[Focus on hot topics]

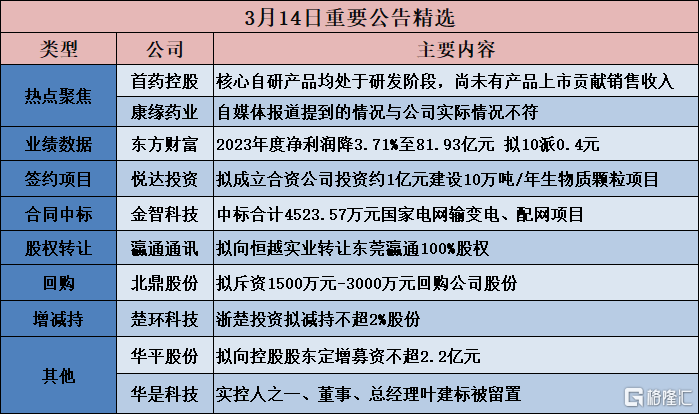

First Pharmaceutical Holdings (688197.SH): The core self-developed products are all in the R&D stage, and no products have yet been launched to contribute to sales revenue

First Pharmaceutical Holdings (688197.SH) announced an announcement of abnormal fluctuations in stock trading. The company's daily operations are all normal, and every effort is being made to promote clinical research on the core pipeline. As of the disclosure date of this announcement, the core self-developed product SY-707 is undergoing pre-NDA communication based on registered clinical phase III trial results; the NSCLC critical phase II trial of the third-generation ALK inhibitor SY-3505 against second-generation ALK inhibitor treatment failure is undergoing rapid enrollment, and a critical phase III clinical study on first-line treatment of ALK-positive NSCLC patients with crizotinib was officially launched in December 2023; the critical phase II trial of the selective RET inhibitor SY-5007 for RET positive NSCLC has been completed All subjects were enrolled, and the Phase III confirmatory clinical study was officially launched in July 2023, and is currently progressing rapidly. As of the disclosure date of this announcement, the company's core self-developed products are all in the R&D stage, and no products have been launched to contribute to sales revenue.

Kangyuan Pharmaceutical (600557.SH): The situation mentioned in self-media reports does not match the actual situation of the company

Kangyuan Pharmaceutical (600557.SH) announced that some self-media outlets have repeatedly made misleading reports on income tax expenses, R&D results, etc. disclosed in the company's 2023 annual report. After verification by the company, the situation mentioned in the aforementioned self-media report did not match the company's actual situation. In order to avoid misleading investors, the main relevant situations are explained now.

In 2023, the company's total profit was 551 million yuan, net profit was 547 million yuan, and income tax expenses were 39.323 million yuan, mainly due to the impact of preferential national tax policies. The higher the company's R&D investment, the stronger the income tax relief it can enjoy. The settlement amount of corporate income tax and the pre-tax deduction amount for R&D expenses have been reviewed and verified by a professional tax agent firm. Paying taxes according to law is the responsibility and obligation of every enterprise. The company has always paid taxes on time and in accordance with the amount. In 2023, it paid taxes such as value-added tax, urban maintenance and construction tax, corporate income tax, etc., with a total tax amount of 607 million yuan, an increase of 12.95% over the previous year, fully fulfilling the social responsibilities of the enterprise. For details of the company's tax amount, please refer to “(1) Taxation according to law” in “10. Returning to Society” of the company's “2023 Corporate Social Responsibility Report”. Investors are kindly requested to read it. The company's financial statements over the years have been prepared in strict accordance with the provisions of corporate accounting standards in major aspects. Lixin Certified Public Accountants (special general partnership) hired by the company has audited the financial data and issued a standard unqualified audit report.

[Investment projects]

Baoan, China (000009.SZ): Betray Hong Kong plans to increase capital in Indonesia and build an integrated anode material project for new energy lithium batteries with an annual output of 80,000 tons

China Baoan (000009.SZ) announced that the 47th meeting of the company's board of directors held on March 14, 2024 reviewed and passed the “Proposal on Joint Venture Agreements and Foreign Investment by Subsidiaries”. Betray Hong Kong plans to sign the “Supplementary Agreement (2) to the Joint Venture Agreement for the Integrated Project of New Energy Lithium Battery Anode Materials with an Annual Output of 80,000 Tons” with an annual output of 80,000 tons (“Phase II Project”). The total investment of the project is estimated to be about 299 million yuan dollars. With this capital increase, Betray Hong Kong plans to increase its capital by US$62.79 million, and STELLAR plans to increase its capital by US$41.86 million. After the capital increase is completed, Betray Hong Kong will still hold 60% of the shares in the joint venture.

Yueda Investment (600805.SH): Plans to establish a joint venture to invest about 100 million yuan to build a 100,000 tons/year biomass pellet project

Yueda Investment (600805.SH) announced that in order to lay out hydrogen-based green energy, promote industrial transformation, and enhance the company's core competitiveness, the company established Yueda Biomass Company with a registered capital of 50 million yuan, the company pledged an investment of 0.27 billion yuan, a shareholding ratio of 55%, China Chemical Construction Investment Group pledged an investment of 0.2 billion yuan, a shareholding ratio of 40%, and Dadihe Company pledged an investment of 0.025 million yuan, and a shareholding ratio of 5%. Yueda Biomass Company initially invested in the construction of a 100,000 tons/year biomass pellet project, with a total investment of about 100 million yuan.

[Contract won the bid]

Dashi Intelligence (002421.SZ): The consortium won the bid for the Longhua District Hospital of Traditional Chinese Medicine Intelligent Project

Dashi Intelligence (002421.SZ) announced that recently, Shenzhen Dashi Intelligence Co., Ltd. received a “Notice of Winning Bid” jointly issued by the bidding agency Yunji Smart Engineering Co., Ltd. and the bidding unit, the Shenzhen Longhua District Construction Works Department. The company and Enlightenment Digital Technology (Shenzhen) Co., Ltd. as a consortium won the bid for the Longhua District Hospital of Traditional Chinese Medicine intelligent project, with a bid amount of 509.659 million yuan.

Nandu Power (300068.SZ): won the bid for 327 million yuan energy storage project

Nandu Power (300068.SZ) announced that it recently received a notice of winning bid from the bidding agency Guangdong Telecom Planning and Design Institute Co., Ltd., confirming that the company was the winner of China Tower's 2024 centralized tender for valve-controlled sealed lead-acid battery products. The winning bid amount (tax included) was approximately 327 million yuan.

Yingtang Intelligent Control (300131.SZ): The participating company won the bid for the Urban Renewal Unit Project in Xixiang Street No. 1 Industrial Zone, Bao'an District

Yingtang Intelligent Control (300131.SZ) announced that according to the “Notice of Winning the Bid for the Urban Renewal Project of Lequn No. 1 Industrial Zone, Xixiang Street, Bao'an District, Shenzhen” issued by the Shenzhen Public Resources Exchange Public Service Platform, it is determined that the winning bidder for the project is Shenzhen Yingtangxin Technology Industry Development Co., Ltd. Recently, the bid announcement period for this project has ended. Shenzhen Yingtangxin recently received the “Winning Bid Confirmation” from Baoan Branch of Shenzhen Trading Group Co., Ltd. The project will complete procedures such as preparation of a special plan for the urban renewal unit and confirmation of project implementers in accordance with Shenzhen's urban renewal related policies before implementing the park construction and operation management can be carried out.

Jinzhi Technology (002090.SZ): Won the bid for a total of 45.2357 million yuan for national grid transmission, transformation, and distribution network projects

Jinzhi Technology (002090.SZ) announced that recently, Jiangsu Jinzhi Technology Co., Ltd. successfully won the bid for transmission, transformation and distribution network-related projects of State Grid Co., Ltd. and its subsidiaries, with a total bid amount of 45.2357 million yuan.

[[Share acquisition]

Yingtong Communications (002861.SZ): Plans to transfer 100% of Dongguan Yingtong's shares to Hengyue Industrial

Yingtong Communications (002861.SZ) announced that the company signed an “Share Transfer Intent Agreement” with Dongguan Hengyue Industrial Co., Ltd. (“Hengyue Industrial”) on March 13, 2024. The company plans to transfer 100% of the shares of Dongguan Yingtong Wire Co., Ltd. (hereinafter referred to as “Dongguan Yingtong”), a wholly-owned subsidiary of Hengyue Industrial Co., Ltd. (“Dongguan Yingtong”). According to preliminary negotiations between the parties, the transaction price is tentatively estimated at RMB 106.8 million. The parties to the transaction will negotiate and determine the final transaction price and transaction conditions of the target shares based on the net assets and overall valuation of Dongguan Yingtong determined by the audit report and evaluation report issued by the intermediary agency. After the transaction was completed, Dongguan Yingtong was no longer included in the scope of the company's consolidated statements.

Huichang Communications (300578.SZ): Shanghai Shenglong plans to transfer 30% of Huiren Fund's partnership share

Huichang Communications (300578.SZ) announced that Shanghai Shenglong Technology Co., Ltd. (“Shanghai Shenglong”), a wholly-owned subsidiary of the company, signed a “Fund Share Transfer Agreement” with Ms. Leng Ling on March 13, 2024. Shanghai Shenglong used its own capital to transfer the Huiren (Qingdao) equity investment fund partnership (limited partnership) (hereinafter referred to as “Huiren Fund” or “partnership”) with an actual investment amount of RMB 1981.8 million (hereinafter referred to as “partnership share”) of Huiren Fund. The consideration for this transaction was RMB 1981.8 million. Meanwhile, Shanghai Shenglong has signed the “Huiren (Qingdao) Equity Investment Partnership (Limited Partnership) Partnership Agreement” with Huiren Fund's general partner Zhongmin Huiyuan (Shandong) Equity Investment Management Co., Ltd. (hereinafter referred to as “Zhongmin Huiyuan” or “General Partner”) and 14 other limited partners. After the transaction was completed, Shanghai Shenglong became one of Huiren Fund's limited partners, with a paid-in capital of RMB 1981.8 million and holding 30% of its partnership share.

[Performance data]

China Aviation Heavy Equipment (600765.SH): Net profit in 2023 increased 10.70% year-on-year to 1,329 billion yuan, and plans to distribute 10 to 2.71 yuan

China Aviation Heavy Machinery (600765.SH) released its 2023 annual report. The company's revenue during the reporting period was 10.577 billion yuan, up 0.07% year on year; net profit attributable to shareholders of listed companies was 1,329 billion yuan, up 10.70% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 1,289 billion yuan, up 8.81% year on year; and basic earnings per share was 0.9 yuan. It is proposed to distribute a cash dividend of 2.71 yuan (tax included) for every 10 shares to all shareholders.

Oriental Wealth (300059.SZ): Net profit for 2023 fell 3.71% to 8.193 billion yuan, and plans to distribute 10 to 0.4 yuan

Oriental Wealth (300059.SZ) announced its 2023 annual report. In 2023, the company achieved total operating income of 11.081 billion yuan, a year-on-year decrease of 11.25%; net profit attributable to shareholders of listed companies was 8.193 billion yuan, a year-on-year decrease of 3.71%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 7.862 billion yuan, a year-on-year decrease of 4.18%; basic income per share was 0.52 yuan; and plans to distribute a cash dividend of 0.40 yuan (tax included) for every 10 shares to all shareholders.

Baitong Energy (001376.SZ): Net profit for 2023 increased by 19.50% to 131 million yuan, plans to pay 10 to 1 yuan

Baitong Energy (001376.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 1,082 million yuan, a year-on-year decrease of 0.01%; net profit attributable to shareholders of listed companies was 131 million yuan, up 19.50% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 123 million yuan, an increase of 22.63% year on year; basic income per share was 0.31 yuan; and plans to distribute a cash dividend of 1 yuan (tax included) for every 10 shares to all shareholders.

Long Cable Technology (002879.SZ): Net profit for 2023 increased by 142.79% to 72.1326 million yuan, and plans to distribute 10 to 2.5 yuan

Changcable Technology (002879.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 1,042 billion yuan, up 5.39% year on year; net profit attributable to shareholders of listed companies was 72.1326 million yuan, up 142.79% year on year; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss was 666.104 million yuan, an increase of 745.59% year on year; basic income per share was 0.38 yuan; and a cash dividend of 2.5 yuan (tax included) was distributed to all shareholders for every 10 shares.

Tianhong Co., Ltd. (002419.SZ): Net profit for 2023 increased by 88.75% to 227 million yuan, plans to distribute 10 to 1.6 yuan

Tianhong Co., Ltd. (002419.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 12.086 billion yuan, a year-on-year decrease of 0.32%; net profit attributable to shareholders of listed companies of 227 million yuan, an increase of 88.75%; net profit attributable to shareholders of listed companies after deducting non-recurring profit and loss of 128 million yuan; basic earnings per share of 0.1939 yuan; and plans to distribute a cash dividend of 1.6 yuan (tax included) for every 10 shares to all shareholders.

Ping An Bank (000001.SZ): 2023 net profit of 46.455 billion yuan, plans to distribute 10 to 7.19 yuan

Ping An Bank (000001.SZ) announced its 2023 annual report. In 2023, the company achieved operating income of 164.699 billion yuan; realized net profit attributable to the Bank's shareholders of 46.455 billion yuan, up 2.1% year on year; net profit attributable to the Bank's shareholders after deducting non-recurring profit and loss of 46.431 billion yuan, up 2.3% year on year; basic/diluted earnings per share of 2.25 yuan; weighted average return on net assets of 11.38%; plans to distribute cash dividends of RMB 7.19 yuan (tax included) for every 10 shares to all shareholders. At the end of 2023, Ping An Bank's total assets were 55,87.116 billion yuan, up 5.0% from the end of the previous year; the non-performing loan ratio was 1.06%, which remained stable overall; and the capital adequacy ratio was 13.43%, up 0.42 percentage points from the end of the previous year.

[Repurchase]

Beiding Co., Ltd. (300824.SZ): Plans to spend 15 million yuan to 30 million yuan to buy back the company's shares

Beiding Co., Ltd. (300824.SZ) announced that the company plans to repurchase RMB common shares (A shares) issued by the company. Use the repurchased shares for employee stock ownership plans or equity incentive plans at an appropriate time in the future; if the company fails to use the repurchased shares for the above purposes within three years after disclosing the repurchase results and share change announcements, the shares repurchased by the company will be cancelled in accordance with law. If the country adjusts the relevant policy, the relevant repurchase plan will be implemented in accordance with the adjusted policy. The total capital to be repurchased shall not be less than RMB 15.00 million (inclusive) and not more than RMB 30.01 million (inclusive). The price of the shares to be repurchased shall not exceed RMB 10.00 per share (inclusive). The proposed repurchase period is 12 months from the date the board of directors of the company reviews and approves the repurchase plan.

[Increase or decrease holdings]

Xinyuanwei (688037.SH): Natural person shareholders and core employees increased their corporate shares by a total of 1.034,600 yuan

Xinyuan Micro (688037.SH) announced that as of March 14, 2024, the total amount of the holdings increase plan reached RMB 10.34,600. According to the “Notice of Shenyang Xinyuan Microelectronics Equipment Co., Ltd. on Proposing the Company's Repurchase, Natural Person Shareholders and Core Employees, and the Company's Action Plan to “Improve Quality, Increase Efficiency, and Value Return”, the company disclosed the progress of the holdings increase plan. As of March 14, 2024, the amount of increase in holdings of Mr. Miao Tao and Mr. Zhang Huaidong has reached the lower limit of the current holdings increase plan, and the implementation of the current holdings increase plan has been completed; Mr. Zhou Bingbing, Mr. Wang Shaoyong, and Mr. Wang Tao have not yet completed the current holdings increase plan.

Chuhuan Technology (001336.SZ): Zhejiang Chu Investment plans to reduce its holdings by no more than 2%

Chuhuan Technology (001336.SZ) announced that the shareholder Anji Zhechu Equity Investment Partnership (limited partnership) (“Zhejiang Investment”), which holds 5,308,278 shares (6.60% of the company's total share capital), plans to reduce the total number of shares of the company by means of centralized bidding transactions (the period is 3 months after 15 trading days from the date of the announcement of the current holdings reduction plan) or bulk trading (the period is within three months from the date of the announcement of the current holdings reduction plan) to reduce the total number of shares of the company by no more than 1,607,470 shares of the company (This ratio is 2%).

Vision Life (300642.SZ): Rongzhen Investment plans to reduce its holdings by no more than 1%

Percussion Life (300642.SZ) announced that the company recently received a “Notice Letter on Plans to Reduce the Company's Shares” from the shareholder Shanghai Rongzhen Investment Group Co., Ltd. (“Rongzhen Investment” or “Shareholder”). It plans to reduce the company's shares holdings by no more than 1,637,733 shares through centralized bidding transactions or bulk transactions on the stock exchange, that is, no more than 1% of the company's total share capital after excluding the number of shares in the special repurchase account.

[Other]

Huaping Co., Ltd. (300074.SZ): Proposed capital increase of no more than 220 million yuan from the controlling shareholder

Huaping Co., Ltd. (300074.SZ) announced plans to issue shares to specific targets. This time, the number of shares issued to specific targets did not exceed 76,388,888 shares (including the number of shares), and the upper limit of the number of shares issued did not exceed 30% of the company's total share capital before issuance. The price of the shares issued is 2.88 yuan/share.

The target of this distribution is Zhihui Technology Investment (Shenzhen) Co., Ltd. The issuer subscribes for all shares issued to a specific target in cash. Zhihui Technology is the controlling shareholder, so the issuance of shares to a specific target constituted a related transaction. The total amount of capital raised to issue shares to specific targets this time is no more than 220 million yuan. After deducting issuance fees, all of the funds raised will be used to supplement working capital and repay bank loans.

Huashi Technology (301218.SZ): Ye Jianbiao, one of the actual controllers, director and general manager, was detained

Huashi Technology (301218.SZ) announced that the company recently received the “Notice of Detention” and “Notice of Case Filing” issued by the Dongyang Municipal Supervisory Commission. Mr. Ye Jianbiao, one of the actual controllers, director and general manager of the company, was placed in lien and investigated.