XBP Europe Holdings, Inc. (NASDAQ:XBP) shareholders are no doubt pleased to see that the share price has bounced 29% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 75% share price decline over the last year.

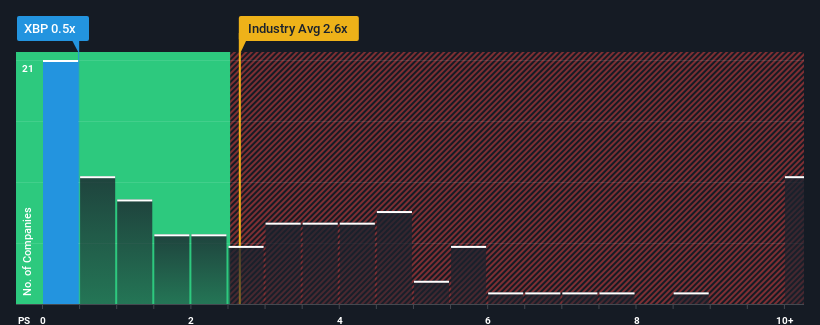

In spite of the firm bounce in price, XBP Europe Holdings may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.5x, since almost half of all companies in the Diversified Financial industry in the United States have P/S ratios greater than 2.6x and even P/S higher than 5x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

What Does XBP Europe Holdings' Recent Performance Look Like?

For example, consider that XBP Europe Holdings' financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on XBP Europe Holdings will help you shine a light on its historical performance.How Is XBP Europe Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like XBP Europe Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 9.6% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 22% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 4.3% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that XBP Europe Holdings' P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

Shares in XBP Europe Holdings have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of XBP Europe Holdings revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 5 warning signs for XBP Europe Holdings (3 are a bit unpleasant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.