The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in MGE Energy (NASDAQ:MGEE). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Quickly Is MGE Energy Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, MGE Energy has grown EPS by 7.8% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While MGE Energy may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

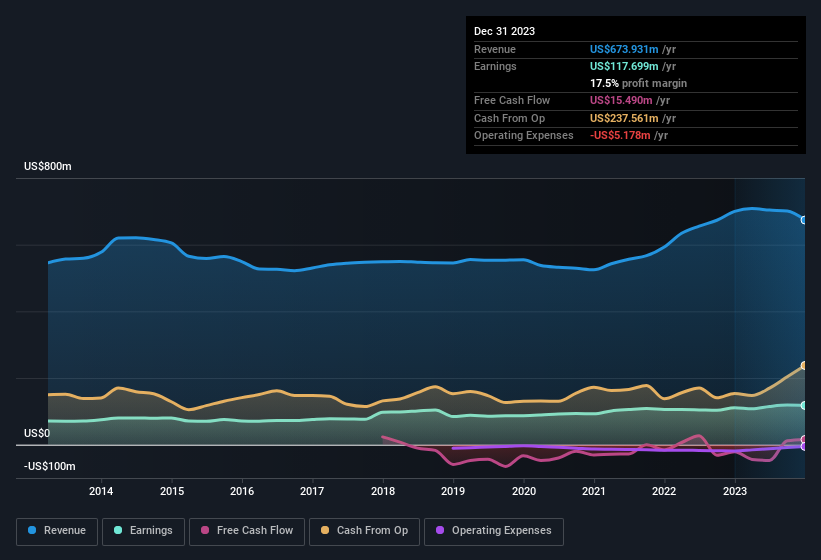

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check MGE Energy's balance sheet strength, before getting too excited.

Are MGE Energy Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Not only did MGE Energy insiders refrain from selling stock during the year, but they also spent US$94k buying it. That paints the company in a nice light, as it signals that its leaders are feeling confident in where the company is heading.

It's commendable to see that insiders have been buying shares in MGE Energy, but there is more evidence of shareholder friendly management. Namely, MGE Energy has a very reasonable level of CEO pay. Our analysis has discovered that the median total compensation for the CEOs of companies like MGE Energy with market caps between US$2.0b and US$6.4b is about US$6.3m.

The CEO of MGE Energy only received US$1.7m in total compensation for the year ending December 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does MGE Energy Deserve A Spot On Your Watchlist?

As previously touched on, MGE Energy is a growing business, which is encouraging. And there's more to MGE Energy, with the insider buying and modest CEO pay being a great look for those with an eye on the company. All things considered, MGE Energy is certainly displaying its merits and is worthy of taking research to the next step. Even so, be aware that MGE Energy is showing 2 warning signs in our investment analysis , you should know about...

Keen growth investors love to see insider buying. Thankfully, MGE Energy isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.