Yue Yuen Industrial (Holdings) Limited (HKG:551) shares have had a really impressive month, gaining 48% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 4.4% isn't as impressive.

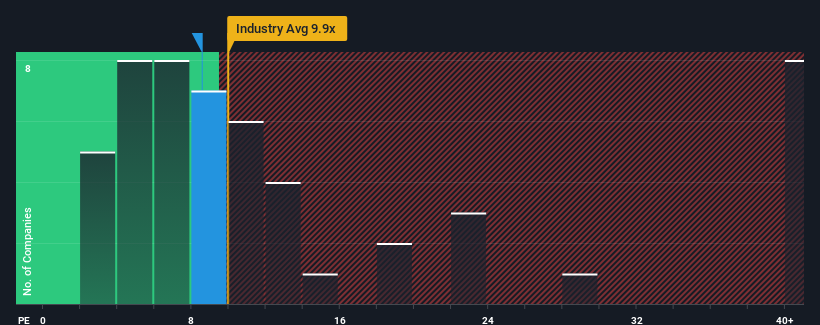

Although its price has surged higher, you could still be forgiven for feeling indifferent about Yue Yuen Industrial (Holdings)'s P/E ratio of 8.6x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 9x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings that are retreating more than the market's of late, Yue Yuen Industrial (Holdings) has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Yue Yuen Industrial (Holdings) would need to produce growth that's similar to the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.4%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 11% each year during the coming three years according to the ten analysts following the company. That's shaping up to be materially lower than the 15% per year growth forecast for the broader market.

In light of this, it's curious that Yue Yuen Industrial (Holdings)'s P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Yue Yuen Industrial (Holdings)'s stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Yue Yuen Industrial (Holdings)'s analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 2 warning signs for Yue Yuen Industrial (Holdings) that we have uncovered.

If you're unsure about the strength of Yue Yuen Industrial (Holdings)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.