Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Obio Technology (Shanghai) Corp., Ltd. (SHSE:688238) does have debt on its balance sheet. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Obio Technology (Shanghai)'s Debt?

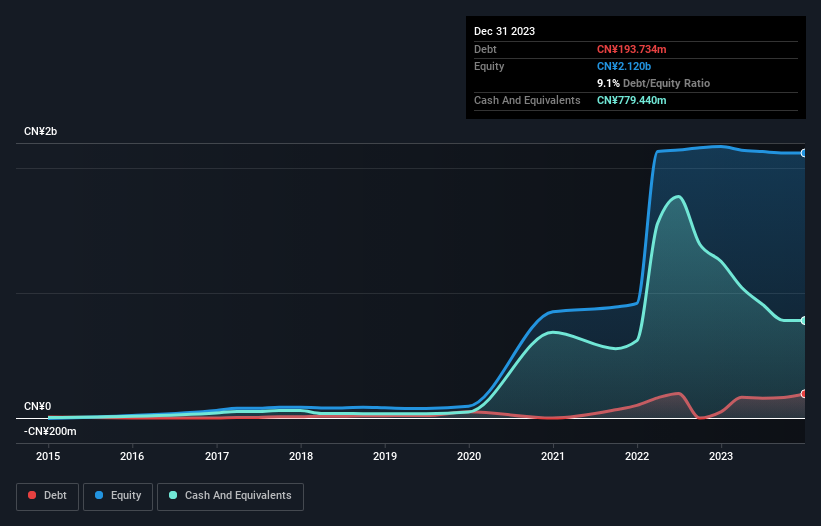

The image below, which you can click on for greater detail, shows that at September 2023 Obio Technology (Shanghai) had debt of CN¥193.7m, up from CN¥49.4m in one year. However, its balance sheet shows it holds CN¥779.4m in cash, so it actually has CN¥585.7m net cash.

A Look At Obio Technology (Shanghai)'s Liabilities

Zooming in on the latest balance sheet data, we can see that Obio Technology (Shanghai) had liabilities of CN¥261.4m due within 12 months and liabilities of CN¥239.7m due beyond that. Offsetting these obligations, it had cash of CN¥779.4m as well as receivables valued at CN¥106.2m due within 12 months. So it can boast CN¥384.5m more liquid assets than total liabilities.

This surplus suggests that Obio Technology (Shanghai) has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Obio Technology (Shanghai) has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Obio Technology (Shanghai) can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Obio Technology (Shanghai) had a loss before interest and tax, and actually shrunk its revenue by 27%, to CN¥213m. That makes us nervous, to say the least.

So How Risky Is Obio Technology (Shanghai)?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Obio Technology (Shanghai) had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of CN¥730m and booked a CN¥128m accounting loss. Given it only has net cash of CN¥585.7m, the company may need to raise more capital if it doesn't reach break-even soon. Overall, its balance sheet doesn't seem overly risky, at the moment, but we're always cautious until we see the positive free cash flow. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Obio Technology (Shanghai)'s profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.