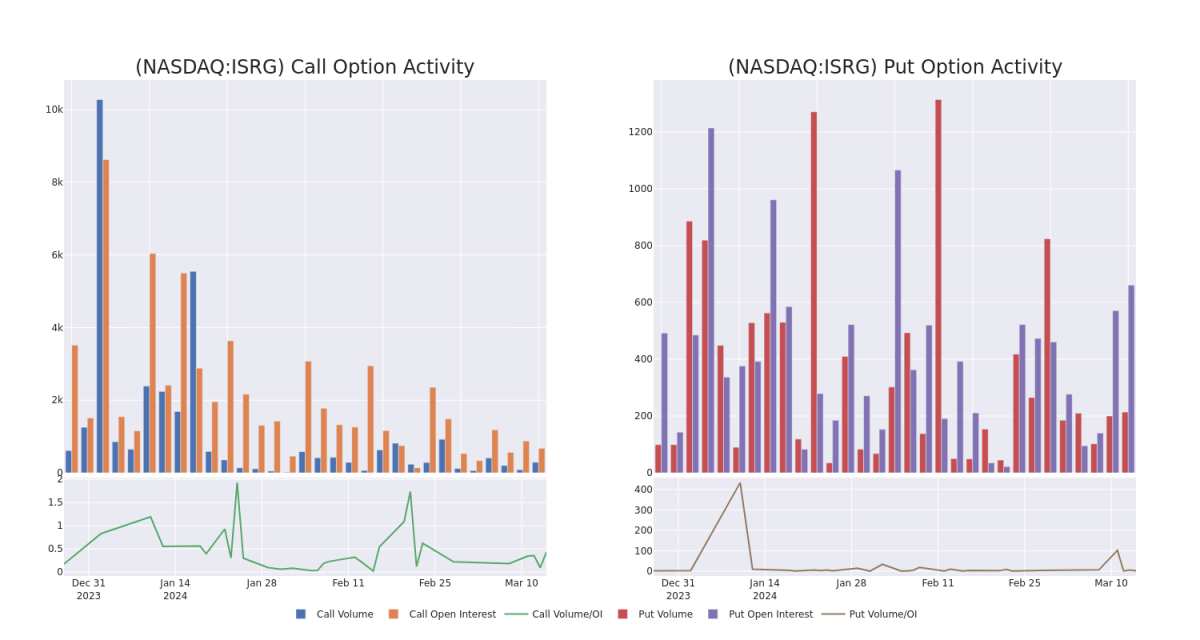

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Intuitive Surgical's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Intuitive Surgical's significant trades, within a strike price range of $330.0 to $490.0, over the past month.

Intuitive Surgical Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | SWEEP | BULLISH | 04/19/24 | $400.00 | $255.2K | 513 | 207 |

| ISRG | CALL | TRADE | BEARISH | 03/28/24 | $390.00 | $58.5K | 59 | 0 |

| ISRG | PUT | TRADE | NEUTRAL | 04/19/24 | $387.50 | $53.0K | 0 | 0 |

| ISRG | CALL | TRADE | BULLISH | 06/21/24 | $330.00 | $43.3K | 169 | 60 |

| ISRG | PUT | SWEEP | BEARISH | 04/19/24 | $395.00 | $37.2K | 190 | 87 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Following our analysis of the options activities associated with Intuitive Surgical, we pivot to a closer look at the company's own performance.

Present Market Standing of Intuitive Surgical

- With a volume of 1,014,806, the price of ISRG is down -0.36% at $394.86.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 29 days.

What The Experts Say On Intuitive Surgical

1 market experts have recently issued ratings for this stock, with a consensus target price of $420.0.

- Reflecting concerns, an analyst from Stifel lowers its rating to Buy with a new price target of $420.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.