Hangzhou Heshun Technology Co.,LTD. (SZSE:301237) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 33% over that time.

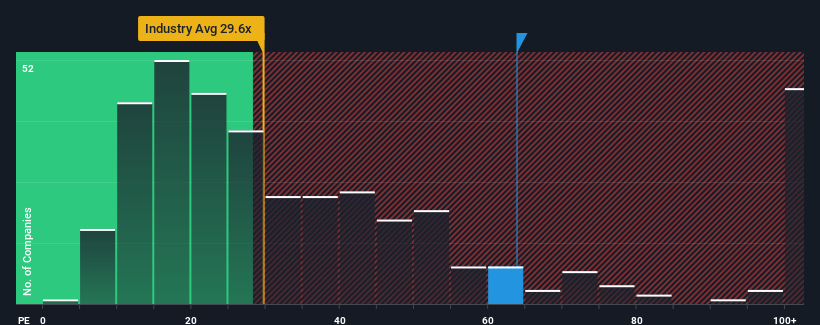

After such a large jump in price, Hangzhou Heshun TechnologyLTD's price-to-earnings (or "P/E") ratio of 63.8x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 31x and even P/E's below 19x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Hangzhou Heshun TechnologyLTD has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Hangzhou Heshun TechnologyLTD would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 72%. As a result, earnings from three years ago have also fallen 61% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 123% as estimated by the only analyst watching the company. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

In light of this, it's understandable that Hangzhou Heshun TechnologyLTD's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Hangzhou Heshun TechnologyLTD's P/E?

Hangzhou Heshun TechnologyLTD's P/E is flying high just like its stock has during the last month. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hangzhou Heshun TechnologyLTD's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Hangzhou Heshun TechnologyLTD has 4 warning signs (and 2 which are a bit unpleasant) we think you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.